Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

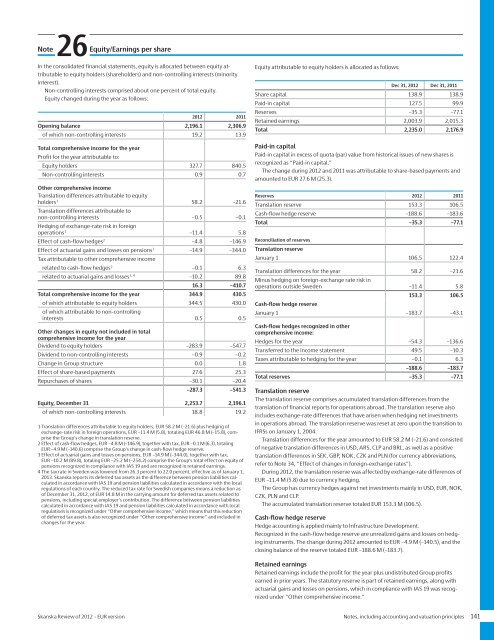

Note26Equity/Earnings per shareIn the consolidated financial statements, equity is allocated between equity attributableto equity holders (shareholders) and non-controlling interests (minorityinterest).Non-controlling interests comprised about one percent <strong>of</strong> total equity.Equity changed during the year as follows:<strong>2012</strong> 2011Opening balance 2,196.1 2,306.9<strong>of</strong> which non-controlling interests 19.2 13.9Total comprehensive income for the yearPr<strong>of</strong>it for the year attributable to:Equity holders 327.7 840.5Non-controlling interests 0.9 0.7Other comprehensive incomeTranslation differences attributable to equityholders 1 58.2 –21.6Translation differences attributable tonon-controlling interests –0.5 –0.1Hedging <strong>of</strong> exchange-rate risk in foreignoperations 1 –11.4 5.8Effect <strong>of</strong> cash-flow hedges 2 –4.8 –146.9Effect <strong>of</strong> actuarial gains and losses on pensions 3 –14.9 –344.0Tax attributable to other comprehensive incomerelated to cash-flow hedges 2 –0.1 6.3related to actuarial gains and losses 3, 4 –10.2 89.816.3 –410.7Total comprehensive income for the year 344.9 430.5<strong>of</strong> which attributable to equity holders 344.5 430.0<strong>of</strong> which attributable to non-controllinginterests 0.5 0.5Other changes in equity not included in totalcomprehensive income for the yearDividend to equity holders –283.9 –547.7Dividend to non-controlling interests –0.9 –0.2Change in Group structure 0.0 1.8Effect <strong>of</strong> share-based payments 27.6 25.3Repurchases <strong>of</strong> shares –30.1 –20.4–287.3 –541.3Equity, December 31 2,253.7 2,196.1<strong>of</strong> which non-controlling interests 18.8 19.21 Translation differences attributable to equity holders, <strong>EUR</strong> 58.2 M (–21.6) plus hedging <strong>of</strong>exchange-rate risk in foreign operations, <strong>EUR</strong> –11.4 M (5.8), totaling <strong>EUR</strong> 46.8 M (–15.8), comprisethe Group’s change in translation reserve.2 Effect <strong>of</strong> cash-flow hedges, <strong>EUR</strong> –4.8 M (–146.9), together with tax, <strong>EUR</strong> –0.1 M (6.3), totaling<strong>EUR</strong> –4.9 M (–140.6) comprise the Group’s change in cash-flow hedge reserve.3 Effect <strong>of</strong> actuarial gains and losses on pensions, <strong>EUR</strong> –14.9 M (–344.0), together with tax,<strong>EUR</strong> –10.2 M (89.8), totaling <strong>EUR</strong> –25.2 M (–254.2) comprise the Group’s total effect on equity <strong>of</strong>pensions recognized in compliance with IAS 19 and are recognized in retained earnings.4 The tax rate in Sweden was lowered from 26.3 percent to 22.0 percent, effective as <strong>of</strong> January 1,2013. <strong>Skanska</strong> reports its deferred tax assets as the difference between pension liabilities calculatedin accordance with IAS 19 and pension liabilities calculated in accordance with the localregulations <strong>of</strong> each country. The reduced tax rate for Swedish companies means a reduction as<strong>of</strong> December 31, <strong>2012</strong>, <strong>of</strong> <strong>EUR</strong> 14.8 M in the carrying amount for deferred tax assets related topensions, including special employer’s contribution. The difference between pension liabilitiescalculated in accordance with IAS 19 and pension liabilities calculated in accordance with localregulations is recognized under “Other comprehensive income,” which means that this reduction<strong>of</strong> deferred tax assets is also recognized under “Other comprehensive income” and included inchanges for the year.Equity attributable to equity holders is allocated as follows:Dec 31, <strong>2012</strong> Dec 31, 2011Share capital 138.9 138.9Paid-in capital 127.5 99.9Reserves –35.3 –77.1Retained earnings 2,003.9 2,015.3Total 2,235.0 2,176.9Paid-in capitalPaid-in capital in excess <strong>of</strong> quota (par) value from historical issues <strong>of</strong> new shares isrecognized as “Paid-in capital.”The change during <strong>2012</strong> and 2011 was attributable to share-based payments andamounted to <strong>EUR</strong> 27.6 M (25.3).Reserves <strong>2012</strong> 2011Translation reserve 153.3 106.5Cash-flow hedge reserve –188.6 –183.6Total –35.3 –77.1Reconciliation <strong>of</strong> reservesTranslation reserveJanuary 1 106.5 122.4Translation differences for the year 58.2 –21.6Minus hedging on foreign-exchange rate risk inoperations outside Sweden –11.4 5.8153.3 106.5Cash-flow hedge reserveJanuary 1 –183.7 –43.1Cash-flow hedges recognized in othercomprehensive income:Hedges for the year –54.3 –136.6Transferred to the income statement 49.5 –10.3Taxes attributable to hedging for the year –0.1 6.3–188.6 –183.7Total reserves –35.3 –77.1Translation reserveThe translation reserve comprises accumulated translation differences from thetranslation <strong>of</strong> financial reports for operations abroad. The translation reserve alsoincludes exchange-rate differences that have arisen when hedging net investmentsin operations abroad. The translation reserve was reset at zero upon the transition toIFRSs on January 1, 2004.Translation differences for the year amounted to <strong>EUR</strong> 58.2 M (–21.6) and consisted<strong>of</strong> negative translation differences in USD, ARS, CLP and BRL, as well as a positivetranslation differences in SEK, GBP, NOK, CZK and PLN (for currency abbreviations,refer to Note 34, “Effect <strong>of</strong> changes in foreign-exchange rates”).During <strong>2012</strong>, the translation reserve was affected by exchange-rate differences <strong>of</strong><strong>EUR</strong> –11.4 M (5.8) due to currency hedging.The Group has currency hedges against net investments mainly in USD, <strong>EUR</strong>, NOK,CZK, PLN and CLP.The accumulated translation reserve totaled <strong>EUR</strong> 153.3 M (106.5).Cash-flow hedge reserveHedge accounting is applied mainly to Infrastructure Development.Recognized in the cash-flow hedge reserve are unrealized gains and losses on hedginginstruments. The change during <strong>2012</strong> amounted to <strong>EUR</strong> –4.9 M (–140.5), and theclosing balance <strong>of</strong> the reserve totaled <strong>EUR</strong> –188.6 M (–183.7).Retained earningsRetained earnings include the pr<strong>of</strong>it for the year plus undistributed Group pr<strong>of</strong>itsearned in prior years. The statutory reserve is part <strong>of</strong> retained earnings, along withactuarial gains and losses on pensions, which in compliance with IAS 19 was recognizedunder “Other comprehensive income.”<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version Notes, including accounting and valuation principles 141