PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

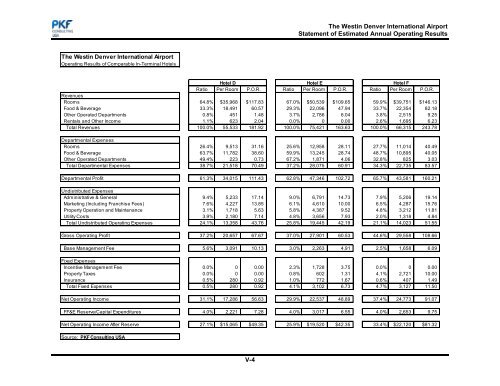

The Westin Denver International AirportStatement of Estimated Annual Operating ResultsThe Westin Denver International AirportOperating Results of Comparable In-Terminal <strong>Hotel</strong>s<strong>Hotel</strong> D <strong>Hotel</strong> E <strong>Hotel</strong> FRatio Per Room P.O.R. Ratio Per Room P.O.R. Ratio Per Room P.O.R.RevenuesRooms 64.8% $35,968 $117.83 67.0% $50,539 $109.65 59.9% $39,751 $146.13Food & Beverage 33.3% 18,491 60.57 29.3% 22,096 47.94 33.7% 22,354 82.18Other Operated Departments 0.8% 451 1.48 3.7% 2,786 6.04 3.8% 2,515 9.25Rentals <strong>and</strong> Other Income 1.1% 623 2.04 0.0% 0 0.00 2.6% 1,695 6.23Total Revenues 100.0% 55,533 181.92 100.0% 75,421 163.63 100.0% 66,315 243.78Departmental ExpensesRooms 26.4% 9,513 31.16 25.6% 12,958 28.11 27.7% 11,014 40.49Food & Beverage 63.7% 11,782 38.60 59.9% 13,245 28.74 48.7% 10,895 40.05Other Operated Departments 49.4% 223 0.73 67.2% 1,871 4.06 32.8% 825 3.03Total Departmental Expenses 38.7% 21,518 70.49 37.2% 28,075 60.91 34.3% 22,735 83.57Departmental Profit 61.3% 34,015 111.43 62.8% 47,346 102.72 65.7% 43,581 160.21Undistributed ExpensesAdministrative & General 9.4% 5,233 17.14 9.0% 6,791 14.73 7.9% 5,206 19.14<strong>Market</strong>ing (Including Franchise Fees) 7.6% 4,227 13.85 6.1% 4,610 10.00 6.5% 4,287 15.76Property Operation <strong>and</strong> Maintenance 3.1% 1,718 5.63 5.8% 4,387 9.52 4.8% 3,212 11.81Utility Costs 3.9% 2,180 7.14 4.8% 3,656 7.93 2.0% 1,318 4.84Total Undistributed Operating Expenses 24.1% 13,358 43.76 25.8% 19,445 42.19 21.1% 14,023 51.55Gross Operating Profit 37.2% 20,657 67.67 37.0% 27,901 60.53 44.6% 29,558 108.66Base Management Fee 5.6% 3,091 10.13 3.0% 2,263 4.91 2.5% 1,658 6.09Fixed ExpensesIncentive Management Fee 0.0% 0 0.00 2.3% 1,728 3.75 0.0% 0 0.00Property Taxes 0.0% 0 0.00 0.8% 602 1.31 4.1% 2,721 10.00Insurance 0.5% 280 0.92 1.0% 772 1.67 0.6% 407 1.49Total Fixed Expenses 0.5% 280 0.92 4.1% 3,102 6.73 4.7% 3,127 11.50Net Operating Income 31.1% 17,286 56.63 29.9% 22,537 48.89 37.4% 24,773 91.07FF&E Reserve/Capital Expenditures 4.0% 2,221 7.28 4.0% 3,017 6.55 4.0% 2,653 9.75Net Operating Income After Reserve 27.1% $15,065 $49.35 25.9% $19,520 $42.35 33.4% $22,120 $81.32Source: <strong>PKF</strong> Consulting USAV-4