Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

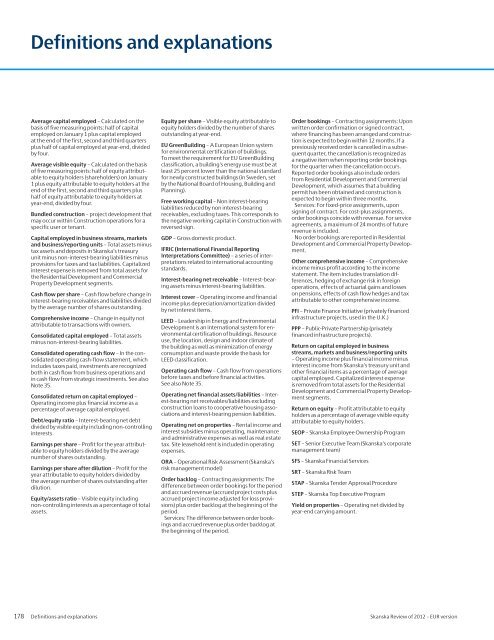

Definitions and explanationsAverage capital employed – Calculated on thebasis <strong>of</strong> five measuring points: half <strong>of</strong> capitalemployed on January 1 plus capital employedat the end <strong>of</strong> the first, second and third quartersplus half <strong>of</strong> capital employed at year-end, dividedby four.Average visible equity – Calculated on the basis<strong>of</strong> five measuring points: half <strong>of</strong> equity attributableto equity holders (shareholders) on January1 plus equity attributable to equity holders at theend <strong>of</strong> the first, second and third quarters plushalf <strong>of</strong> equity attributable to equity holders atyear-end, divided by four.Bundled construction – project development thatmay occur within Construction operations for aspecific user or tenant.Capital employed in business streams, marketsand business/reporting units – Total assets minustax assets and deposits in <strong>Skanska</strong>’s treasuryunit minus non-interest-bearing liabilities minusprovisions for taxes and tax liabilities. Capitalizedinterest expense is removed from total assets forthe Residential Development and CommercialProperty Development segments.Cash flow per share – Cash flow before change ininterest-bearing receivables and liabilities dividedby the average number <strong>of</strong> shares outstanding.Comprehensive income – Change in equity notattributable to transactions with owners.Consolidated capital employed – Total assetsminus non-interest-bearing liabilities.Consolidated operating cash flow – In the consolidatedoperating cash-flow statement, whichincludes taxes paid, investments are recognizedboth in cash flow from business operations andin cash flow from strategic investments. See alsoNote 35.Consolidated return on capital employed –Operating income plus financial income as apercentage <strong>of</strong> average capital employed.Debt/equity ratio – Interest-bearing net debtdivided by visible equity including non-controllinginterests.Earnings per share – Pr<strong>of</strong>it for the year attributableto equity holders divided by the averagenumber <strong>of</strong> shares outstanding.Earnings per share after dilution – Pr<strong>of</strong>it for theyear attributable to equity holders divided bythe average number <strong>of</strong> shares outstanding afterdilution.Equity/assets ratio – Visible equity includingnon-controlling interests as a percentage <strong>of</strong> totalassets.Equity per share – Visible equity attributable toequity holders divided by the number <strong>of</strong> sharesoutstanding at year-end.EU GreenBuilding – A European Union systemfor environmental certification <strong>of</strong> buildings.To meet the requirement for EU GreenBuildingclassification, a building’s energy use must be atleast 25 percent lower than the national standardfor newly constructed buildings (in Sweden, setby the National Board <strong>of</strong> Housing, Building andPlanning).Free working capital – Non interest-bearingliabilities reduced by non interest-bearingreceivables, excluding taxes. This corresponds tothe negative working capital in Construction withreversed sign.GDP – Gross domestic product.IFRIC (International Financial ReportingInterpretations Committee) – a series <strong>of</strong> interpretationsrelated to international accountingstandards.Interest-bearing net receivable – Interest-bearingassets minus interest-bearing liabilities.Interest cover – Operating income and financialincome plus depreciation/amortization dividedby net interest items.LEED – Leadership in Energy and EnvironmentalDevelopment is an international system for environmentalcertification <strong>of</strong> buildings. Resourceuse, the location, design and indoor climate <strong>of</strong>the building as well as minimization <strong>of</strong> energyconsumption and waste provide the basis forLEED classification.Operating cash flow – Cash flow from operationsbefore taxes and before financial activities.See also Note 35.Operating net financial assets/liabilities – Interest-bearingnet receivables/liabilities excludingconstruction loans to cooperative housing associationsand interest-bearing pension liabilities.Operating net on properties – Rental income andinterest subsidies minus operating, maintenanceand administrative expenses as well as real estatetax. Site leasehold rent is included in operatingexpenses.ORA – Operational Risk Assessment (<strong>Skanska</strong>’srisk management model)Order backlog – Contracting assignments: Thedifference between order bookings for the periodand accrued revenue (accrued project costs plusaccrued project income adjusted for loss provisions)plus order backlog at the beginning <strong>of</strong> theperiod.Services: The difference between order bookingsand accrued revenue plus order backlog atthe beginning <strong>of</strong> the period.Order bookings – Contracting assignments: Uponwritten order confirmation or signed contract,where financing has been arranged and constructionis expected to begin within 12 months. If apreviously received order is cancelled in a subsequentquarter, the cancellation is recognized asa negative item when reporting order bookingsfor the quarter when the cancellation occurs.Reported order bookings also include ordersfrom Residential Development and CommercialDevelopment, which assumes that a buildingpermit has been obtained and construction isexpected to begin within three months.Services: For fixed-price assignments, uponsigning <strong>of</strong> contract. For cost-plus assignments,order bookings coincide with revenue. For serviceagreements, a maximum <strong>of</strong> 24 months <strong>of</strong> futurerevenue is included.No order bookings are reported in ResidentialDevelopment and Commercial Property Development.Other comprehensive income – Comprehensiveincome minus pr<strong>of</strong>it according to the incomestatement. The item includes translation differences,hedging <strong>of</strong> exchange risk in foreignoperations, effects <strong>of</strong> actuarial gains and losseson pensions, effects <strong>of</strong> cash flow hedges and taxattributable to other comprehensive income.PFI – Private Finance Initiative (privately financedinfrastructure projects, used in the U.K.)PPP – Public-Private Partnership (privatelyfinanced infrastructure projects).Return on capital employed in businessstreams, markets and business/reporting units– Operating income plus financial income minusinterest income from <strong>Skanska</strong>’s treasury unit andother financial items as a percentage <strong>of</strong> averagecapital employed. Capitalized interest expenseis removed from total assets for the ResidentialDevelopment and Commercial Property Developmentsegments.Return on equity – Pr<strong>of</strong>it attributable to equityholders as a percentage <strong>of</strong> average visible equityattributable to equity holders.SEOP – <strong>Skanska</strong> Employee Ownership ProgramSET – Senior Executive Team (<strong>Skanska</strong>’s corporatemanagement team)SFS – <strong>Skanska</strong> Financial ServicesSRT – <strong>Skanska</strong> Risk TeamSTAP – <strong>Skanska</strong> Tender Approval ProcedureSTEP – <strong>Skanska</strong> Top Executive ProgramYield on properties – Operating net divided byyear-end carrying amount.178 Definitions and explanations <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version