Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

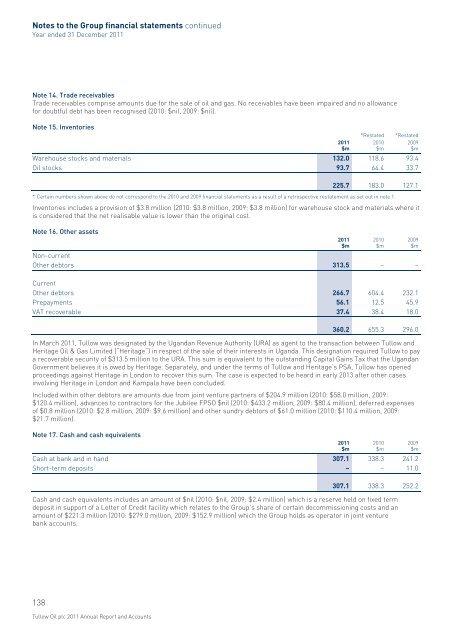

Notes to the <strong>Group</strong> financial statements continuedYear ended 31 December <strong>2011</strong>Note 14. Trade receivablesTrade receivables comprise amounts due for the sale of oil and gas. No receivables have been impaired and no allowancefor doubtful debt has been recognised (2010: $nil, 2009: $nil).Note 15. Inventories<strong>2011</strong>$m*Restated2010$m*Restated2009$mWarehouse stocks and materials 132.0 118.6 93.4<strong>Oil</strong> stocks 93.7 64.4 33.7225.7 183.0 127.1* Certain numbers shown above do not correspond to the 2010 and 2009 financial statements as a result of a retrospective restatement as set out in note 1.Inventories includes a provision of $3.8 million (2010: $3.8 million, 2009: $3.8 million) for warehouse stock and materials where itis considered that the net realisable value is lower than the original cost.Note 16. Other assetsNon-currentOther debtors 313.5 – –CurrentOther debtors 266.7 604.4 232.1Prepayments 56.1 12.5 45.9VAT recoverable 37.4 38.4 18.0<strong>2011</strong>$m2010$m2009$m360.2 655.3 296.0In March <strong>2011</strong>, <strong>Tullow</strong> was designated by the Ugandan Revenue Authority (URA) as agent to the transaction between <strong>Tullow</strong> andHeritage <strong>Oil</strong> & Gas Limited (“Heritage”) in respect of the sale of their interests in Uganda. This designation required <strong>Tullow</strong> to paya recoverable security of $313.5 million to the URA. This sum is equivalent to the outstanding Capital Gains Tax that the UgandanGovernment believes it is owed by Heritage. Separately, and under the terms of <strong>Tullow</strong> and Heritage’s PSA, <strong>Tullow</strong> has openedproceedings against Heritage in London to recover this sum. <strong>The</strong> case is expected to be heard in early 2013 after other casesinvolving Heritage in London and Kampala have been concluded.Included within other debtors are amounts due from joint venture partners of $204.9 million (2010: $58.0 million, 2009:$120.4 million), advances to contractors for the Jubilee FPSO $nil (2010: $433.2 million, 2009: $80.4 million), deferred expensesof $0.8 million (2010: $2.8 million, 2009: $9.6 million) and other sundry debtors of $61.0 million (2010: $110.4 million, 2009:$21.7 million).Note 17. Cash and cash equivalentsCash at bank and in hand 307.1 338.3 241.2Short-term deposits – – 11.0<strong>2011</strong>$m2010$m2009$m307.1 338.3 252.2Cash and cash equivalents includes an amount of $nil (2010: $nil, 2009: $2.4 million) which is a reserve held on fixed termdeposit in support of a Letter of Credit facility which relates to the <strong>Group</strong>’s share of certain decommissioning costs and anamount of $221.3 million (2010: $279.0 million, 2009: $152.9 million) which the <strong>Group</strong> holds as operator in joint venturebank accounts.138<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts