Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

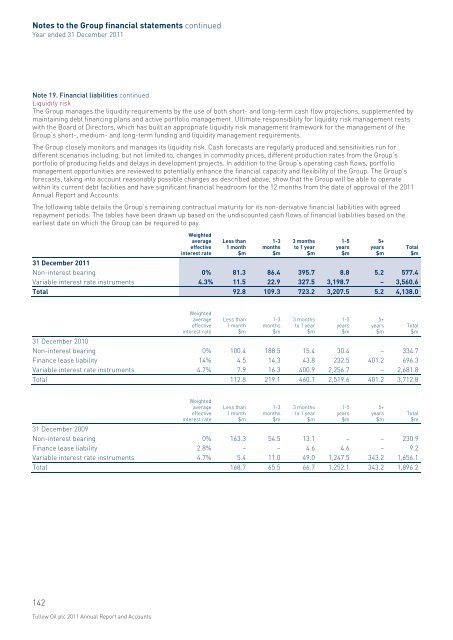

Notes to the <strong>Group</strong> financial statements continuedYear ended 31 December <strong>2011</strong>Note 19. Financial liabilities continuedLiquidity risk<strong>The</strong> <strong>Group</strong> manages the liquidity requirements by the use of both short- and long-term cash flow projections, supplemented bymaintaining debt financing plans and active portfolio management. Ultimate responsibility for liquidity risk management restswith the Board of Directors, which has built an appropriate liquidity risk management framework for the management of the<strong>Group</strong>’s short-, medium- and long-term funding and liquidity management requirements.<strong>The</strong> <strong>Group</strong> closely monitors and manages its liquidity risk. Cash forecasts are regularly produced and sensitivities run fordifferent scenarios including, but not limited to, changes in commodity prices, different production rates from the <strong>Group</strong>’sportfolio of producing fields and delays in development projects. In addition to the <strong>Group</strong>’s operating cash flows, portfoliomanagement opportunities are reviewed to potentially enhance the financial capacity and flexibility of the <strong>Group</strong>. <strong>The</strong> <strong>Group</strong>’sforecasts, taking into account reasonably possible changes as described above, show that the <strong>Group</strong> will be able to operatewithin its current debt facilities and have significant financial headroom for the 12 months from the date of approval of the <strong>2011</strong><strong>Annual</strong> <strong>Report</strong> and Accounts.<strong>The</strong> following table details the <strong>Group</strong>’s remaining contractual maturity for its non-derivative financial liabilities with agreedrepayment periods. <strong>The</strong> tables have been drawn up based on the undiscounted cash flows of financial liabilities based on theearliest date on which the <strong>Group</strong> can be required to pay.Weightedaverageeffectiveinterest rateLess than1 month$m1-3months$m3 monthsto 1 year$m31 December <strong>2011</strong>Non-interest bearing 0% 81.3 86.4 395.7 8.8 5.2 577.4Variable interest rate instruments 4.3% 11.5 22.9 327.5 3,198.7 – 3,560.6Total 92.8 109.3 723.2 3,207.5 5.2 4,138.01-5years$m5+years$mTotal$mWeightedaverageeffectiveinterest rateLess than1 month$m1-3months$m3 monthsto 1 year$m31 December 2010Non-interest bearing 0% 100.4 188.5 15.4 30.4 – 334.7Finance lease liability 14% 4.5 14.3 43.8 232.5 401.2 696.3Variable interest rate instruments 4.7% 7.9 16.3 400.9 2,256.7 – 2,681.8Total 112.8 219.1 460.1 2,519.6 401.2 3,712.81-5years$m5+years$mTotal$mWeightedaverageeffectiveinterest rateLess than1 month$m1-3months$m3 monthsto 1 year$m31 December 2009Non-interest bearing 0% 163.3 54.5 13.1 – – 230.9Finance lease liability 2.8% – – 4.6 4.6 – 9.2Variable interest rate instruments 4.7% 5.4 11.0 49.0 1,247.5 343.2 1,656.1Total 168.7 65.5 66.7 1,252.1 343.2 1,896.21-5years$m5+years$mTotal$m142<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts