Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

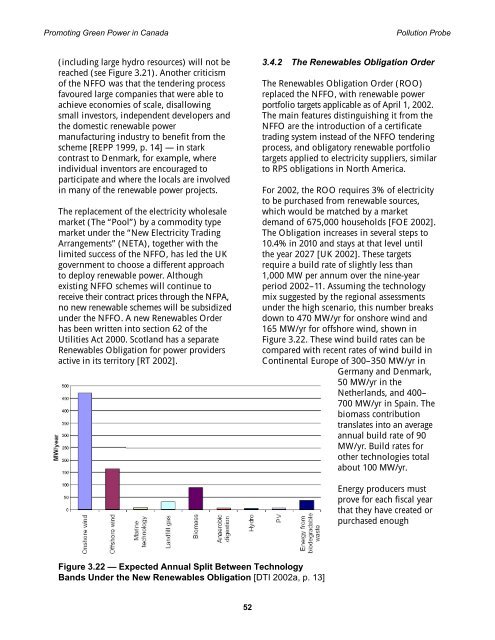

<strong>Promot<strong>in</strong>g</strong> <strong>Green</strong> <strong>Power</strong> <strong>in</strong> <strong>Canada</strong> Pollution Probe(<strong>in</strong>clud<strong>in</strong>g large hydro resources) will not bereached (see Figure 3.21). Another criticismof the NFFO was that the tender<strong>in</strong>g processfavoured large companies that were able toachieve economies of scale, disallow<strong>in</strong>gsmall <strong>in</strong>vestors, <strong>in</strong>dependent developers andthe domestic renewable powermanufactur<strong>in</strong>g <strong>in</strong>dustry to benefit from thescheme [REPP 1999, p. 14] — <strong>in</strong> starkcontrast to Denmark, <strong>for</strong> example, where<strong>in</strong>dividual <strong>in</strong>ventors are encouraged toparticipate and where the locals are <strong>in</strong>volved<strong>in</strong> many of the renewable power projects.The replacement of the electricity wholesalemarket (The “Pool”) by a commodity typemarket under the “New Electricity Trad<strong>in</strong>gArrangements” (NETA), together with thelimited success of the NFFO, has led the UKgovernment to choose a different approachto deploy renewable power. Althoughexist<strong>in</strong>g NFFO schemes will cont<strong>in</strong>ue toreceive their contract prices through the NFPA,no new renewable schemes will be subsidizedunder the NFFO. A new Renewables Orderhas been written <strong>in</strong>to section 62 of theUtilities Act 2000. Scotland has a separateRenewables Obligation <strong>for</strong> power providersactive <strong>in</strong> its territory [RT 2002].3.4.2 The Renewables Obligation OrderThe Renewables Obligation Order (ROO)replaced the NFFO, with renewable powerportfolio targets applicable as of April 1, 2002.The ma<strong>in</strong> features dist<strong>in</strong>guish<strong>in</strong>g it from theNFFO are the <strong>in</strong>troduction of a certificatetrad<strong>in</strong>g system <strong>in</strong>stead of the NFFO tender<strong>in</strong>gprocess, and obligatory renewable portfoliotargets applied to electricity suppliers, similarto RPS obligations <strong>in</strong> North America.For 2002, the ROO requires 3% of electricityto be purchased from renewable sources,which would be matched by a marketdemand of 675,000 households [FOE 2002].The Obligation <strong>in</strong>creases <strong>in</strong> several steps to10.4% <strong>in</strong> 2010 and stays at that level untilthe year 2027 [UK 2002]. These targetsrequire a build rate of slightly less than1,000 MW per annum over the n<strong>in</strong>e-yearperiod 2002–11. Assum<strong>in</strong>g the technologymix suggested by the regional assessmentsunder the high scenario, this number breaksdown to 470 MW/yr <strong>for</strong> onshore w<strong>in</strong>d and165 MW/yr <strong>for</strong> offshore w<strong>in</strong>d, shown <strong>in</strong>Figure 3.22. These w<strong>in</strong>d build rates can becompared with recent rates of w<strong>in</strong>d build <strong>in</strong>Cont<strong>in</strong>ental Europe of 300–350 MW/yr <strong>in</strong>Germany and Denmark,50 MW/yr <strong>in</strong> theNetherlands, and 400–700 MW/yr <strong>in</strong> Spa<strong>in</strong>. Thebiomass contributiontranslates <strong>in</strong>to an averageannual build rate of 90MW/yr. Build rates <strong>for</strong>other technologies totalabout 100 MW/yr.Energy producers mustprove <strong>for</strong> each fiscal yearthat they have created orpurchased enoughFigure 3.22 — Expected Annual Split Between TechnologyBands Under the New Renewables Obligation [DTI 2002a, p. 13]52