PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

PKF Hotel Market Demand and Financial Analysis - DIA Business ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

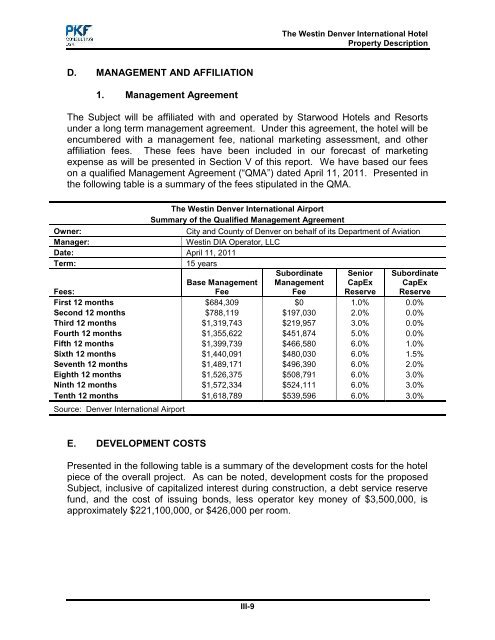

The Westin Denver International <strong>Hotel</strong>Property DescriptionD. MANAGEMENT AND AFFILIATION1. Management AgreementThe Subject will be affiliated with <strong>and</strong> operated by Starwood <strong>Hotel</strong>s <strong>and</strong> Resortsunder a long term management agreement. Under this agreement, the hotel will beencumbered with a management fee, national marketing assessment, <strong>and</strong> otheraffiliation fees. These fees have been included in our forecast of marketingexpense as will be presented in Section V of this report. We have based our feeson a qualified Management Agreement (“QMA”) dated April 11, 2011. Presented inthe following table is a summary of the fees stipulated in the QMA.Owner:Manager:Date: April 11, 2011Term:15 yearsThe Westin Denver International AirportSummary of the Qualified Management AgreementCity <strong>and</strong> County of Denver on behalf of its Department of AviationWestin <strong>DIA</strong> Operator, LLCSubordinateManagementFeeSeniorCapExReserveSubordinateCapExReserveBase ManagementFees:FeeFirst 12 months $684,309 $0 1.0% 0.0%Second 12 months $788,119 $197,030 2.0% 0.0%Third 12 months $1,319,743 $219,957 3.0% 0.0%Fourth 12 months $1,355,622 $451,874 5.0% 0.0%Fifth 12 months $1,399,739 $466,580 6.0% 1.0%Sixth 12 months $1,440,091 $480,030 6.0% 1.5%Seventh 12 months $1,489,171 $496,390 6.0% 2.0%Eighth 12 months $1,526,375 $508,791 6.0% 3.0%Ninth 12 months $1,572,334 $524,111 6.0% 3.0%Tenth 12 months $1,618,789 $539,596 6.0% 3.0%Source: Denver International AirportE. DEVELOPMENT COSTSPresented in the following table is a summary of the development costs for the hotelpiece of the overall project. As can be noted, development costs for the proposedSubject, inclusive of capitalized interest during construction, a debt service reservefund, <strong>and</strong> the cost of issuing bonds, less operator key money of $3,500,000, isapproximately $221,100,000, or $426,000 per room.III-9