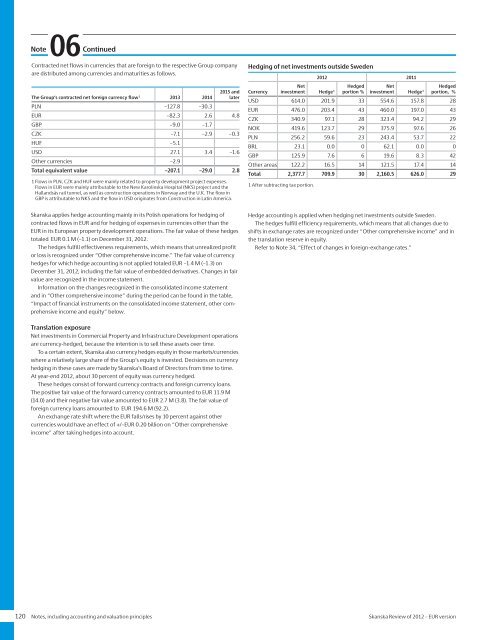

06NoteContinuedContracted net flows in currencies that are foreign to the respective Group companyare distributed among currencies and maturities as follows.The Group’s contracted net foreign currency flow 1 2013 20142015 andlaterPLN –127.8 –30.3<strong>EUR</strong> –82.3 2.6 4.8GBP –9.0 –1.7CZK –7.1 –2.9 –0.3HUF –5.1USD 27.1 3.4 –1.6Other currencies –2.9Total equivalent value –207.1 –29.0 2.81 Flows in PLN, CZK and HUF were mainly related to property development project expenses.Flows in <strong>EUR</strong> were mainly attributable to the New Karolinska Hospital (NKS) project and theHallandsås rail tunnel, as well as construction operations in Norway and the U.K. The flow inGBP is attributable to NKS and the flow in USD originates from Construction in Latin America.Hedging <strong>of</strong> net investments outside Sweden<strong>2012</strong> 2011CurrencyNetinvestment Hedge 1 Hedgedportion %Netinvestment Hedge 1 Hedgedportion, %USD 614.0 201.9 33 554.6 157.8 28<strong>EUR</strong> 476.0 203.4 43 460.0 197.0 43CZK 340.9 97.1 28 323.4 94.2 29NOK 419.6 123.7 29 375.9 97.6 26PLN 256.2 59.6 23 243.4 53.7 22BRL 23.1 0.0 0 62.1 0.0 0GBP 125.9 7.6 6 19.6 8.3 42Other areas 122.2 16.5 14 121.5 17.4 14Total 2,377.7 709.9 30 2,160.5 626.0 291 After subtracting tax portion.<strong>Skanska</strong> applies hedge accounting mainly in its Polish operations for hedging <strong>of</strong>contracted flows in <strong>EUR</strong> and for hedging <strong>of</strong> expenses in currencies other than the<strong>EUR</strong> in its European property development operations. The fair value <strong>of</strong> these hedgestotaled <strong>EUR</strong> 0.1 M (–1.1) on December 31, <strong>2012</strong>.The hedges fulfill effectiveness requirements, which means that unrealized pr<strong>of</strong>itor loss is recognized under “Other comprehensive income.” The fair value <strong>of</strong> currencyhedges for which hedge accounting is not applied totaled <strong>EUR</strong> –1.4 M (–1.3) onDecember 31, <strong>2012</strong>, including the fair value <strong>of</strong> embedded derivatives. Changes in fairvalue are recognized in the income statement.Information on the changes recognized in the consolidated income statementand in “Other comprehensive income” during the period can be found in the table,“Impact <strong>of</strong> financial instruments on the consolidated income statement, other comprehensiveincome and equity” below.Hedge accounting is applied when hedging net investments outside Sweden.The hedges fulfill efficiency requirements, which means that all changes due toshifts in exchange rates are recognized under “Other comprehensive income” and inthe translation reserve in equity.Refer to Note 34, “Effect <strong>of</strong> changes in foreign-exchange rates.”Translation exposureNet investments in Commercial Property and Infrastructure Development operationsare currency-hedged, because the intention is to sell these assets over time.To a certain extent, <strong>Skanska</strong> also currency hedges equity in those markets/currencieswhere a relatively large share <strong>of</strong> the Group’s equity is invested. Decisions on currencyhedging in these cases are made by <strong>Skanska</strong>’s Board <strong>of</strong> Directors from time to time.At year-end <strong>2012</strong>, about 30 percent <strong>of</strong> equity was currency hedged.These hedges consist <strong>of</strong> forward currency contracts and foreign currency loans.The positive fair value <strong>of</strong> the forward currency contracts amounted to <strong>EUR</strong> 11.9 M(14.0) and their negative fair value amounted to <strong>EUR</strong> 2.7 M (3.8). The fair value <strong>of</strong>foreign currency loans amounted to <strong>EUR</strong> 194.6 M (92.2).An exchange rate shift where the <strong>EUR</strong> falls/rises by 10 percent against othercurrencies would have an effect <strong>of</strong> +/–<strong>EUR</strong> 0.20 billion on “Other comprehensiveincome” after taking hedges into account.120 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version

06NoteContinuedThe role <strong>of</strong> financial instruments in the group’s financial positionand incomeFinancial instruments in the statement <strong>of</strong> financial positionThe following table presents the carrying amount <strong>of</strong> financial instruments allocatedby category as well as a reconciliation with total assets and liabilities in the statement<strong>of</strong> financial position. Derivatives subject to hedge accounting are presented separatelyboth as financial assets and financial liabilities, but belong to the category,“At fair value through pr<strong>of</strong>it and loss.”See also Note 21, “Financial assets,” Note 24, “Trade and other receivables,”Note 27, “Financial liabilities” and Note 30, “Operating liabilities.”AssetsAt fair valuethrough pr<strong>of</strong>itor lossHedgeaccountedderivativesHeld-tomaturityinvestmentsAvailable-forsaleassetsLoans andreceivablesTotal carryingamount<strong>2012</strong>Financial instrumentsInterest-bearing assets and derivativesFinancial assets 1Financial investments at fair value 10.0 11.9 21.9Financial investments at amortized cost 153.6 153.6Financial interest-bearing receivables 713.1 713.110.0 11.9 153.6 0.0 713.1 888.6Current investments at fair valueCash 671.9 671.910.0 11.9 153.6 0.0 1,385.0 1,560.5Trade accounts receivable 2 2,201.8 2,201.8Other operating receivables including sharesShares recognized as available-for-sale assets 3 5.8 5.8Other operating receivables 2, 4 6.2 6.20.0 0.0 0.0 5.8 6.2 12.0Total financial instruments 10.0 11.9 153.6 5.8 3,593.0 3,774.32011Financial instrumentsInterest-bearing assets and derivativesFinancial assets 1Financial investments at fair value 11.8 14.0 25.8Financial investments at amortized cost 172.0 172.0Financial interest-bearing receivables 747.7 747.711.8 14.0 172.0 0.0 747.7 945.5Current investments at fair valueCash 595.4 595.411.8 14.0 172.0 0.0 1,343.1 1,540.9Trade accounts receivable 2 2,023.6 2,023.6Other operating receivables including sharesShares recognized as available-for-sale assets 3 4.3 4.3Other operating receivables 2, 4 17.8 17.80.0 0.0 0.0 4.3 17.8 22.1Total financial instruments 11.8 14.0 172.0 4.3 3,384.4 3,586.5The difference between fair value and carrying amount for financial assets is marginal.1 The carrying amount for financial assets excluding shares, totaling <strong>EUR</strong> 888.6 M (945.5) can be seen in Note 21, “Financial assets.”2 Refer to Note 24, “Trade and other receivables.”3 The shares are recognized at cost. The shares are reported in the consolidated statement <strong>of</strong> financial position among financial assets. See also Note 21, “Financial assets.”4 In the consolidated statement <strong>of</strong> financial position, <strong>EUR</strong> 2,744.3 M (2,538.7) was reported as “Trade and other receivables.” Refer to Note 24, “Trade and other receivables.” Of this amount, <strong>EUR</strong>2,201.8 M (2,023.6) was under “Trade accounts receivable.” These were reported as financial instruments. The remaining amount was <strong>EUR</strong> 542.4 M (515.2) and was allocated between <strong>EUR</strong> 6.2 M(17.8) in financial instruments and <strong>EUR</strong> 536.3 M (497.4) in non-financial instruments. The amount reported as financial instruments included accrued interest income, deposits etc. Reported as nonfinancialitems were, for example, interim items other than accrued interest, VAT receivables, pension-related receivables and other employee-related receivables.<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version Notes, including accounting and valuation principles 121

- Page 1:

Review of 2012EUR version

- Page 4 and 5:

Skanska’s strengthsPositions Empl

- Page 6 and 7:

2012 in briefFirst quarterSecond qu

- Page 8 and 9:

Comments by the President and CEOTh

- Page 10 and 11:

MissionSkanska’s mission isto dev

- Page 12 and 13:

◀◀◀◀◀Business modelProjec

- Page 14 and 15:

Financial targetsSkanska’s busine

- Page 16 and 17:

Risk managementThe continuous stren

- Page 18 and 19:

30,000potential projects analyzed e

- Page 20 and 21:

Skanska’s role in the communitySk

- Page 22 and 23:

-100of thousands of people get invo

- Page 24 and 25:

Earnings are generated by peopleCom

- Page 26 and 27:

22,000employees are developed each

- Page 28 and 29:

Share dataFor more than ten years,

- Page 30 and 31:

Growth in equityDividends re-invest

- Page 32 and 33:

ConstructionThe Värtan Interchange

- Page 34 and 35:

Increased revenues and strong order

- Page 36 and 37:

Nordic countriesSwedenNorwayFinland

- Page 38 and 39:

StatoilBuilt by: Skanska NorwayCust

- Page 40 and 41:

Other European countriesPolandCzech

- Page 42 and 43:

Cross London Rail Links - Cross Rai

- Page 44 and 45:

The AmericasUSA BuildingUSA CivilLa

- Page 46 and 47:

High pace forhigher education

- Page 48 and 49:

Residential DevelopmentContinued gr

- Page 50 and 51:

Enhancing efficiency in the Nordic

- Page 52 and 53:

Nordic countriesSwedenNorwayFinland

- Page 54 and 55:

Other European countriesPolandCzech

- Page 56 and 57:

Commercial Property DevelopmentFull

- Page 58 and 59:

Profitable property divestments yea

- Page 60 and 61:

Nordic countriesSwedenNorwayFinland

- Page 62 and 63:

Other European countriesPolandCzech

- Page 64 and 65:

Strong expansionin PolandPoznańWar

- Page 66 and 67:

United StatesIn the U.S., Skanska i

- Page 68 and 69:

Infrastructure DevelopmentOne of Lo

- Page 70 and 71:

Improved conditions for new project

- Page 72 and 73:

Project portfolioSkanska’s Infras

- Page 74 and 75: Elizabeth River Tunnels(Downtown Tu

- Page 76 and 77: Sustainable developmentSustainable

- Page 78 and 79: We play fairSkanska Czech Republic

- Page 80 and 81: Väla Gård, Helsingborg, SwedenVä

- Page 82 and 83: WasteSkanska’s targets for waste

- Page 84 and 85: Global leadershipRecognitionSkanska

- Page 86 and 87: Financial review 2012Revenue showed

- Page 88 and 89: Operating incomeEUR M 2012 2011Oper

- Page 90 and 91: Investments/DivestmentsEUR M 2012 2

- Page 92 and 93: Greater standardization, with short

- Page 94 and 95: NominationCommitteeCompensationComm

- Page 96 and 97: The President and CEO and the eight

- Page 98 and 99: term balance between financial resu

- Page 100 and 101: The allotment of shares earned by t

- Page 102 and 103: Consolidated statement of comprehen

- Page 104 and 105: Consolidated statement of financial

- Page 106 and 107: Consolidated cash flow statementCha

- Page 108 and 109: Notes including accounting and valu

- Page 110 and 111: Note01ContinuedEquityThe Group’s

- Page 112 and 113: 01NoteContinuedhanded over to the c

- Page 114 and 115: 01NoteContinuedwhich means that a p

- Page 116 and 117: Note01Continuedwere an independent

- Page 118 and 119: 02NoteKey estimates and judgmentsKe

- Page 120 and 121: Note04Continued2011 ConstructionRes

- Page 122 and 123: 06NoteFinancial instruments and fin

- Page 126 and 127: 06NoteContinuedReconciliation with

- Page 128 and 129: 06NoteContinuedImpact of financial

- Page 130 and 131: 07NoteContinuedPurchase price alloc

- Page 132 and 133: 08NoteContinuedRevenue by category2

- Page 134 and 135: Note14Net financial items2012 2011F

- Page 136 and 137: Note17Property, plant and equipment

- Page 138 and 139: Note19Intangible assetsIntangible a

- Page 140 and 141: 20NoteContinuedInfrastructure Devel

- Page 142 and 143: Note21FinancialassetsFinancial inve

- Page 144 and 145: 22NoteContinuedNoteDifference betwe

- Page 146 and 147: 26NoteContinuedActuarial gains and

- Page 148 and 149: 28NoteContinuedPlan assetsSweden No

- Page 150 and 151: Note29ProvisionsProvisions are repo

- Page 152 and 153: Note32Expected recovery periods of

- Page 154 and 155: 34NoteForeign-exchange rates and ef

- Page 156 and 157: Note35Cash-flow statementAside from

- Page 158 and 159: Note36PersonnelWages, salaries, oth

- Page 160 and 161: Note37ContinuedIn addition to the a

- Page 162 and 163: Note37ContinuedFinancial targets fo

- Page 164 and 165: Note42Consolidatedquarterly results

- Page 166 and 167: 43NoteFive-year Group financial sum

- Page 168 and 169: Note43ContinuedFinancial ratios etc

- Page 170 and 171: Note45Supplementary information, Pa

- Page 172 and 173: Independent Auditors’ ReportTo th

- Page 174 and 175:

Senior Executive TeamPositionJohan

- Page 176 and 177:

Board of directorsStuart E. Graham

- Page 178 and 179:

Major events during 2012This page s

- Page 180 and 181:

Below are the investments and dives

- Page 182 and 183:

Definitions and explanationsAverage

- Page 184 and 185:

Annual Shareholders’ MeetingInves