PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

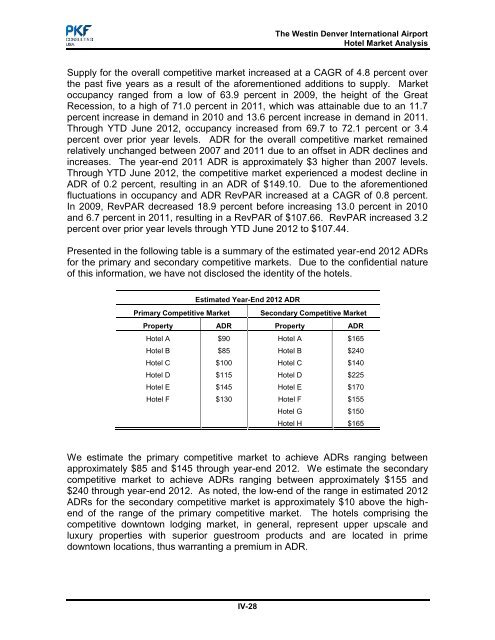

The Westin Denver International Airport<strong>Hotel</strong> <strong>Market</strong> <strong>Analysis</strong>Supply for the overall competitive market increased at a CAGR of 4.8 percent overthe past five years as a result of the aforementioned additions to supply. <strong>Market</strong>occupancy ranged from a low of 63.9 percent in 2009, the height of the GreatRecession, to a high of 71.0 percent in 2011, which was attainable due to an 11.7percent increase in dem<strong>and</strong> in 2010 <strong>and</strong> 13.6 percent increase in dem<strong>and</strong> in 2011.Through YTD June 2012, occupancy increased from 69.7 to 72.1 percent or 3.4percent over prior year levels. ADR for the overall competitive market remainedrelatively unchanged between 2007 <strong>and</strong> 2011 due to an offset in ADR declines <strong>and</strong>increases. The year-end 2011 ADR is approximately $3 higher than 2007 levels.Through YTD June 2012, the competitive market experienced a modest decline inADR of 0.2 percent, resulting in an ADR of $149.10. Due to the aforementionedfluctuations in occupancy <strong>and</strong> ADR RevPAR increased at a CAGR of 0.8 percent.In 2009, RevPAR decreased 18.9 percent before increasing 13.0 percent in 2010<strong>and</strong> 6.7 percent in 2011, resulting in a RevPAR of $107.66. RevPAR increased 3.2percent over prior year levels through YTD June 2012 to $107.44.Presented in the following table is a summary of the estimated year-end 2012 ADRsfor the primary <strong>and</strong> secondary competitive markets. Due to the confidential natureof this information, we have not disclosed the identity of the hotels.Estimated Year-End 2012 ADRPrimary Competitive <strong>Market</strong> Secondary Competitive <strong>Market</strong>Property ADR Property ADR<strong>Hotel</strong> A $90 <strong>Hotel</strong> A $165<strong>Hotel</strong> B $85 <strong>Hotel</strong> B $240<strong>Hotel</strong> C $100 <strong>Hotel</strong> C $140<strong>Hotel</strong> D $115 <strong>Hotel</strong> D $225<strong>Hotel</strong> E $145 <strong>Hotel</strong> E $170<strong>Hotel</strong> F $130 <strong>Hotel</strong> F $155<strong>Hotel</strong> G $150<strong>Hotel</strong> H $165We estimate the primary competitive market to achieve ADRs ranging betweenapproximately $85 <strong>and</strong> $145 through year-end 2012. We estimate the secondarycompetitive market to achieve ADRs ranging between approximately $155 <strong>and</strong>$240 through year-end 2012. As noted, the low-end of the range in estimated 2012ADRs for the secondary competitive market is approximately $10 above the highendof the range of the primary competitive market. The hotels comprising thecompetitive downtown lodging market, in general, represent upper upscale <strong>and</strong>luxury properties with superior guestroom products <strong>and</strong> are located in primedowntown locations, thus warranting a premium in ADR.IV-28