Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

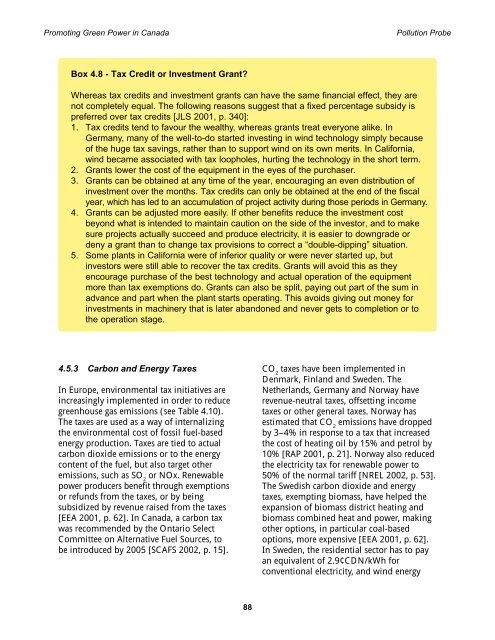

<strong>Promot<strong>in</strong>g</strong> <strong>Green</strong> <strong>Power</strong> <strong>in</strong> <strong>Canada</strong> Pollution ProbeBox 4.8 - Tax Credit or Investment Grant?Whereas tax credits and <strong>in</strong>vestment grants can have the same f<strong>in</strong>ancial effect, they arenot completely equal. The follow<strong>in</strong>g reasons suggest that a fixed percentage subsidy ispreferred over tax credits [JLS 2001, p. 340]:1. Tax credits tend to favour the wealthy, whereas grants treat everyone alike. InGermany, many of the well-to-do started <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> w<strong>in</strong>d technology simply becauseof the huge tax sav<strong>in</strong>gs, rather than to support w<strong>in</strong>d on its own merits. In Cali<strong>for</strong>nia,w<strong>in</strong>d became associated with tax loopholes, hurt<strong>in</strong>g the technology <strong>in</strong> the short term.2. Grants lower the cost of the equipment <strong>in</strong> the eyes of the purchaser.3. Grants can be obta<strong>in</strong>ed at any time of the year, encourag<strong>in</strong>g an even distribution of<strong>in</strong>vestment over the months. Tax credits can only be obta<strong>in</strong>ed at the end of the fiscalyear, which has led to an accumulation of project activity dur<strong>in</strong>g those periods <strong>in</strong> Germany.4. Grants can be adjusted more easily. If other benefits reduce the <strong>in</strong>vestment costbeyond what is <strong>in</strong>tended to ma<strong>in</strong>ta<strong>in</strong> caution on the side of the <strong>in</strong>vestor, and to makesure projects actually succeed and produce electricity, it is easier to downgrade ordeny a grant than to change tax provisions to correct a “double-dipp<strong>in</strong>g” situation.5. Some plants <strong>in</strong> Cali<strong>for</strong>nia were of <strong>in</strong>ferior quality or were never started up, but<strong>in</strong>vestors were still able to recover the tax credits. Grants will avoid this as theyencourage purchase of the best technology and actual operation of the equipmentmore than tax exemptions do. Grants can also be split, pay<strong>in</strong>g out part of the sum <strong>in</strong>advance and part when the plant starts operat<strong>in</strong>g. This avoids giv<strong>in</strong>g out money <strong>for</strong><strong>in</strong>vestments <strong>in</strong> mach<strong>in</strong>ery that is later abandoned and never gets to completion or tothe operation stage.4.5.3 Carbon and Energy TaxesIn Europe, environmental tax <strong>in</strong>itiatives are<strong>in</strong>creas<strong>in</strong>gly implemented <strong>in</strong> order to reducegreenhouse gas emissions (see Table 4.10).The taxes are used as a way of <strong>in</strong>ternaliz<strong>in</strong>gthe environmental cost of fossil fuel-basedenergy production. Taxes are tied to actualcarbon dioxide emissions or to the energycontent of the fuel, but also target otheremissions, such as SO 2or NOx. Renewablepower producers benefit through exemptionsor refunds from the taxes, or by be<strong>in</strong>gsubsidized by revenue raised from the taxes[EEA 2001, p. 62]. In <strong>Canada</strong>, a carbon taxwas recommended by the Ontario SelectCommittee on Alternative Fuel Sources, tobe <strong>in</strong>troduced by 2005 [SCAFS 2002, p. 15].CO 2taxes have been implemented <strong>in</strong>Denmark, F<strong>in</strong>land and Sweden. TheNetherlands, Germany and Norway haverevenue-neutral taxes, offsett<strong>in</strong>g <strong>in</strong>cometaxes or other general taxes. Norway hasestimated that CO 2emissions have droppedby 3–4% <strong>in</strong> response to a tax that <strong>in</strong>creasedthe cost of heat<strong>in</strong>g oil by 15% and petrol by10% [RAP 2001, p. 21]. Norway also reducedthe electricity tax <strong>for</strong> renewable power to50% of the normal tariff [NREL 2002, p. 53].The Swedish carbon dioxide and energytaxes, exempt<strong>in</strong>g biomass, have helped theexpansion of biomass district heat<strong>in</strong>g andbiomass comb<strong>in</strong>ed heat and power, mak<strong>in</strong>gother options, <strong>in</strong> particular coal-basedoptions, more expensive [EEA 2001, p. 62].In Sweden, the residential sector has to payan equivalent of 2.9¢CDN/kWh <strong>for</strong>conventional electricity, and w<strong>in</strong>d energy88