Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

Tullow Oil plc Annual Report 2011 - The Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

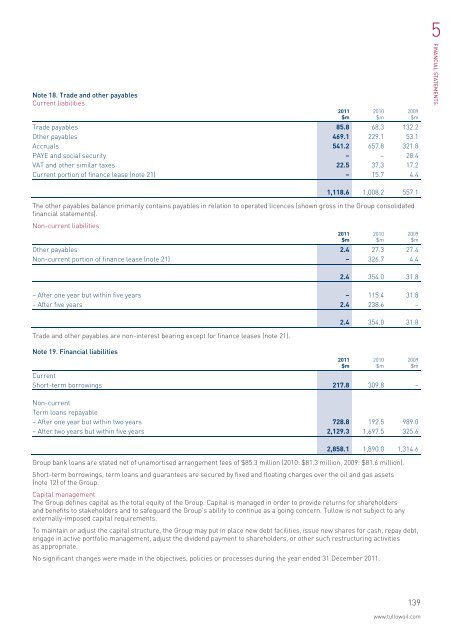

5Note 18. Trade and other payablesCurrent liabilitiesTrade payables 85.8 68.3 132.2Other payables 469.1 229.1 53.1Accruals 541.2 657.8 321.8PAYE and social security – – 28.4VAT and other similar taxes 22.5 37.3 17.2Current portion of finance lease (note 21) – 15.7 4.4<strong>2011</strong>$m2010$m2009$mFINANCIAL STATEMENTS1,118.6 1,008.2 557.1<strong>The</strong> other payables balance primarily contains payables in relation to operated licences (shown gross in the <strong>Group</strong> consolidatedfinancial statements).Non-current liabilitiesOther payables 2.4 27.3 27.4Non-current portion of finance lease (note 21) – 326.7 4.4<strong>2011</strong>$m2010$m2009$m2.4 354.0 31.8– After one year but within five years – 115.4 31.8– After five years 2.4 238.6 –Trade and other payables are non-interest bearing except for finance leases (note 21).Note 19. Financial liabilities2.4 354.0 31.8CurrentShort-term borrowings 217.8 309.8 –Non-currentTerm loans repayable– After one year but within two years 728.8 192.5 989.0– After two years but within five years 2,129.3 1,697.5 325.6<strong>2011</strong>$m2010$m2009$m2,858.1 1,890.0 1,314.6<strong>Group</strong> bank loans are stated net of unamortised arrangement fees of $85.3 million (2010: $81.3 million, 2009: $81.6 million).Short-term borrowings, term loans and guarantees are secured by fixed and floating charges over the oil and gas assets(note 12) of the <strong>Group</strong>.Capital management<strong>The</strong> <strong>Group</strong> defines capital as the total equity of the <strong>Group</strong>. Capital is managed in order to provide returns for shareholdersand benefits to stakeholders and to safeguard the <strong>Group</strong>’s ability to continue as a going concern. <strong>Tullow</strong> is not subject to anyexternally-imposed capital requirements.To maintain or adjust the capital structure, the <strong>Group</strong> may put in place new debt facilities, issue new shares for cash, repay debt,engage in active portfolio management, adjust the dividend payment to shareholders, or other such restructuring activitiesas appropriate.No significant changes were made in the objectives, policies or processes during the year ended 31 December <strong>2011</strong>.139www.tullowoil.com