Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

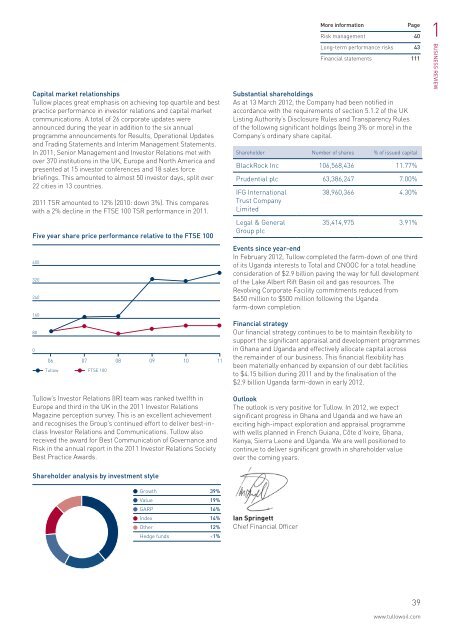

Capital market relationships<strong>Tullow</strong> places great emphasis on achieving top quartile and bestpractice performance in investor relations and capital marketcommunications. A total of 26 corporate updates wereannounced during the year in addition to the six annualprogramme announcements for Results, Operational Updatesand Trading Statements and Interim Management Statements.In <strong>2011</strong>, Senior Management and Investor Relations met withover 370 institutions in the UK, Europe and North America andpresented at 15 investor conferences and 18 sales forcebriefings. This amounted to almost 50 investor days, split over22 cities in 13 countries.<strong>2011</strong> TSR amounted to 12% (2010: down 3%). This compareswith a 2% decline in the FTSE 100 TSR performance in <strong>2011</strong>.Five year share price performance relative to the FTSE 10040032024016080006 07 08 09 1011<strong>Tullow</strong> FTSE 100<strong>Tullow</strong>’s Investor Relations (IR) team was ranked twelfth inEurope and third in the UK in the <strong>2011</strong> Investor RelationsMagazine perception survey. This is an excellent achievementand recognises the <strong>Group</strong>’s continued effort to deliver best-inclassInvestor Relations and Communications. <strong>Tullow</strong> alsoreceived the award for Best Communication of Governance andRisk in the annual report in the <strong>2011</strong> Investor Relations SocietyBest Practice Awards.Substantial shareholdingsAs at 13 March 2012, the Company had been notified inaccordance with the requirements of section 5.1.2 of the UKListing Authority’s Disclosure Rules and Transparency Rulesof the following significant holdings (being 3% or more) in theCompany’s ordinary share capital.Shareholder Number of shares % of issued capitalBlackRock Inc 106,568,436 11.77%Prudential <strong>plc</strong> 63,386,247 7.00%IFG InternationalTrust CompanyLimitedLegal & General<strong>Group</strong> <strong>plc</strong>More informationPageRisk management 40Long-term performance risks 43Financial statements 11138,960,366 4.30%35,414,975 3.91%Events since year-endIn February 2012, <strong>Tullow</strong> completed the farm-down of one thirdof its Uganda interests to Total and CNOOC for a total headlineconsideration of $2.9 billion paving the way for full developmentof the Lake Albert Rift Basin oil and gas resources. <strong>The</strong>Revolving Corporate Facility commitments reduced from$650 million to $500 million following the Ugandafarm-down completion.Financial strategyOur financial strategy continues to be to maintain flexibility tosupport the significant appraisal and development programmesin Ghana and Uganda and effectively allocate capital acrossthe remainder of our business. This financial flexibility hasbeen materially enhanced by expansion of our debt facilitiesto $4.15 billion during <strong>2011</strong> and by the finalisation of the$2.9 billion Uganda farm-down in early 2012.Outlook<strong>The</strong> outlook is very positive for <strong>Tullow</strong>. In 2012, we expectsignificant progress in Ghana and Uganda and we have anexciting high-impact exploration and appraisal programmewith wells planned in French Guiana, Côte d’Ivoire, Ghana,Kenya, Sierra Leone and Uganda. We are well positioned tocontinue to deliver significant growth in shareholder valueover the coming years.1BUSINESS REVIEWShareholder analysis by investment styleGrowth 39%Value 19%GARP 16%Index 14%Other 12%Hedge funds