Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

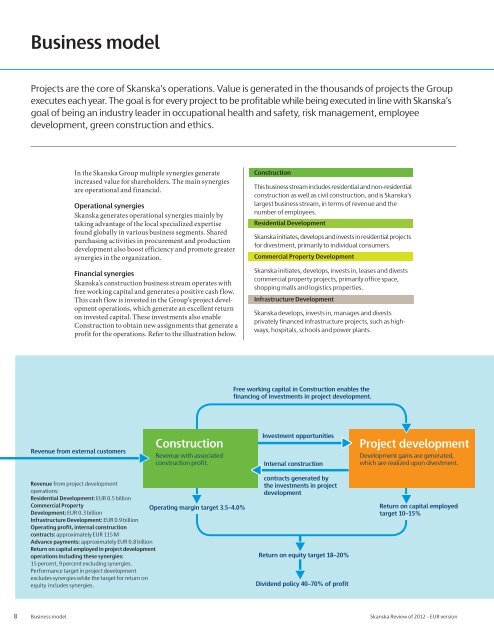

◀◀◀◀◀Business modelProjects are the core <strong>of</strong> <strong>Skanska</strong>’s operations. Value is generated in the thousands <strong>of</strong> projects the Groupexecutes each year. The goal is for every project to be pr<strong>of</strong>itable while being executed in line with <strong>Skanska</strong>’sgoal <strong>of</strong> being an industry leader in occupational health and safety, risk management, employeedevelopment, green construction and ethics.In the <strong>Skanska</strong> Group multiple synergies generateincreased value for shareholders. The main synergiesare operational and financial.Operational synergies<strong>Skanska</strong> generates operational synergies mainly bytaking advantage <strong>of</strong> the local specialized expertisefound globally in various business segments. Sharedpurchasing activities in procurement and productiondevelopment also boost efficiency and promote greatersynergies in the organization.Financial synergies<strong>Skanska</strong>’s construction business stream operates withfree working capital and generates a positive cash flow.This cash flow is invested in the Group’s project developmentoperations, which generate an excellent returnon invested capital. These investments also enableConstruction to obtain new assignments that generate apr<strong>of</strong>it for the operations. Refer to the illustration below.ConstructionThis business stream includes residential and non-residentialconstruction as well as civil construction, and is <strong>Skanska</strong>’slargest business stream, in terms <strong>of</strong> revenue and thenumber <strong>of</strong> employees.Residential Development<strong>Skanska</strong> initiates, develops and invests in residential projectsfor divestment, primarily to individual consumers.Commercial Property Development<strong>Skanska</strong> initiates, develops, invests in, leases and divestscommercial property projects, primarily <strong>of</strong>fice space,shopping malls and logistics properties.Infrastructure Development<strong>Skanska</strong> develops, invests in, manages and divestsprivately financed infrastructure projects, such as highways,hospitals, schools and power plants.Free working capital in Construction enables thefinancing <strong>of</strong> investments in project development.Revenue from external customersConstructionRevenue with associatedconstruction pr<strong>of</strong>it.Revenue from project developmentoperations:Residential Development: <strong>EUR</strong> 0.5 billionCommercial PropertyOperating margin target 3.5–4.0%Development: <strong>EUR</strong> 0.3 billionInfrastructure Development: <strong>EUR</strong> 0.9 billionOperating pr<strong>of</strong>it, internal constructioncontracts: approximately <strong>EUR</strong> 115 MAdvance payments: approximately <strong>EUR</strong> 0.8 billionReturn on capital employed in project developmentoperations including these synergies:15 percent, 9 percent excluding synergies.Performance target in project developmentexcludes synergies while the target for return onequity includes synergies.◀◀Investment opportunitiesInternal constructioncontracts generated bythe investments in projectdevelopmentReturn on equity target 18–20%Dividend policy 40–70% <strong>of</strong> pr<strong>of</strong>it◀Project developmentDevelopment gains are generated,which are realized upon divestment.Return on capital employedtarget 10–15%8 Business model <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version