Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

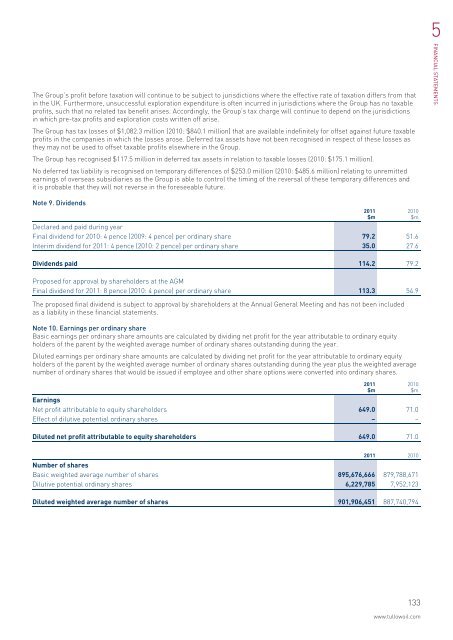

5<strong>The</strong> <strong>Group</strong>’s profit before taxation will continue to be subject to jurisdictions where the effective rate of taxation differs from thatin the UK. Furthermore, unsuccessful exploration expenditure is often incurred in jurisdictions where the <strong>Group</strong> has no taxableprofits, such that no related tax benefit arises. Accordingly, the <strong>Group</strong>’s tax charge will continue to depend on the jurisdictionsin which pre-tax profits and exploration costs written off arise.<strong>The</strong> <strong>Group</strong> has tax losses of $1,082.3 million (2010: $840.1 million) that are available indefinitely for offset against future taxableprofits in the companies in which the losses arose. Deferred tax assets have not been recognised in respect of these losses asthey may not be used to offset taxable profits elsewhere in the <strong>Group</strong>.<strong>The</strong> <strong>Group</strong> has recognised $117.5 million in deferred tax assets in relation to taxable losses (2010: $175.1 million).No deferred tax liability is recognised on temporary differences of $253.0 million (2010: $485.6 million) relating to unremittedearnings of overseas subsidiaries as the <strong>Group</strong> is able to control the timing of the reversal of these temporary differences andit is probable that they will not reverse in the foreseeable future.FINANCIAL STATEMENTSNote 9. DividendsDeclared and paid during yearFinal dividend for 2010: 4 pence (2009: 4 pence) per ordinary share 79.2 51.6Interim dividend for <strong>2011</strong>: 4 pence (2010: 2 pence) per ordinary share 35.0 27.6Dividends paid 114.2 79.2Proposed for approval by shareholders at the AGMFinal dividend for <strong>2011</strong>: 8 pence (2010: 4 pence) per ordinary share 113.3 54.9<strong>The</strong> proposed final dividend is subject to approval by shareholders at the <strong>Annual</strong> General Meeting and has not been includedas a liability in these financial statements.Note 10. Earnings per ordinary shareBasic earnings per ordinary share amounts are calculated by dividing net profit for the year attributable to ordinary equityholders of the parent by the weighted average number of ordinary shares outstanding during the year.Diluted earnings per ordinary share amounts are calculated by dividing net profit for the year attributable to ordinary equityholders of the parent by the weighted average number of ordinary shares outstanding during the year plus the weighted averagenumber of ordinary shares that would be issued if employee and other share options were converted into ordinary shares.EarningsNet profit attributable to equity shareholders 649.0 71.0Effect of dilutive potential ordinary shares – –<strong>2011</strong>$m<strong>2011</strong>$m2010$m2010$mDiluted net profit attributable to equity shareholders 649.0 71.0<strong>2011</strong> 2010Number of sharesBasic weighted average number of shares 895,676,666 879,788,671Dilutive potential ordinary shares 6,229,785 7,952,123Diluted weighted average number of shares 901,906,451 887,740,794133www.tullowoil.com