PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

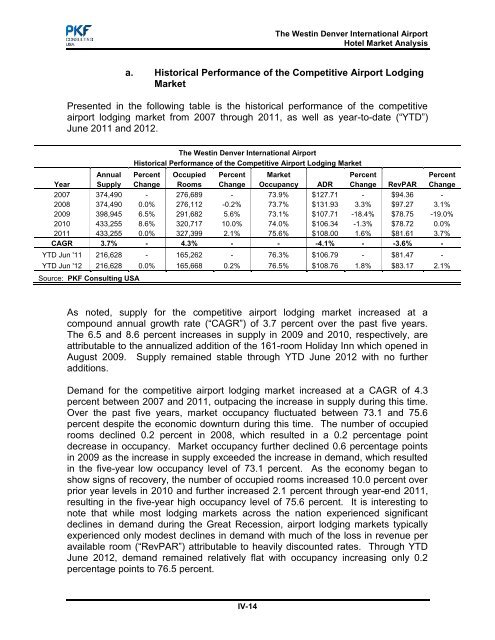

The Westin Denver International Airport<strong>Hotel</strong> <strong>Market</strong> <strong>Analysis</strong>a. Historical Performance of the Competitive Airport Lodging<strong>Market</strong>Presented in the following table is the historical performance of the competitiveairport lodging market from 2007 through 2011, as well as year-to-date (“YTD”)June 2011 <strong>and</strong> 2012.The Westin Denver International AirportHistorical Performance of the Competitive Airport Lodging <strong>Market</strong>Annual Percent Occupied Percent <strong>Market</strong> Percent PercentYear Supply Change Rooms Change Occupancy ADR Change RevPAR Change2007 374,490 - 276,689 - 73.9% $127.71 - $94.36 -2008 374,490 0.0% 276,112 -0.2% 73.7% $131.93 3.3% $97.27 3.1%2009 398,945 6.5% 291,682 5.6% 73.1% $107.71 -18.4% $78.75 -19.0%2010 433,255 8.6% 320,717 10.0% 74.0% $106.34 -1.3% $78.72 0.0%2011 433,255 0.0% 327,399 2.1% 75.6% $108.00 1.6% $81.61 3.7%CAGR 3.7% - 4.3% - - -4.1% - -3.6% -YTD Jun '11 216,628 - 165,262 - 76.3% $106.79 - $81.47 -YTD Jun '12 216,628 0.0% 165,668 0.2% 76.5% $108.76 1.8% $83.17 2.1%Source: <strong>PKF</strong> Consulting USAAs noted, supply for the competitive airport lodging market increased at acompound annual growth rate (“CAGR”) of 3.7 percent over the past five years.The 6.5 <strong>and</strong> 8.6 percent increases in supply in 2009 <strong>and</strong> 2010, respectively, areattributable to the annualized addition of the 161-room Holiday Inn which opened inAugust 2009. Supply remained stable through YTD June 2012 with no furtheradditions.<strong>Dem<strong>and</strong></strong> for the competitive airport lodging market increased at a CAGR of 4.3percent between 2007 <strong>and</strong> 2011, outpacing the increase in supply during this time.Over the past five years, market occupancy fluctuated between 73.1 <strong>and</strong> 75.6percent despite the economic downturn during this time. The number of occupiedrooms declined 0.2 percent in 2008, which resulted in a 0.2 percentage pointdecrease in occupancy. <strong>Market</strong> occupancy further declined 0.6 percentage pointsin 2009 as the increase in supply exceeded the increase in dem<strong>and</strong>, which resultedin the five-year low occupancy level of 73.1 percent. As the economy began toshow signs of recovery, the number of occupied rooms increased 10.0 percent overprior year levels in 2010 <strong>and</strong> further increased 2.1 percent through year-end 2011,resulting in the five-year high occupancy level of 75.6 percent. It is interesting tonote that while most lodging markets across the nation experienced significantdeclines in dem<strong>and</strong> during the Great Recession, airport lodging markets typicallyexperienced only modest declines in dem<strong>and</strong> with much of the loss in revenue peravailable room (“RevPAR”) attributable to heavily discounted rates. Through YTDJune 2012, dem<strong>and</strong> remained relatively flat with occupancy increasing only 0.2percentage points to 76.5 percent.IV-14