Note14Net financial items<strong>2012</strong> 2011Financial incomeInterest income 20.9 19.7Net interest income on pensions 6.3Gain on divestments <strong>of</strong> shares 0.3 0.2Change in fair value 5.7 5.927.0 32.1Financial expensesInterest expenses –53.2 –37.4Net interest income on pensions –7.8Capitalized interest expenses 17.3 14.8Change in fair value –0.3 –2.4Net exchange-rate differences –2.2 1.2Other financial items –7.7 –7.0–53.9 –30.8Total –26.9 1.3Disclosures on how large a portion <strong>of</strong> income and expenses in net financial items comesfrom financial instruments are presented in Note 6, “Financial instruments and financialrisk management.”Net interest itemsNet financial items amounted to <strong>EUR</strong> –26.9 M (1.3). Net interest items declined to<strong>EUR</strong> –22.7 M (3.4). Interest income rose to <strong>EUR</strong> 20.9 M (19.7). Interest expensesincluding capitalized interest rose to <strong>EUR</strong> –53.2 M (–37.4), which was mainly attributableto an increase in interest–bearing liabilities and the extension <strong>of</strong> interest refixingperiods. During the year, <strong>Skanska</strong> capitalized interest expenses <strong>of</strong> <strong>EUR</strong> 17.3 M (14.8)in ongoing projects for its own account.Interest income was received at an average interest rate <strong>of</strong> 0.98 (1.03) percent.Interest expenses, excluding interest on pension liability, were paid at an averageinterest rate <strong>of</strong> 3.19 (3.03) percent during the year.Taking into account derivatives, the average interest rate was 2.34 (2.09) percent.The increase was primarily due to the extension <strong>of</strong> refixing periods on outstandingliabilities.Net interest on pensions, which refers to the estimated net amount <strong>of</strong> interestexpenses related to defined–benefit pension obligations and return on pension planassets on January 1, 2011, decreased to <strong>EUR</strong> –7.8 M (6.3). See also Note 28, “Pensions.”The Group had net interest items <strong>of</strong> <strong>EUR</strong> 2.2 M (4.7) that were recognized in operatingincome. See “Accounting and valuation principles,” Note 1.Change in fair valueChange in fair value <strong>of</strong> financial instruments amounted to <strong>EUR</strong> 5.4 M (3.4). Theimprovement was mainly due to favorable interest-rate differences related tocurrency-rate hedging <strong>of</strong> net investments in <strong>Skanska</strong>’s businesses outside Sweden,primarily in USD, <strong>EUR</strong> and CZK.Net other financial itemsOther financial items totaled <strong>EUR</strong> –7.7 M (–7.0) and mainly consisted <strong>of</strong> variousfinancial fees.Note15Borrowing costsBorrowing costs related to investments that require a substantial period for completionare capitalized. See “Accounting and valuation principles,” Note 1. During <strong>2012</strong>,borrowing costs were capitalized at an unchanged interest rate <strong>of</strong> about 3.0 percent.Note16Income taxesIncome taxes are reported in compliance with IAS 12, “Income Taxes.”See “Accounting and valuation principles,” Note 1.Tax expenses<strong>2012</strong> 2011Current taxes –93.7 –96.0Deferred tax expenses from change in temporary differences–43.2 –11.6Deferred tax benefits from change in loss carryforwards 33.4 21.7Taxes in joint ventures –2.5 –5.9Taxes in associated companies 0.0 –0.1Total –106.0 –91.9Tax items recognized under other comprehensive income<strong>2012</strong> 2011Deferred taxes attributable to cash-flow hedges –0.1 6.3Deferred taxes attributable to pensions –10.2 89.8Total –10.3 96.1There was no deferred tax attributable to the category, “available-for-sale financialassets.”Income taxes paid in <strong>2012</strong> amounted to <strong>EUR</strong> –130.4 M (–189.6).Relation between taxes calculated after aggregating nominal tax ratesand recognized taxesThe Group’s recognized taxe rate amounted to 24 (10) percent. The differencecompared to 2011 is mainly attributable to the effect <strong>of</strong> the tax-free Autopista Centraldivestment in 2011.The Group’s aggregated nominal tax rate was estimated at 32 (29) percent.The average nominal tax rate in <strong>Skanska</strong>’s home markets in Europe amounted toabout 24 (24) percent, and in the U.S., more than 40 (40) percent, depending on theallocation <strong>of</strong> income between the different states.The relation between taxes calculated after aggregating nominal tax rates 32 (29)and recognized taxes <strong>of</strong> 24 (10) percent is explained in the table below.<strong>2012</strong> 2011Income after financial items 434.7 933.1Tax according to aggregation <strong>of</strong> nominal tax rates,32 (29) percent –139.1 –270.6Tax effect <strong>of</strong>:Property divestments 28.6 32.5Divestments <strong>of</strong> infrastructure projects 12.3 144.5Changed tax rate in Sweden 1 19.3Other items –27.1 1.7Recognized tax expenses –106.0 –91.91 The tax rate in Sweden was changed from 26.3 percent to 22.0 percent, effective January 1, 2013.The effect <strong>of</strong> the change in the tax rate on deferred tax assets related to pensions is recognizedunder “Other comprehensive income.” Refer to note 26. The effect <strong>of</strong> the change in the tax rateon other deferred tax assets and deferred tax liabilities totaled <strong>EUR</strong> 19.3 M and is recognized inthe income statement.Capitalized interestduring the yearTotal accumulated capitalizedinterest included in cost<strong>2012</strong> 2011 <strong>2012</strong> 2011Current-asset properties 17.3 14.8 39.0 25.8Total 17.3 14.8 39.0 25.8130 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version

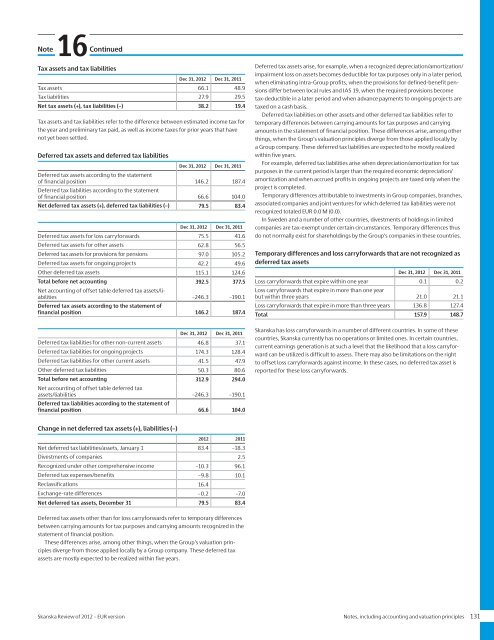

Note16ContinuedTax assets and tax liabilitiesDec 31, <strong>2012</strong> Dec 31, 2011Tax assets 66.1 48.9Tax liabilities 27.9 29.5Net tax assets (+), tax liabilities (–) 38.2 19.4Tax assets and tax liabilities refer to the difference between estimated income tax forthe year and preliminary tax paid, as well as income taxes for prior years that havenot yet been settled.Deferred tax assets and deferred tax liabilitiesDec 31, <strong>2012</strong> Dec 31, 2011Deferred tax assets according to the statement<strong>of</strong> financial position 146.2 187.4Deferred tax liabilities according to the statement<strong>of</strong> financial position 66.6 104.0Net deferred tax assets (+), deferred tax liabilities (–) 79.5 83.4Dec 31, <strong>2012</strong> Dec 31, 2011Deferred tax assets for loss carryforwards 75.5 41.6Deferred tax assets for other assets 62.8 56.5Deferred tax assets for provisions for pensions 97.0 105.2Deferred tax assets for ongoing projects 42.2 49.6Other deferred tax assets 115.1 124.6Total before net accounting 392.5 377.5Net accounting <strong>of</strong> <strong>of</strong>fset table deferred tax assets/liabilities–246.3 –190.1Deferred tax assets according to the statement <strong>of</strong>financial position 146.2 187.4Dec 31, <strong>2012</strong> Dec 31, 2011Deferred tax liabilities for other non-current assets 46.8 37.1Deferred tax liabilities for ongoing projects 174.3 128.4Deferred tax liabilities for other current assets 41.5 47.9Other deferred tax liabilities 50.3 80.6Total before net accounting 312.9 294.0Net accounting <strong>of</strong> <strong>of</strong>fset table deferred taxassets/liabilities –246.3 –190.1Deferred tax liabilities according to the statement <strong>of</strong>financial position 66.6 104.0Deferred tax assets arise, for example, when a recognized depreciation/amortization/impairment loss on assets becomes deductible for tax purposes only in a later period,when eliminating intra-Group pr<strong>of</strong>its, when the provisions for defined-benefit pensionsdiffer between local rules and IAS 19, when the required provisions becometax-deductible in a later period and when advance payments to ongoing projects aretaxed on a cash basis.Deferred tax liabilities on other assets and other deferred tax liabilities refer totemporary differences between carrying amounts for tax purposes and carryingamounts in the statement <strong>of</strong> financial position. These differences arise, among otherthings, when the Group’s valuation principles diverge from those applied locally bya Group company. These deferred tax liabilities are expected to be mostly realizedwithin five years.For example, deferred tax liabilities arise when depreciation/amortization for taxpurposes in the current period is larger than the required economic depreciation/amortization and when accrued pr<strong>of</strong>its in ongoing projects are taxed only when theproject is completed.Temporary differences attributable to investments in Group companies, branches,associated companies and joint ventures for which deferred tax liabilities were notrecognized totaled <strong>EUR</strong> 0.0 M (0.0).In Sweden and a number <strong>of</strong> other countries, divestments <strong>of</strong> holdings in limitedcompanies are tax-exempt under certain circumstances. Temporary differences thusdo not normally exist for shareholdings by the Group’s companies in these countries.Temporary differences and loss carryforwards that are not recognized asdeferred tax assetsDec 31, <strong>2012</strong> Dec 31, 2011Loss carryforwards that expire within one year 0.1 0.2Loss carryforwards that expire in more than one yearbut within three years 21.0 21.1Loss carryforwards that expire in more than three years 136.8 127.4Total 157.9 148.7<strong>Skanska</strong> has loss carryforwards in a number <strong>of</strong> different countries. In some <strong>of</strong> thesecountries, <strong>Skanska</strong> currently has no operations or limited ones. In certain countries,current earnings generation is at such a level that the likelihood that a loss carryforwardcan be utilized is difficult to assess. There may also be limitations on the rightto <strong>of</strong>fset loss carryforwards against income. In these cases, no deferred tax asset isreported for these loss carryforwards.Change in net deferred tax assets (+), liabilities (–)<strong>2012</strong> 2011Net deferred tax liabilities/assets, January 1 83.4 –18.3Divestments <strong>of</strong> companies 2.5Recognized under other comprehensive income –10.3 96.1Deferred tax expenses/benefits –9.8 10.1Reclassifications 16.4Exchange-rate differences –0.2 –7.0Net deferred tax assets, December 31 79.5 83.4Deferred tax assets other than for loss carryforwards refer to temporary differencesbetween carrying amounts for tax purposes and carrying amounts recognized in thestatement <strong>of</strong> financial position.These differences arise, among other things, when the Group’s valuation principlesdiverge from those applied locally by a Group company. These deferred taxassets are mostly expected to be realized within five years.<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version Notes, including accounting and valuation principles 131

- Page 1:

Review of 2012EUR version

- Page 4 and 5:

Skanska’s strengthsPositions Empl

- Page 6 and 7:

2012 in briefFirst quarterSecond qu

- Page 8 and 9:

Comments by the President and CEOTh

- Page 10 and 11:

MissionSkanska’s mission isto dev

- Page 12 and 13:

◀◀◀◀◀Business modelProjec

- Page 14 and 15:

Financial targetsSkanska’s busine

- Page 16 and 17:

Risk managementThe continuous stren

- Page 18 and 19:

30,000potential projects analyzed e

- Page 20 and 21:

Skanska’s role in the communitySk

- Page 22 and 23:

-100of thousands of people get invo

- Page 24 and 25:

Earnings are generated by peopleCom

- Page 26 and 27:

22,000employees are developed each

- Page 28 and 29:

Share dataFor more than ten years,

- Page 30 and 31:

Growth in equityDividends re-invest

- Page 32 and 33:

ConstructionThe Värtan Interchange

- Page 34 and 35:

Increased revenues and strong order

- Page 36 and 37:

Nordic countriesSwedenNorwayFinland

- Page 38 and 39:

StatoilBuilt by: Skanska NorwayCust

- Page 40 and 41:

Other European countriesPolandCzech

- Page 42 and 43:

Cross London Rail Links - Cross Rai

- Page 44 and 45:

The AmericasUSA BuildingUSA CivilLa

- Page 46 and 47:

High pace forhigher education

- Page 48 and 49:

Residential DevelopmentContinued gr

- Page 50 and 51:

Enhancing efficiency in the Nordic

- Page 52 and 53:

Nordic countriesSwedenNorwayFinland

- Page 54 and 55:

Other European countriesPolandCzech

- Page 56 and 57:

Commercial Property DevelopmentFull

- Page 58 and 59:

Profitable property divestments yea

- Page 60 and 61:

Nordic countriesSwedenNorwayFinland

- Page 62 and 63:

Other European countriesPolandCzech

- Page 64 and 65:

Strong expansionin PolandPoznańWar

- Page 66 and 67:

United StatesIn the U.S., Skanska i

- Page 68 and 69:

Infrastructure DevelopmentOne of Lo

- Page 70 and 71:

Improved conditions for new project

- Page 72 and 73:

Project portfolioSkanska’s Infras

- Page 74 and 75:

Elizabeth River Tunnels(Downtown Tu

- Page 76 and 77:

Sustainable developmentSustainable

- Page 78 and 79:

We play fairSkanska Czech Republic

- Page 80 and 81:

Väla Gård, Helsingborg, SwedenVä

- Page 82 and 83:

WasteSkanska’s targets for waste

- Page 84 and 85: Global leadershipRecognitionSkanska

- Page 86 and 87: Financial review 2012Revenue showed

- Page 88 and 89: Operating incomeEUR M 2012 2011Oper

- Page 90 and 91: Investments/DivestmentsEUR M 2012 2

- Page 92 and 93: Greater standardization, with short

- Page 94 and 95: NominationCommitteeCompensationComm

- Page 96 and 97: The President and CEO and the eight

- Page 98 and 99: term balance between financial resu

- Page 100 and 101: The allotment of shares earned by t

- Page 102 and 103: Consolidated statement of comprehen

- Page 104 and 105: Consolidated statement of financial

- Page 106 and 107: Consolidated cash flow statementCha

- Page 108 and 109: Notes including accounting and valu

- Page 110 and 111: Note01ContinuedEquityThe Group’s

- Page 112 and 113: 01NoteContinuedhanded over to the c

- Page 114 and 115: 01NoteContinuedwhich means that a p

- Page 116 and 117: Note01Continuedwere an independent

- Page 118 and 119: 02NoteKey estimates and judgmentsKe

- Page 120 and 121: Note04Continued2011 ConstructionRes

- Page 122 and 123: 06NoteFinancial instruments and fin

- Page 124 and 125: 06NoteContinuedContracted net flows

- Page 126 and 127: 06NoteContinuedReconciliation with

- Page 128 and 129: 06NoteContinuedImpact of financial

- Page 130 and 131: 07NoteContinuedPurchase price alloc

- Page 132 and 133: 08NoteContinuedRevenue by category2

- Page 136 and 137: Note17Property, plant and equipment

- Page 138 and 139: Note19Intangible assetsIntangible a

- Page 140 and 141: 20NoteContinuedInfrastructure Devel

- Page 142 and 143: Note21FinancialassetsFinancial inve

- Page 144 and 145: 22NoteContinuedNoteDifference betwe

- Page 146 and 147: 26NoteContinuedActuarial gains and

- Page 148 and 149: 28NoteContinuedPlan assetsSweden No

- Page 150 and 151: Note29ProvisionsProvisions are repo

- Page 152 and 153: Note32Expected recovery periods of

- Page 154 and 155: 34NoteForeign-exchange rates and ef

- Page 156 and 157: Note35Cash-flow statementAside from

- Page 158 and 159: Note36PersonnelWages, salaries, oth

- Page 160 and 161: Note37ContinuedIn addition to the a

- Page 162 and 163: Note37ContinuedFinancial targets fo

- Page 164 and 165: Note42Consolidatedquarterly results

- Page 166 and 167: 43NoteFive-year Group financial sum

- Page 168 and 169: Note43ContinuedFinancial ratios etc

- Page 170 and 171: Note45Supplementary information, Pa

- Page 172 and 173: Independent Auditors’ ReportTo th

- Page 174 and 175: Senior Executive TeamPositionJohan

- Page 176 and 177: Board of directorsStuart E. Graham

- Page 178 and 179: Major events during 2012This page s

- Page 180 and 181: Below are the investments and dives

- Page 182 and 183: Definitions and explanationsAverage

- Page 184 and 185:

Annual Shareholders’ MeetingInves