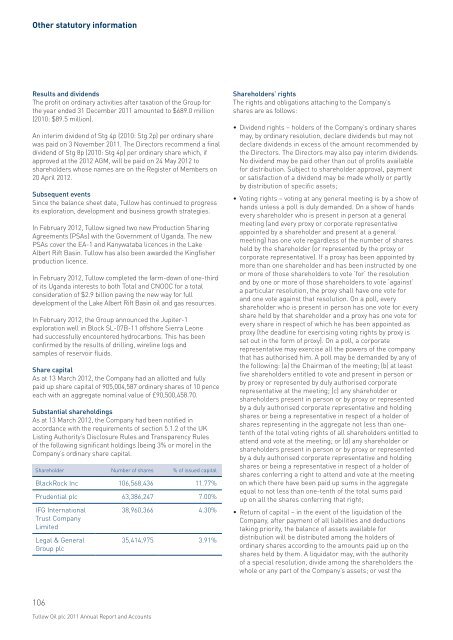

Other statutory informationResults and dividends<strong>The</strong> profit on ordinary activities after taxation of the <strong>Group</strong> forthe year ended 31 December <strong>2011</strong> amounted to $689.0 million(2010: $89.5 million).An interim dividend of Stg 4p (2010: Stg 2p) per ordinary sharewas paid on 3 November <strong>2011</strong>. <strong>The</strong> Directors recommend a finaldividend of Stg 8p (2010: Stg 4p) per ordinary share which, ifapproved at the 2012 AGM, will be paid on 24 May 2012 toshareholders whose names are on the Register of Members on20 April 2012.Subsequent eventsSince the balance sheet date, <strong>Tullow</strong> has continued to progressits exploration, development and business growth strategies.In February 2012, <strong>Tullow</strong> signed two new Production SharingAgreements (PSAs) with the Government of Uganda. <strong>The</strong> newPSAs cover the EA-1 and Kanywataba licences in the LakeAlbert Rift Basin. <strong>Tullow</strong> has also been awarded the Kingfisherproduction licence.In February 2012, <strong>Tullow</strong> completed the farm-down of one-thirdof its Uganda interests to both Total and CNOOC for a totalconsideration of $2.9 billion paving the new way for fulldevelopment of the Lake Albert Rift Basin oil and gas resources.In February 2012, the <strong>Group</strong> announced the Jupiter-1exploration well in Block SL-07B-11 offshore Sierra Leonehad successfully encountered hydrocarbons. This has beenconfirmed by the results of drilling, wireline logs andsamples of reservoir fluids.Share capitalAs at 13 March 2012, the Company had an allotted and fullypaid up share capital of 905,004,587 ordinary shares of 10 penceeach with an aggregate nominal value of £90,500,458.70.Substantial shareholdingsAs at 13 March 2012, the Company had been notified inaccordance with the requirements of section 5.1.2 of the UKListing Authority’s Disclosure Rules and Transparency Rulesof the following significant holdings (being 3% or more) in theCompany’s ordinary share capital.Shareholder Number of shares % of issued capitalBlackRock Inc 106,568,436 11.77%Prudential <strong>plc</strong> 63,386,247 7.00%IFG InternationalTrust CompanyLimitedLegal & General<strong>Group</strong> <strong>plc</strong>38,960,366 4.30%35,414,975 3.91%Shareholders’ rights<strong>The</strong> rights and obligations attaching to the Company’sshares are as follows: Dividend rights – holders of the Company’s ordinary sharesmay, by ordinary resolution, declare dividends but may notdeclare dividends in excess of the amount recommended bythe Directors. <strong>The</strong> Directors may also pay interim dividends.No dividend may be paid other than out of profits availablefor distribution. Subject to shareholder approval, paymentor satisfaction of a dividend may be made wholly or partlyby distribution of specific assets; Voting rights – voting at any general meeting is by a show ofhands unless a poll is duly demanded. On a show of handsevery shareholder who is present in person at a generalmeeting (and every proxy or corporate representativeappointed by a shareholder and present at a generalmeeting) has one vote regardless of the number of sharesheld by the shareholder (or represented by the proxy orcorporate representative). If a proxy has been appointed bymore than one shareholder and has been instructed by oneor more of those shareholders to vote ‘for’ the resolutionand by one or more of those shareholders to vote ‘against’a particular resolution, the proxy shall have one vote forand one vote against that resolution. On a poll, everyshareholder who is present in person has one vote for everyshare held by that shareholder and a proxy has one vote forevery share in respect of which he has been appointed asproxy (the deadline for exercising voting rights by proxy isset out in the form of proxy). On a poll, a corporaterepresentative may exercise all the powers of the companythat has authorised him. A poll may be demanded by any ofthe following: (a) the Chairman of the meeting; (b) at leastfive shareholders entitled to vote and present in person orby proxy or represented by duly authorised corporaterepresentative at the meeting; (c) any shareholder orshareholders present in person or by proxy or representedby a duly authorised corporate representative and holdingshares or being a representative in respect of a holder ofshares representing in the aggregate not less than onetenthof the total voting rights of all shareholders entitled toattend and vote at the meeting; or (d) any shareholder orshareholders present in person or by proxy or representedby a duly authorised corporate representative and holdingshares or being a representative in respect of a holder ofshares conferring a right to attend and vote at the meetingon which there have been paid up sums in the aggregateequal to not less than one-tenth of the total sums paidup on all the shares conferring that right; Return of capital – in the event of the liquidation of theCompany, after payment of all liabilities and deductionstaking priority, the balance of assets available fordistribution will be distributed among the holders ofordinary shares according to the amounts paid up on theshares held by them. A liquidator may, with the authorityof a special resolution, divide among the shareholders thewhole or any part of the Company’s assets; or vest the106<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts

Company’s assets in whole or in part in trustees upon suchtrusts for the benefit of shareholders, but no shareholder iscompelled to accept any property in respect of which thereis a liability; Control rights under employee share schemes – theCompany operates a number of employee share schemes.Under some of these arrangements, shares are held bytrustees on behalf of employees. <strong>The</strong> employees are notentitled to exercise directly any voting or other controlrights. <strong>The</strong> trustees will generally vote in accordance withemployees’ instructions and abstain where no instructionsare received. Unallocated shares are generally voted at thediscretion of the trustees; and Restrictions on holding securities – there are no restrictionsunder the Company’s Articles of Association or under UKlaw that either restrict the rights of UK residentshareholders to hold shares or limit the rights of nonresidentor foreign shareholders to hold or vote theCompany’s ordinary shares.<strong>The</strong>re are no UK foreign exchange control restrictionson the payment of dividends to US persons on the Company’sordinary shares.Material agreements containing‘change of control’ provisions<strong>The</strong> following significant agreements will, in the event of a‘change of control’ of the Company, be affected as follows: US$3.235 billion senior secured revolving credit facilityagreement between, among others, the Company andcertain subsidiaries of the Company, BNP Paribas, Bank ofScotland <strong>plc</strong>, <strong>The</strong> Royal Bank of Scotland <strong>plc</strong>, StandardChartered Bank, Lloyds TSB Bank <strong>plc</strong> and Crédit AgricoleCorporate and Investment Bank and the lenders specifiedtherein pursuant to which each lender thereunder maydemand repayment of all outstanding amounts owed by theCompany and certain subsidiaries of the Company to itunder the agreement and any connected finance document,which amount will become immediately due and payableand, in respect of each letter of credit issued under theagreement, full cash cover will be required immediately, inthe event that any person (or group of persons acting inconcert) gains control of the Company; US$100 million junior secured revolving credit facilityagreement between, among others, the Company andcertain subsidiaries of the Company, BNP Paribas, Bank ofScotland <strong>plc</strong>, <strong>The</strong> Royal Bank of Scotland <strong>plc</strong> and Lloyds TSBBank <strong>plc</strong> and the lenders specified therein pursuant towhich each lender thereunder may demand repayment ofall outstanding amounts owed by the Company and certainsubsidiaries of the Company to it under the agreement andany connected finance document, which amount willbecome immediately due and payable, in the event thatany person (or group of persons acting in concert) gainscontrol of the Company; US$165 million finance contract in respect of a seniorsecured revolving credit facility agreement between, amongothers, the Company and certain subsidiaries of the Companyand International Finance Corporation and the lendersspecified therein pursuant to which each lender thereundermay demand repayment of all outstanding amounts owed bythe Company and certain subsidiaries of the Company to itunder the agreement and any connected finance document,which amount will become immediately due and payable, inthe event that any person (or group of persons acting inconcert) gains control of the Company; and US$500 million secured revolving credit facility agreementbetween, among others, the Company and certain subsidiariesof the Company, BNP Paribas, Credit Agricole Corporate andInvestment Bank, Standard Chartered Bank and HSBC Bank<strong>plc</strong> and the lenders specified therein pursuant to which eachlender thereunder may demand repayment of all outstandingamounts owed by the Company and certain subsidiaries of theCompany to it under the agreement and any connected financedocument, which amount will become immediately due andpayable, in the event that any person (or group of personsacting in concert) gains control of the Company.Under the terms of each of these agreements, a ‘change ofcontrol’ occurs if any person, or group of persons acting inconcert (as defined in the City Code on Takeovers and Mergers)gains control of the Company.Contractual or other arrangements<strong>The</strong> <strong>Group</strong> does not have any contractual or otherarrangements that are essential to the business of the <strong>Group</strong>as described by section 417 (5)(c) of the Companies Act 2006.Directors<strong>The</strong> biographical details of the Directors of the Companyat the date of this report are given on pages 81 to 83.Details of Directors’ service agreements and letters ofappointment are set out on page 95. Details of the Directors’interests in the ordinary shares of the Company and inthe <strong>Group</strong>’s long-term incentive and other share optionschemes are set out on pages 97 to 99 in the Directors’remuneration report.Directors’ indemnities and insurance coverAs at the date of this report, indemnities are in force underwhich the Company has agreed to indemnify the Directors, tothe extent permitted by the Companies Act 2006, against claimsfrom third parties in respect of certain liabilities arising out of,or in connection with, the execution of their powers, duties andresponsibilities as Directors of the Company or any of itssubsidiaries. <strong>The</strong> Directors are also indemnified against thecost of defending a criminal prosecution or a claim by theCompany, its subsidiaries or a regulator provided that where thedefence is unsuccessful the Director must repay those defencecosts. <strong>The</strong> Company also maintains Directors’ and Officers’Liability insurance cover, the level of which is reviewed annually.4CORPORATE GOVERNANCE107www.tullowoil.com

- Page 4 and 5:

Production operators in the central

- Page 6:

2011 highlightsRECORD RESULTSIndust

- Page 11 and 12:

In Ghana, we have experienced techn

- Page 13 and 14:

More informationPageStrong organisa

- Page 15 and 16:

CLEARVISIONSPECIAL FEATURETO BE THE

- Page 17 and 18:

1Exploration& appraisal7Sharedprosp

- Page 19 and 20:

EXPLORATION& APPRAISALStrategic pri

- Page 21 and 22:

DELIVERING MATERIALPRODUCTIONGROWTH

- Page 23 and 24:

21www.tullowoil.com

- Page 25:

RISKMANAGEMENTStrategic priority: E

- Page 28 and 29:

MAINTAINING OURENTREPRENEURIALCHARA

- Page 30 and 31:

SHAREDPROSPERITYStrategic priority:

- Page 32 and 33:

DELIVERINGSUBSTANTIAL RETURNSOur st

- Page 34 and 35:

Key Performance Indicators continue

- Page 36 and 37:

Financial reviewFUNDING FUTURE GROW

- Page 38 and 39:

Financial review continued2011 Grou

- Page 40 and 41:

Financial review continuedDividendT

- Page 43 and 44:

Regional business management unitsI

- Page 45 and 46:

LONG-TERMPERFORMANCE RISKSWe group

- Page 47 and 48:

1Operational risk continuedKey deve

- Page 49 and 50:

482011 operations overviewOverall,

- Page 51 and 52:

2OPERATIONS REVIEWEurope,South Amer

- Page 53 and 54:

DEVELOPMENT & OPERATIONSA new scale

- Page 55 and 56:

Senior DrillingSupervisor withtrain

- Page 57 and 58: Mauritania & SenegalProduction from

- Page 59 and 60: periods for Kasamene, Wahrindi, Kig

- Page 61 and 62: 2West African and South American ex

- Page 63 and 64: 62Creating shared prosperityCreatin

- Page 65 and 66: More informationPageSpecial feature

- Page 67 and 68: Social performance standardsWe are

- Page 69 and 70: 3The effect of Uncontrolled Release

- Page 71 and 72: 3Future talent poolIn October 2011,

- Page 73 and 74: 3LOCAL CONTENTCreating real opportu

- Page 75 and 76: 3Key corporate responsibility polic

- Page 77 and 78: 76Chairman’s introductionAt Board

- Page 79 and 80: 4In order to provide the human and

- Page 81 and 82: I am delighted to have taken on the

- Page 83 and 84: Board of DirectorsEXPERIENCED LEADE

- Page 85 and 86: 4CORPORATE GOVERNANCEAnn GrantNon-e

- Page 87 and 88: Audit planning and update on releva

- Page 89 and 90: Directors in their place. On 12 May

- Page 91: CONTENTS89 Introduction89 Remunerat

- Page 94 and 95: Directors’ remuneration report co

- Page 96 and 97: Directors’ remuneration report co

- Page 98 and 99: Directors’ remuneration report co

- Page 100 and 101: Directors’ remuneration report co

- Page 102 and 103: Corporate governanceThe UK Corporat

- Page 104 and 105: Corporate governance continuedThe f

- Page 106 and 107: Corporate governance continuedAccou

- Page 111 and 112: All employees are helped and encour

- Page 113 and 114: As part of our Code of Business Con

- Page 115 and 116: Independent Auditor’s Reportto th

- Page 117 and 118: Group balance sheetAs at 31 Decembe

- Page 119 and 120: Group cash flow statementYear ended

- Page 121 and 122: The principal accounting policies a

- Page 123 and 124: 5Finance costs of debt are allocate

- Page 125 and 126: 5Commercial reserves estimates (not

- Page 127 and 128: 5Note 2. Business combinationsOn 24

- Page 129 and 130: 5Europe,South Americaand Asia$mWest

- Page 131 and 132: 5Non-current assets by originGhana

- Page 133 and 134: 5Note 6. Staff costsThe average mon

- Page 135 and 136: 5The Group’s profit before taxati

- Page 137 and 138: 5Note 12. Property, plant and equip

- Page 139 and 140: 5Note 13. Investments2011$m2010$m20

- Page 141 and 142: 5Note 18. Trade and other payablesC

- Page 143 and 144: 5The $3.5 billion Reserves Based Le

- Page 145 and 146: 5Note 20. Financial instrumentsFina

- Page 147 and 148: 5Oil and gas pricesThe Group uses a

- Page 149 and 150: 5Financial derivativesThe Group int

- Page 151 and 152: 5Deferred tax assets are recognised

- Page 153 and 154: 5Note 27. Share-based payments2005

- Page 155 and 156: 5UK & Irish Share Incentive Plans (

- Page 157 and 158: Independent Auditor’s Reportto th

- Page 159 and 160:

Company balance sheetAs at 31 Decem

- Page 161 and 162:

Notes to the Company financial stat

- Page 163 and 164:

5Note 6. Bank loansCurrentShort-ter

- Page 165 and 166:

5Note 9. Shareholders’ fundsShare

- Page 167 and 168:

2010 Share Option Plan (2010 SOP) a

- Page 169 and 170:

5Note 13. Subsequent eventsSince th

- Page 171 and 172:

Commercial reserves and contingent

- Page 173 and 174:

Area TullowLicenceFieldssq km inter

- Page 175 and 176:

Licence / BlocksFieldsAreasq kmTull

- Page 177 and 178:

ContactsSecretary & registered offi

- Page 179 and 180:

KKenya 6, 7, 57Key financial metric

- Page 181 and 182:

MmmbblmmboemmscfdMoUMTMMillion barr

- Page 183 and 184:

This report is printed on Heaven 42