Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

Promoting Green Power in Canada - Centre for Human Settlements

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

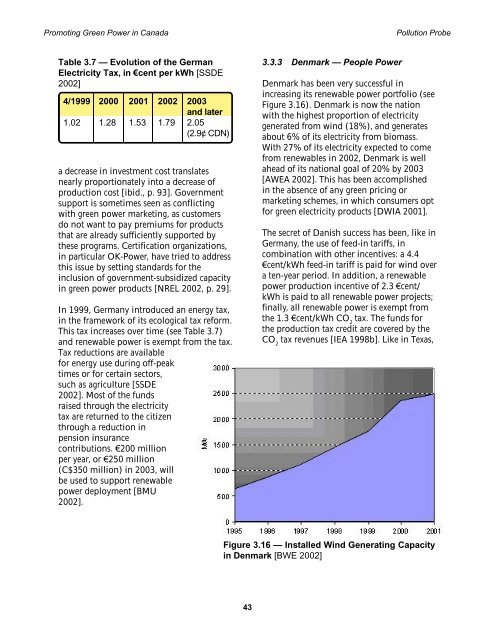

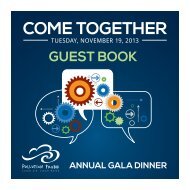

<strong>Promot<strong>in</strong>g</strong> <strong>Green</strong> <strong>Power</strong> <strong>in</strong> <strong>Canada</strong> Pollution ProbeTable 3.7 — Evolution of the GermanElectricity Tax, <strong>in</strong> €cent per kWh [SSDE2002]4/1999 2000 2001 2002 2003and later1.02 1.28 1.53 1.79 2.05(2.9¢ CDN)a decrease <strong>in</strong> <strong>in</strong>vestment cost translatesnearly proportionately <strong>in</strong>to a decrease ofproduction cost [ibid., p. 93]. Governmentsupport is sometimes seen as conflict<strong>in</strong>gwith green power market<strong>in</strong>g, as customersdo not want to pay premiums <strong>for</strong> productsthat are already sufficiently supported bythese programs. Certification organizations,<strong>in</strong> particular OK-<strong>Power</strong>, have tried to addressthis issue by sett<strong>in</strong>g standards <strong>for</strong> the<strong>in</strong>clusion of government-subsidized capacity<strong>in</strong> green power products [NREL 2002, p. 29].In 1999, Germany <strong>in</strong>troduced an energy tax,<strong>in</strong> the framework of its ecological tax re<strong>for</strong>m.This tax <strong>in</strong>creases over time (see Table 3.7)and renewable power is exempt from the tax.Tax reductions are available<strong>for</strong> energy use dur<strong>in</strong>g off-peaktimes or <strong>for</strong> certa<strong>in</strong> sectors,such as agriculture [SSDE2002]. Most of the fundsraised through the electricitytax are returned to the citizenthrough a reduction <strong>in</strong>pension <strong>in</strong>surancecontributions. €200 millionper year, or €250 million(C$350 million) <strong>in</strong> 2003, willbe used to support renewablepower deployment [BMU2002].3.3.3 Denmark — People <strong>Power</strong>Denmark has been very successful <strong>in</strong><strong>in</strong>creas<strong>in</strong>g its renewable power portfolio (seeFigure 3.16). Denmark is now the nationwith the highest proportion of electricitygenerated from w<strong>in</strong>d (18%), and generatesabout 6% of its electricity from biomass.With 27% of its electricity expected to comefrom renewables <strong>in</strong> 2002, Denmark is wellahead of its national goal of 20% by 2003[AWEA 2002]. This has been accomplished<strong>in</strong> the absence of any green pric<strong>in</strong>g ormarket<strong>in</strong>g schemes, <strong>in</strong> which consumers opt<strong>for</strong> green electricity products [DWIA 2001].The secret of Danish success has been, like <strong>in</strong>Germany, the use of feed-<strong>in</strong> tariffs, <strong>in</strong>comb<strong>in</strong>ation with other <strong>in</strong>centives: a 4.4€cent/kWh feed-<strong>in</strong> tariff is paid <strong>for</strong> w<strong>in</strong>d overa ten-year period. In addition, a renewablepower production <strong>in</strong>centive of 2.3 €cent/kWh is paid to all renewable power projects;f<strong>in</strong>ally, all renewable power is exempt fromthe 1.3 €cent/kWh CO 2tax. The funds <strong>for</strong>the production tax credit are covered by theCO 2tax revenues [IEA 1998b]. Like <strong>in</strong> Texas,Figure 3.16 — Installed W<strong>in</strong>d Generat<strong>in</strong>g Capacity<strong>in</strong> Denmark [BWE 2002]43