Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

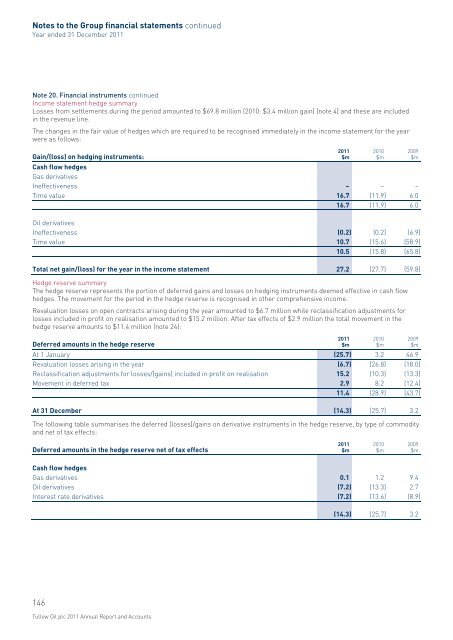

Notes to the <strong>Group</strong> financial statements continuedYear ended 31 December <strong>2011</strong>Note 20. Financial instruments continuedIncome statement hedge summaryLosses from settlements during the period amounted to $69.8 million (2010: $3.4 million gain) (note 4) and these are includedin the revenue line.<strong>The</strong> changes in the fair value of hedges which are required to be recognised immediately in the income statement for the yearwere as follows:Gain/(loss) on hedging instruments:Cash flow hedgesGas derivativesIneffectiveness – – –Time value 16.7 (11.9) 6.016.7 (11.9) 6.0<strong>Oil</strong> derivativesIneffectiveness (0.2) (0.2) (6.9)Time value 10.7 (15.6) (58.9)10.5 (15.8) (65.8)Total net gain/(loss) for the year in the income statement 27.2 (27.7) (59.8)Hedge reserve summary<strong>The</strong> hedge reserve represents the portion of deferred gains and losses on hedging instruments deemed effective in cash flowhedges. <strong>The</strong> movement for the period in the hedge reserve is recognised in other comprehensive income.Revaluation losses on open contracts arising during the year amounted to $6.7 million while reclassification adjustments forlosses included in profit on realisation amounted to $15.2 million. After tax effects of $2.9 million the total movement in thehedge reserve amounts to $11.4 million (note 24):Deferred amounts in the hedge reserveAt 1 January (25.7) 3.2 46.9Revaluation losses arising in the year (6.7) (26.8) (18.0)Reclassification adjustments for losses/(gains) included in profit on realisation 15.2 (10.3) (13.3)Movement in deferred tax 2.9 8.2 (12.4)11.4 (28.9) (43.7)At 31 December (14.3) (25.7) 3.2<strong>The</strong> following table summarises the deferred (losses)/gains on derivative instruments in the hedge reserve, by type of commodityand net of tax effects:<strong>2011</strong>$m<strong>2011</strong>$m2010$m2010$m2009$m2009$mDeferred amounts in the hedge reserve net of tax effects<strong>2011</strong>$m2010$m2009$mCash flow hedgesGas derivatives 0.1 1.2 9.4<strong>Oil</strong> derivatives (7.2) (13.3) 2.7Interest rate derivatives (7.2) (13.6) (8.9)(14.3) (25.7) 3.2146<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts