Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

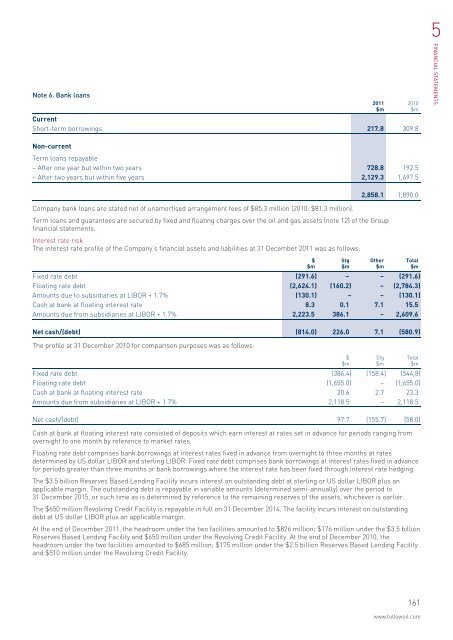

5Note 6. Bank loansCurrentShort-term borrowings 217.8 309.8<strong>2011</strong>$m2010$mFINANCIAL STATEMENTSNon-currentTerm loans repayable– After one year but within two years 728.8 192.5– After two years but within five years 2,129.3 1,697.52,858.1 1,890.0Company bank loans are stated net of unamortised arrangement fees of $85.3 million (2010: $81.3 million).Term loans and guarantees are secured by fixed and floating charges over the oil and gas assets (note 12) of the <strong>Group</strong>financial statements.Interest rate risk<strong>The</strong> interest rate profile of the Company’s financial assets and liabilities at 31 December <strong>2011</strong> was as follows:Fixed rate debt (291.6) – – (291.6)Floating rate debt (2,624.1) (160.2) – (2,784.3)Amounts due to subsidiaries at LIBOR + 1.7% (130.1) – – (130.1)Cash at bank at floating interest rate 8.3 0.1 7.1 15.5Amounts due from subsidiaries at LIBOR + 1.7% 2,223.5 386.1 – 2,609.6$$mStg$mOther$mTotal$mNet cash/(debt) (814.0) 226.0 7.1 (580.9)<strong>The</strong> profile at 31 December 2010 for comparison purposes was as follows:Fixed rate debt (386.4) (158.4) (544.8)Floating rate debt (1,655.0) – (1,655.0)Cash at bank at floating interest rate 20.6 2.7 23.3Amounts due from subsidiaries at LIBOR + 1.7% 2,118.5 – 2,118.5$$mStg$mTotal$mNet cash/(debt) 97.7 (155.7) (58.0)Cash at bank at floating interest rate consisted of deposits which earn interest at rates set in advance for periods ranging fromovernight to one month by reference to market rates.Floating rate debt comprises bank borrowings at interest rates fixed in advance from overnight to three months at ratesdetermined by US dollar LIBOR and sterling LIBOR. Fixed rate debt comprises bank borrowings at interest rates fixed in advancefor periods greater than three months or bank borrowings where the interest rate has been fixed through interest rate hedging.<strong>The</strong> $3.5 billion Reserves Based Lending Facility incurs interest on outstanding debt at sterling or US dollar LIBOR plus anapplicable margin. <strong>The</strong> outstanding debt is repayable in variable amounts (determined semi-annually) over the period to31 December 2015, or such time as is determined by reference to the remaining reserves of the assets, whichever is earlier.<strong>The</strong> $650 million Revolving Credit Facility is repayable in full on 31 December 2014. <strong>The</strong> facility incurs interest on outstandingdebt at US dollar LIBOR plus an applicable margin.At the end of December <strong>2011</strong>, the headroom under the two facilities amounted to $826 million; $176 million under the $3.5 billionReserves Based Lending Facility and $650 million under the Revolving Credit Facility. At the end of December 2010, theheadroom under the two facilities amounted to $685 million; $175 million under the $2.5 billion Reserves Based Lending Facilityand $510 million under the Revolving Credit Facility.161www.tullowoil.com