Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

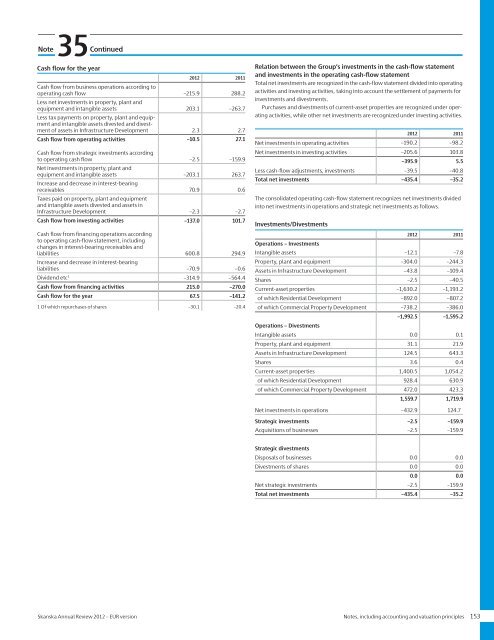

Note35ContinuedCash flow for the year<strong>2012</strong> 2011Cash flow from business operations according tooperating cash flow –215.9 288.2Less net investments in property, plant andequipment and intangible assets 203.1 –263.7Less tax payments on property, plant and equipmentand intangible assets divested and divestment<strong>of</strong> assets in Infrastructure Development 2.3 2.7Cash flow from operating activities –10.5 27.1Cash flow from strategic investments accordingto operating cash flow –2.5 –159.9Net investments in property, plant andequipment and intangible assets –203.1 263.7Increase and decrease in interest-bearingreceivables 70.9 0.6Taxes paid on property, plant and equipmentand intangible assets divested and assets inInfrastructure Development –2.3 –2.7Cash flow from investing activities –137.0 101.7Cash flow from financing operations accordingto operating cash-flow statement, includingchanges in interest-bearing receivables andliabilities 600.8 294.9Increase and decrease in interest-bearingliabilities –70.9 –0.6Dividend etc 1 –314.9 –564.4Cash flow from financing activities 215.0 –270.0Cash flow for the year 67.5 –141.21 Of which repurchases <strong>of</strong> shares –30.1 –20.4Relation between the Group’s investments in the cash-flow statementand investments in the operating cash-flow statementTotal net investments are recognized in the cash-flow statement divided into operatingactivities and investing activities, taking into account the settlement <strong>of</strong> payments forinvestments and divestments.Purchases and divestments <strong>of</strong> current-asset properties are recognized under operatingactivities, while other net investments are recognized under investing activities.<strong>2012</strong> 2011Net investments in operating activities –190.2 –98.2Net investments in investing activities –205.6 103.8–395.9 5.5Less cash-flow adjustments, investments –39.5 –40.8Total net investments –435.4 –35.2The consolidated operating cash-flow statement recognizes net investments dividedinto net investments in operations and strategic net investments as follows.Investments/Divestments<strong>2012</strong> 2011Operations – InvestmentsIntangible assets –12.1 –7.8Property, plant and equipment –304.0 –244.3Assets in Infrastructure Development –43.8 –109.4Shares –2.5 –40.5Current-asset properties –1,630.2 –1,193.2<strong>of</strong> which Residential Development –892.0 –807.2<strong>of</strong> which Commercial Property Development –738.2 –386.0–1,992.5 –1,595.2Operations – DivestmentsIntangible assets 0.0 0.1Property, plant and equipment 31.1 21.9Assets in Infrastructure Development 124.5 643.3Shares 3.6 0.4Current-asset properties 1,400.5 1,054.2<strong>of</strong> which Residential Development 928.4 630.9<strong>of</strong> which Commercial Property Development 472.0 423.31,559.7 1,719.9Net investments in operations –432.9 124.7Strategic investments –2.5 –159.9Acquisitions <strong>of</strong> businesses –2.5 –159.9Strategic divestmentsDisposals <strong>of</strong> businesses 0.0 0.0Divestments <strong>of</strong> shares 0.0 0.00.0 0.0Net strategic investments –2.5 –159.9Total net investments –435.4 –35.2<strong>Skanska</strong> Annual <strong>Review</strong> <strong>2012</strong> – <strong>EUR</strong> version Notes, including accounting and valuation principles 153