Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

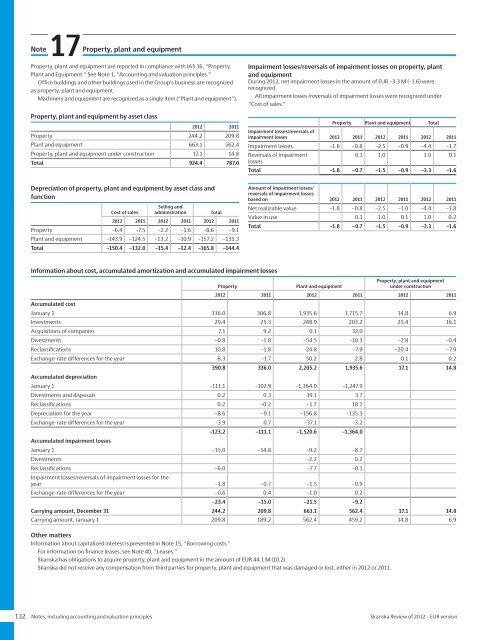

Note17Property, plant and equipmentProperty, plant and equipment are reported in compliance with IAS 16, “Property,Plant and Equipment.” See Note 1, “Accounting and valuation principles.”Office buildings and other buildings used in the Group’s business are recognizedas property, plant and equipment.Machinery and equipment are recognized as a single item (“Plant and equipment”).Property, plant and equipment by asset class<strong>2012</strong> 2011Property 244.2 209.8Plant and equipment 663.1 562.4Property, plant and equipment under construction 17.1 14.8Total 924.4 787.0Impairment losses/reversals <strong>of</strong> impairment losses on property, plantand equipmentDuring <strong>2012</strong>, net impairment losses in the amount <strong>of</strong> <strong>EUR</strong> –3.3 M (–1.6) wererecognized.All impairment losses /reversals <strong>of</strong> impairment losses were recognized under“Cost <strong>of</strong> sales.”Property Plant and equipment TotalImpairment losses/reversals <strong>of</strong>impairment losses <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011Impairment losses –1.8 –0.8 –2.5 –0.9 –4.4 –1.7Reversals <strong>of</strong> impairment0.1 1.0 1.0 0.1lossesTotal –1.8 –0.7 –1.5 –0.9 –3.3 –1.6Depreciation <strong>of</strong> property, plant and equipment by asset class andfunctionSelling andCost <strong>of</strong> sales administrationTotal<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011Property –6.4 –7.5 –2.2 –1.6 –8.6 –9.1Plant and equipment –143.9 –124.5 –13.2 –10.9 –157.2 –135.3Total –150.4 –132.0 –15.4 –12.4 –165.8 –144.4Amount <strong>of</strong> impairment losses/reversals <strong>of</strong> impairment lossesbased on <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011Net realizable value –1.8 –0.8 –2.5 –1.0 –4.4 –1.8Value in use 0.1 1.0 0.1 1.0 0.2Total –1.8 –0.7 –1.5 –0.9 –3.3 –1.6Information about cost, accumulated amortization and accumulated impairment lossesPropertyPlant and equipmentProperty, plant and equipmentunder construction<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011Accumulated costJanuary 1 336.0 306.8 1,935.6 1,715.7 14.8 6.9Investments 29.4 25.3 248.9 203.2 25.4 16.1Acquisitions <strong>of</strong> companies 7.1 9.2 0.1 32.0Divestments –0.8 –1.8 –54.5 –10.3 –2.8 –0.4Reclassifications 10.8 –1.8 24.8 –7.9 –20.4 –7.9Exchange-rate differences for the year 8.3 –1.7 50.2 2.8 0.1 0.2390.8 336.0 2,205.2 1,935.6 17.1 14.8Accumulated depreciationJanuary 1 –111.1 –102.9 –1,364.0 –1,247.9Divestments and disposals 0.2 0.3 39.1 3.7Reclassifications 0.2 –0.2 –1.7 18.7Depreciation for the year –8.6 –9.1 –156.8 –135.3Exchange-rate differences for the year –3.9 0.7 –37.1 –3.2–123.2 –111.1 –1,520.6 –1,364.0Accumulated impairment lossesJanuary 1 –15.0 –14.8 –9.2 –8.7Divestments –2.2 0.2Reclassifications –6.0 –7.7 –0.1Impairment losses/reversals <strong>of</strong> impairment losses for theyear –1.8 –0.7 –1.5 –0.9Exchange-rate differences for the year –0.6 0.4 –1.0 0.2–23.4 –15.0 –21.5 –9.2Carrying amount, December 31 244.2 209.8 663.1 562.4 17.1 14.8Carrying amount, January 1 209.8 189.2 562.4 459.2 14.8 6.9Other mattersInformation about capitalized interest is presented in Note 15, “Borrowing costs.”For information on finance leases, see Note 40, “Leases.”<strong>Skanska</strong> has obligations to acquire property, plant and equipment in the amount <strong>of</strong> <strong>EUR</strong> 44.1 M (10.2).<strong>Skanska</strong> did not receive any compensation from third parties for property, plant and equipment that was damaged or lost, either in <strong>2012</strong> or 2011.132 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version