Journal of European Integration History – Revue d'histoire de l'

Journal of European Integration History – Revue d'histoire de l'

Journal of European Integration History – Revue d'histoire de l'

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

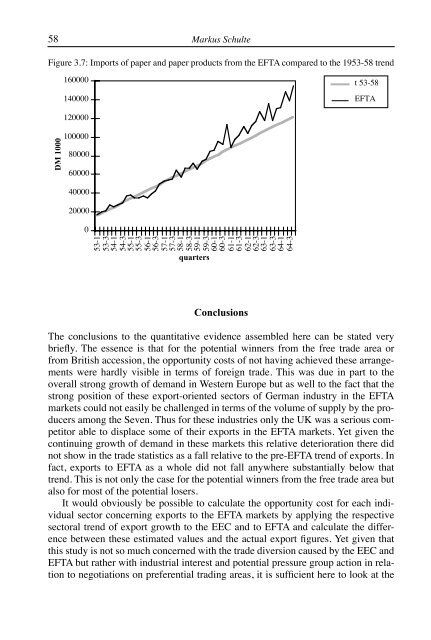

58Markus SchulteFigure 3.7: Imports <strong>of</strong> paper and paper products from the EFTA compared to the 1953-58 trend160000140000t 53-58EFTADM 100012000010000080000600004000020000053-153-354-154-355-155-356-156-357-157-358-158-359-159-360-160-361-161-362-162-363-163-364-164-3quartersConclusionsThe conclusions to the quantitative evi<strong>de</strong>nce assembled here can be stated verybriefly. The essence is that for the potential winners from the free tra<strong>de</strong> area orfrom British accession, the opportunity costs <strong>of</strong> not having achieved these arrangementswere hardly visible in terms <strong>of</strong> foreign tra<strong>de</strong>. This was due in part to theoverall strong growth <strong>of</strong> <strong>de</strong>mand in Western Europe but as well to the fact that thestrong position <strong>of</strong> these export-oriented sectors <strong>of</strong> German industry in the EFTAmarkets could not easily be challenged in terms <strong>of</strong> the volume <strong>of</strong> supply by the producersamong the Seven. Thus for these industries only the UK was a serious competitorable to displace some <strong>of</strong> their exports in the EFTA markets. Yet given thecontinuing growth <strong>of</strong> <strong>de</strong>mand in these markets this relative <strong>de</strong>terioration there didnot show in the tra<strong>de</strong> statistics as a fall relative to the pre-EFTA trend <strong>of</strong> exports. Infact, exports to EFTA as a whole did not fall anywhere substantially below thattrend. This is not only the case for the potential winners from the free tra<strong>de</strong> area butalso for most <strong>of</strong> the potential losers.It would obviously be possible to calculate the opportunity cost for each individualsector concerning exports to the EFTA markets by applying the respectivesectoral trend <strong>of</strong> export growth to the EEC and to EFTA and calculate the differencebetween these estimated values and the actual export figures. Yet given thatthis study is not so much concerned with the tra<strong>de</strong> diversion caused by the EEC andEFTA but rather with industrial interest and potential pressure group action in relationto negotiations on preferential trading areas, it is sufficient here to look at the