PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

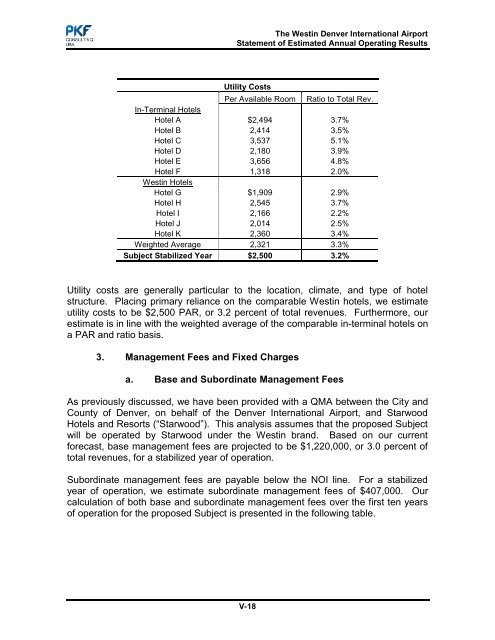

The Westin Denver International AirportStatement of Estimated Annual Operating ResultsUtility CostsPer Available Room Ratio to Total Rev.In-Terminal <strong>Hotel</strong>s<strong>Hotel</strong> A $2,494 3.7%<strong>Hotel</strong> B 2,414 3.5%<strong>Hotel</strong> C 3,537 5.1%<strong>Hotel</strong> D 2,180 3.9%<strong>Hotel</strong> E 3,656 4.8%<strong>Hotel</strong> F 1,318 2.0%Westin <strong>Hotel</strong>s<strong>Hotel</strong> G $1,909 2.9%<strong>Hotel</strong> H 2,545 3.7%<strong>Hotel</strong> I 2,166 2.2%<strong>Hotel</strong> J 2,014 2.5%<strong>Hotel</strong> K 2,360 3.4%Weighted Average 2,321 3.3%Subject Stabilized Year $2,500 3.2%Utility costs are generally particular to the location, climate, <strong>and</strong> type of hotelstructure. Placing primary reliance on the comparable Westin hotels, we estimateutility costs to be $2,500 PAR, or 3.2 percent of total revenues. Furthermore, ourestimate is in line with the weighted average of the comparable in-terminal hotels ona PAR <strong>and</strong> ratio basis.3. Management Fees <strong>and</strong> Fixed Chargesa. Base <strong>and</strong> Subordinate Management FeesAs previously discussed, we have been provided with a QMA between the City <strong>and</strong>County of Denver, on behalf of the Denver International Airport, <strong>and</strong> Starwood<strong>Hotel</strong>s <strong>and</strong> Resorts (“Starwood”). This analysis assumes that the proposed Subjectwill be operated by Starwood under the Westin br<strong>and</strong>. Based on our currentforecast, base management fees are projected to be $1,220,000, or 3.0 percent oftotal revenues, for a stabilized year of operation.Subordinate management fees are payable below the NOI line. For a stabilizedyear of operation, we estimate subordinate management fees of $407,000. Ourcalculation of both base <strong>and</strong> subordinate management fees over the first ten yearsof operation for the proposed Subject is presented in the following table.V-18