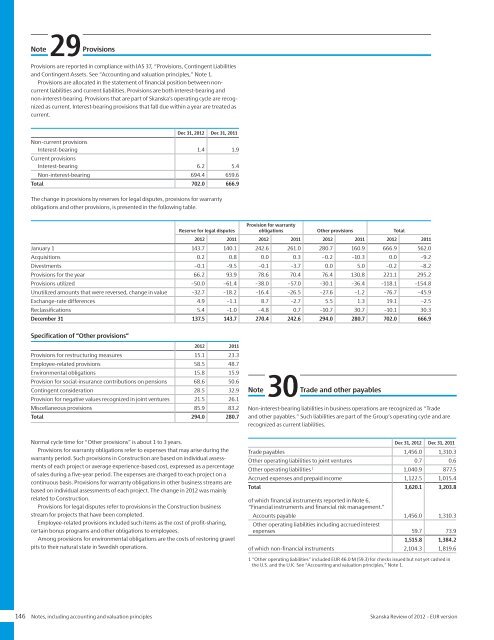

Note29ProvisionsProvisions are reported in compliance with IAS 37, “Provisions, Contingent Liabilitiesand Contingent Assets. See “Accounting and valuation principles,” Note 1.Provisions are allocated in the statement <strong>of</strong> financial position between noncurrentliabilities and current liabilities. Provisions are both interest-bearing andnon-interest-bearing. Provisions that are part <strong>of</strong> <strong>Skanska</strong>’s operating cycle are recognizedas current. Interest-bearing provisions that fall due within a year are treated ascurrent.Dec 31, <strong>2012</strong> Dec 31, 2011Non-current provisionsInterest-bearing 1.4 1.9Current provisionsInterest-bearing 6.2 5.4Non-interest-bearing 694.4 659.6Total 702.0 666.9The change in provisions by reserves for legal disputes, provisions for warrantyobligations and other provisions, is presented in the following table.Reserve for legal disputesProvision for warrantyobligations Other provisions Total<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011January 1 143.7 140.1 242.6 261.0 280.7 160.9 666.9 562.0Acquisitions 0.2 0.8 0.0 0.3 –0.2 –10.3 0.0 –9.2Divestments –0.1 –9.5 –0.1 –3.7 0.0 5.0 –0.2 –8.2Provisions for the year 66.2 93.9 78.6 70.4 76.4 130.8 221.1 295.2Provisions utilized –50.0 –61.4 –38.0 –57.0 –30.1 –36.4 –118.1 –154.8Unutilized amounts that were reversed, change in value –32.7 –18.2 –16.4 –26.5 –27.6 –1.2 –76.7 –45.9Exchange-rate differences 4.9 –1.1 8.7 –2.7 5.5 1.3 19.1 –2.5Reclassifications 5.4 –1.0 –4.8 0.7 –10.7 30.7 –10.1 30.3December 31 137.5 143.7 270.4 242.6 294.0 280.7 702.0 666.9Specification <strong>of</strong> “Other provisions”<strong>2012</strong> 2011Provisions for restructuring measures 15.1 23.3Employee-related provisions 58.5 48.7Environmental obligations 15.8 15.9Provision for social-insurance contributions on pensions 68.6 50.6Contingent consideration 28.5 32.9Provision for negative values recognized in joint ventures 21.5 26.1Miscellaneous provisions 85.9 83.2Total 294.0 280.7Note30Trade and other payablesNon-interest-bearing liabilities in business operations are recognized as “Tradeand other payables.” Such liabilities are part <strong>of</strong> the Group’s operating cycle and arerecognized as current liabilities.Normal cycle time for “Other provisions” is about 1 to 3 years.Provisions for warranty obligations refer to expenses that may arise during thewarranty period. Such provisions in Construction are based on individual assessments<strong>of</strong> each project or average experience-based cost, expressed as a percentage<strong>of</strong> sales during a five-year period. The expenses are charged to each project on acontinuous basis. Provisions for warranty obligations in other business streams arebased on individual assessments <strong>of</strong> each project. The change in <strong>2012</strong> was mainlyrelated to Construction.Provisions for legal disputes refer to provisions in the Construction businessstream for projects that have been completed.Employee-related provisions included such items as the cost <strong>of</strong> pr<strong>of</strong>it-sharing,certain bonus programs and other obligations to employees.Among provisions for environmental obligations are the costs <strong>of</strong> restoring gravelpits to their natural state in Swedish operations.Dec 31, <strong>2012</strong> Dec 31, 2011Trade payables 1,456.0 1,310.3Other operating liabilities to joint ventures 0.7 0.6Other operating liabilities 1 1,040.9 877.5Accrued expenses and prepaid income 1,122.5 1,015.4Total 3,620.1 3,203.8<strong>of</strong> which financial instruments reported in Note 6,“Financial instruments and financial risk management.”Accounts payable 1,456.0 1,310.3Other operating liabilities including accrued interestexpenses 59.7 73.91,515.8 1,384.2<strong>of</strong> which non-financial instruments 2,104.3 1,819.61 “Other operating liabilities” included <strong>EUR</strong> 46.0 M (59.3) for checks issued but not yet cashed inthe U.S. and the U.K. See “Accounting and valuation principles,” Note 1.146 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version

Note31Specification <strong>of</strong> interest-bearing net receivables/liabilities per asset and liabilityThe following table allocates financial current and non-current assets as wellas liabilities between interest-bearing and non-interest-bearing itemsDec 31, <strong>2012</strong> Dec 31, 2011InterestbearingNon-interestbearingNon-interestbearingInterest-bearingTotalTotalASSETSNon-current assetsProperty, plant and equipment 924.4 924.4 787.0 787.0Goodwill 568.5 568.5 562.1 562.1Other intangible assets 21.7 21.7 17.7 17.7Investments in joint ventures and associated companies 281.5 281.5 283.3 283.3Financial non-current assets 208.7 5.8 214.5 232.1 4.3 236.4Deferred tax assets 146.2 146.2 187.4 187.4Total non-current assets 208.7 1,948.1 2,156.7 232.1 1,841.8 2,073.9Current assetsCurrent-asset properties 3,133.1 3,133.1 2,625.4 2,625.4Inventories 125.7 125.7 113.7 113.7Financial current assets 658.0 21.9 679.9 687.6 25.8 713.4Tax assets 66.1 66.1 48.9 48.9Gross amount due from customers for contract work 697.7 697.7 572.8 572.8Other operating receivables 2,744.3 2,744.3 2,538.7 2,538.7Cash 671.9 671.9 595.4 595.4Total current assets 1,329.9 6,788.8 8,118.7 1,282.9 5,925.4 7,208.4TOTAL ASSETS 1,538.6 8,736.8 10,275.4 1,515.1 7,767.2 9,282.3LIABILITIESNon-current liabilitiesFinancial non-current liabilities 555.6 5.7 561.3 149.5 0.2 149.7Pensions 476.7 476.7 421.3 421.3Deferred tax liabilities 66.6 66.6 104.0 104.0Non-current provisions 1.4 1.4 1.9 1.9Total non-current liabilities 1,033.7 72.3 1,106.0 572.7 104.2 676.9Current liabilitiesFinancial current liabilities 721.4 10.2 731.7 608.5 15.4 623.9Tax liabilities 27.9 27.9 29.5 29.5Current provisions 6.2 694.4 700.6 5.4 659.6 665.0Gross amount due to customers for contract work 1,835.3 1,835.3 1,887.1 1,887.1Other operating liabilities 3,620.1 3,620.1 3,203.8 3,203.8Total current liabilities 727.6 6,188.1 6,915.7 613.9 5,795.3 6,409.2TOTAL LIABILITIES 1,761.3 6,260.4 8,021.7 1,186.6 5,899.5 7,086.1Interest-bearing net receivables/liabilities –222.7 328.5<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version Notes, including accounting and valuation principles 147

- Page 1:

Review of 2012EUR version

- Page 4 and 5:

Skanska’s strengthsPositions Empl

- Page 6 and 7:

2012 in briefFirst quarterSecond qu

- Page 8 and 9:

Comments by the President and CEOTh

- Page 10 and 11:

MissionSkanska’s mission isto dev

- Page 12 and 13:

◀◀◀◀◀Business modelProjec

- Page 14 and 15:

Financial targetsSkanska’s busine

- Page 16 and 17:

Risk managementThe continuous stren

- Page 18 and 19:

30,000potential projects analyzed e

- Page 20 and 21:

Skanska’s role in the communitySk

- Page 22 and 23:

-100of thousands of people get invo

- Page 24 and 25:

Earnings are generated by peopleCom

- Page 26 and 27:

22,000employees are developed each

- Page 28 and 29:

Share dataFor more than ten years,

- Page 30 and 31:

Growth in equityDividends re-invest

- Page 32 and 33:

ConstructionThe Värtan Interchange

- Page 34 and 35:

Increased revenues and strong order

- Page 36 and 37:

Nordic countriesSwedenNorwayFinland

- Page 38 and 39:

StatoilBuilt by: Skanska NorwayCust

- Page 40 and 41:

Other European countriesPolandCzech

- Page 42 and 43:

Cross London Rail Links - Cross Rai

- Page 44 and 45:

The AmericasUSA BuildingUSA CivilLa

- Page 46 and 47:

High pace forhigher education

- Page 48 and 49:

Residential DevelopmentContinued gr

- Page 50 and 51:

Enhancing efficiency in the Nordic

- Page 52 and 53:

Nordic countriesSwedenNorwayFinland

- Page 54 and 55:

Other European countriesPolandCzech

- Page 56 and 57:

Commercial Property DevelopmentFull

- Page 58 and 59:

Profitable property divestments yea

- Page 60 and 61:

Nordic countriesSwedenNorwayFinland

- Page 62 and 63:

Other European countriesPolandCzech

- Page 64 and 65:

Strong expansionin PolandPoznańWar

- Page 66 and 67:

United StatesIn the U.S., Skanska i

- Page 68 and 69:

Infrastructure DevelopmentOne of Lo

- Page 70 and 71:

Improved conditions for new project

- Page 72 and 73:

Project portfolioSkanska’s Infras

- Page 74 and 75:

Elizabeth River Tunnels(Downtown Tu

- Page 76 and 77:

Sustainable developmentSustainable

- Page 78 and 79:

We play fairSkanska Czech Republic

- Page 80 and 81:

Väla Gård, Helsingborg, SwedenVä

- Page 82 and 83:

WasteSkanska’s targets for waste

- Page 84 and 85:

Global leadershipRecognitionSkanska

- Page 86 and 87:

Financial review 2012Revenue showed

- Page 88 and 89:

Operating incomeEUR M 2012 2011Oper

- Page 90 and 91:

Investments/DivestmentsEUR M 2012 2

- Page 92 and 93:

Greater standardization, with short

- Page 94 and 95:

NominationCommitteeCompensationComm

- Page 96 and 97:

The President and CEO and the eight

- Page 98 and 99:

term balance between financial resu

- Page 100 and 101: The allotment of shares earned by t

- Page 102 and 103: Consolidated statement of comprehen

- Page 104 and 105: Consolidated statement of financial

- Page 106 and 107: Consolidated cash flow statementCha

- Page 108 and 109: Notes including accounting and valu

- Page 110 and 111: Note01ContinuedEquityThe Group’s

- Page 112 and 113: 01NoteContinuedhanded over to the c

- Page 114 and 115: 01NoteContinuedwhich means that a p

- Page 116 and 117: Note01Continuedwere an independent

- Page 118 and 119: 02NoteKey estimates and judgmentsKe

- Page 120 and 121: Note04Continued2011 ConstructionRes

- Page 122 and 123: 06NoteFinancial instruments and fin

- Page 124 and 125: 06NoteContinuedContracted net flows

- Page 126 and 127: 06NoteContinuedReconciliation with

- Page 128 and 129: 06NoteContinuedImpact of financial

- Page 130 and 131: 07NoteContinuedPurchase price alloc

- Page 132 and 133: 08NoteContinuedRevenue by category2

- Page 134 and 135: Note14Net financial items2012 2011F

- Page 136 and 137: Note17Property, plant and equipment

- Page 138 and 139: Note19Intangible assetsIntangible a

- Page 140 and 141: 20NoteContinuedInfrastructure Devel

- Page 142 and 143: Note21FinancialassetsFinancial inve

- Page 144 and 145: 22NoteContinuedNoteDifference betwe

- Page 146 and 147: 26NoteContinuedActuarial gains and

- Page 148 and 149: 28NoteContinuedPlan assetsSweden No

- Page 152 and 153: Note32Expected recovery periods of

- Page 154 and 155: 34NoteForeign-exchange rates and ef

- Page 156 and 157: Note35Cash-flow statementAside from

- Page 158 and 159: Note36PersonnelWages, salaries, oth

- Page 160 and 161: Note37ContinuedIn addition to the a

- Page 162 and 163: Note37ContinuedFinancial targets fo

- Page 164 and 165: Note42Consolidatedquarterly results

- Page 166 and 167: 43NoteFive-year Group financial sum

- Page 168 and 169: Note43ContinuedFinancial ratios etc

- Page 170 and 171: Note45Supplementary information, Pa

- Page 172 and 173: Independent Auditors’ ReportTo th

- Page 174 and 175: Senior Executive TeamPositionJohan

- Page 176 and 177: Board of directorsStuart E. Graham

- Page 178 and 179: Major events during 2012This page s

- Page 180 and 181: Below are the investments and dives

- Page 182 and 183: Definitions and explanationsAverage

- Page 184 and 185: Annual Shareholders’ MeetingInves