Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

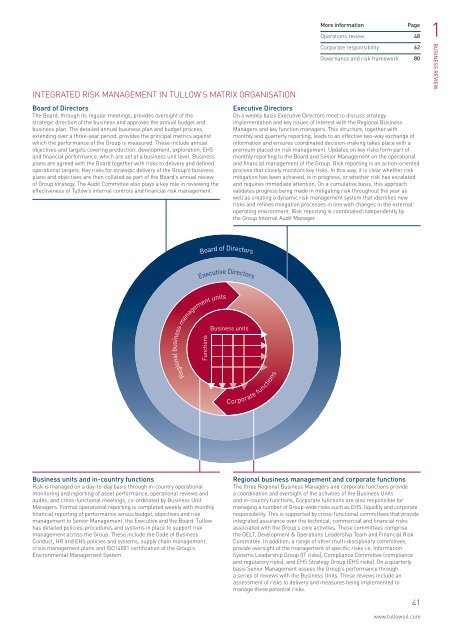

Regional business management unitsINTEGRATED RISK MANAGEMENT IN TULLOW’S MATRIX ORGANISATIONBoard of Directors<strong>The</strong> Board, through its regular meetings, provides oversight of thestrategic direction of the business and approves the annual budget andbusiness plan. <strong>The</strong> detailed annual business plan and budget process,extending over a three-year period, provides the principal metrics againstwhich the performance of the <strong>Group</strong> is measured. <strong>The</strong>se include annualobjectives and targets covering production, development, exploration, EHSand financial performance, which are set at a business unit level. Businessplans are agreed with the Board together with risks to delivery and definedoperational targets. Key risks for strategic delivery of the <strong>Group</strong>’s businessplans and objectives are then collated as part of the Board’s annual reviewof <strong>Group</strong> strategy. <strong>The</strong> Audit Committee also plays a key role in reviewing theeffectiveness of <strong>Tullow</strong>’s internal controls and financial risk management.More informationPageOperations review 48Corporate responsibility 62Governance and risk framework 80Executive DirectorsOn a weekly basis Executive Directors meet to discuss strategyimplementation and key issues of interest with the Regional BusinessManagers and key function managers. This structure, together withmonthly and quarterly reporting, leads to an effective two-way exchange ofinformation and ensures coordinated decision-making takes place with apremium placed on risk management. Updates on key risks form part ofmonthly reporting to the Board and Senior Management on the operationaland financial management of the <strong>Group</strong>. Risk reporting is an action-orientedprocess that closely monitors key risks. In this way, it is clear whether riskmitigation has been achieved, is in progress, or whether risk has escalatedand requires immediate attention. On a cumulative basis, this approachvalidates progress being made in mitigating risk throughout the year aswell as creating a dynamic risk management system that identifies newrisks and refines mitigation processes in line with changes in the externaloperating environment. Risk reporting is coordinated independently bythe <strong>Group</strong> Internal Audit Manager.1BUSINESS REVIEWBoard of DirectorsExecutive DirectorsFunctionsBusiness unitsCorporate functionsBusiness units and in-country functionsRisk is managed on a day-to-day basis through in-country operationalmonitoring and reporting of asset performance, operational reviews andaudits, and cross-functional meetings, co-ordinated by Business UnitManagers. Formal operational reporting is completed weekly with monthlyfinancial reporting of performance versus budget, objectives and riskmanagement to Senior Management, the Executive and the Board. <strong>Tullow</strong>has detailed policies, procedures and systems in place to support riskmanagement across the <strong>Group</strong>. <strong>The</strong>se include the Code of BusinessConduct, HR and EHS policies and systems, supply chain management,crisis management plans and ISO14001 certification of the <strong>Group</strong>’sEnvironmental Management System.Regional business management and corporate functions<strong>The</strong> three Regional Business Managers and corporate functions providea coordination and oversight of the activities of the Business Unitsand in-country functions, Corporate functions are also responsible formanaging a number of <strong>Group</strong>-wide risks such as EHS, liquidity and corporateresponsibility. This is supported by cross-functional committees that provideintegrated assurance over the technical, commercial and financial risksassociated with the <strong>Group</strong>’s core activities. <strong>The</strong>se committees comprisethe GELT, Development & Operations Leadership Team and Financial RiskCommittee. In addition, a range of other multi-disciplinary committeesprovide oversight of the management of specific risks i.e. InformationSystems Leadership <strong>Group</strong> (IT risks), Compliance Committee (complianceand regulatory risks), and EHS Strategy <strong>Group</strong> (EHS risks). On a quarterlybasis Senior Management assess the <strong>Group</strong>’s performance througha series of reviews with the Business Units. <strong>The</strong>se reviews include anassessment of risks to delivery and measures being implemented tomanage these potential risks.41www.tullowoil.com