Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

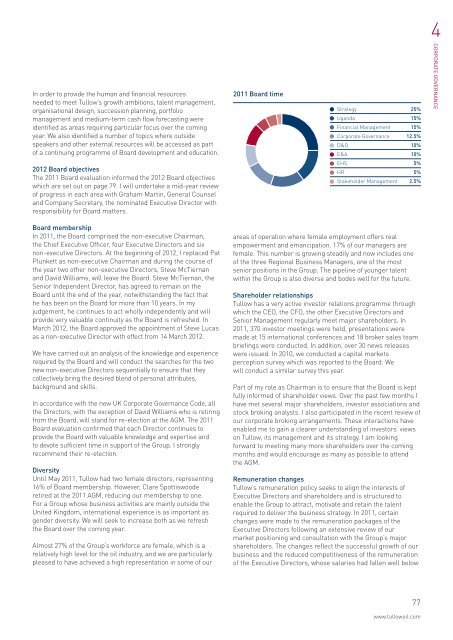

4In order to provide the human and financial resourcesneeded to meet <strong>Tullow</strong>’s growth ambitions, talent management,organisational design, succession planning, portfoliomanagement and medium-term cash flow forecasting wereidentified as areas requiring particular focus over the comingyear. We also identified a number of topics where outsidespeakers and other external resources will be accessed as partof a continuing programme of Board development and education.<strong>2011</strong> Board timeStrategy 25%Uganda 15%Financial Management 15%Corporate Governance 12.5%D&O 10%E&A 10%EHS 5%HR 5%Stakeholder Management 2.5%CORPORATE GOVERNANCE2012 Board objectives<strong>The</strong> <strong>2011</strong> Board evaluation informed the 2012 Board objectiveswhich are set out on page 79. I will undertake a mid-year reviewof progress in each area with Graham Martin, General Counseland Company Secretary, the nominated Executive Director withresponsibility for Board matters.Board membershipIn <strong>2011</strong>, the Board comprised the non-executive Chairman,the Chief Executive Officer, four Executive Directors and sixnon-executive Directors. At the beginning of 2012, I replaced PatPlunkett as non-executive Chairman and during the course ofthe year two other non-executive Directors, Steve McTiernanand David Williams, will leave the Board. Steve McTiernan, theSenior Independent Director, has agreed to remain on theBoard until the end of the year, notwithstanding the fact thathe has been on the Board for more than 10 years. In myjudgement, he continues to act wholly independently and willprovide very valuable continuity as the Board is refreshed. InMarch 2012, the Board approved the appointment of Steve Lucasas a non-executive Director with effect from 14 March 2012.We have carried out an analysis of the knowledge and experiencerequired by the Board and will conduct the searches for the twonew non-executive Directors sequentially to ensure that theycollectively bring the desired blend of personal attributes,background and skills.In accordance with the new UK Corporate Governance Code, allthe Directors, with the exception of David Williams who is retiringfrom the Board, will stand for re-election at the AGM. <strong>The</strong> <strong>2011</strong>Board evaluation confirmed that each Director continues toprovide the Board with valuable knowledge and expertise andto devote sufficient time in support of the <strong>Group</strong>. I stronglyrecommend their re-election.DiversityUntil May <strong>2011</strong>, <strong>Tullow</strong> had two female directors, representing16% of Board membership. However, Clare Spottiswooderetired at the <strong>2011</strong> AGM, reducing our membership to one.For a <strong>Group</strong> whose business activities are mainly outside theUnited Kingdom, international experience is as important asgender diversity. We will seek to increase both as we refreshthe Board over the coming year.Almost 27% of the <strong>Group</strong>’s workforce are female, which is arelatively high level for the oil industry, and we are particularlypleased to have achieved a high representation in some of ourareas of operation where female employment offers realempowerment and emancipation. 17% of our managers arefemale. This number is growing steadily and now includes oneof the three Regional Business Managers, one of the mostsenior positions in the <strong>Group</strong>. <strong>The</strong> pipeline of younger talentwithin the <strong>Group</strong> is also diverse and bodes well for the future.Shareholder relationships<strong>Tullow</strong> has a very active investor relations programme throughwhich the CEO, the CFO, the other Executive Directors andSenior Management regularly meet major shareholders. In<strong>2011</strong>, 370 investor meetings were held, presentations weremade at 15 international conferences and 18 broker sales teambriefings were conducted. In addition, over 30 news releaseswere issued. In 2010, we conducted a capital marketsperception survey which was reported to the Board. Wewill conduct a similar survey this year.Part of my role as Chairman is to ensure that the Board is keptfully informed of shareholder views. Over the past few months Ihave met several major shareholders, investor associations andstock broking analysts. I also participated in the recent review ofour corporate broking arrangements. <strong>The</strong>se interactions haveenabled me to gain a clearer understanding of investors’ viewson <strong>Tullow</strong>, its management and its strategy. I am lookingforward to meeting many more shareholders over the comingmonths and would encourage as many as possible to attendthe AGM.Remuneration changes<strong>Tullow</strong>’s remuneration policy seeks to align the interests ofExecutive Directors and shareholders and is structured toenable the <strong>Group</strong> to attract, motivate and retain the talentrequired to deliver the business strategy. In <strong>2011</strong>, certainchanges were made to the remuneration packages of theExecutive Directors following an extensive review of ourmarket positioning and consultation with the <strong>Group</strong>’s majorshareholders. <strong>The</strong> changes reflect the successful growth of ourbusiness and the reduced competitiveness of the remunerationof the Executive Directors, whose salaries had fallen well below77www.tullowoil.com