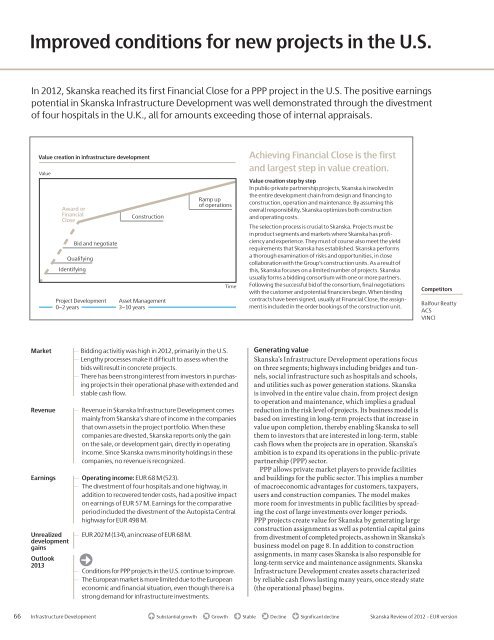

Improved conditions for new projects in the U.S.In <strong>2012</strong>, <strong>Skanska</strong> reached its first Financial Close for a PPP project in the U.S. The positive earningspotential in <strong>Skanska</strong> Infrastructure Development was well demonstrated through the divestment<strong>of</strong> four hospitals in the U.K., all for amounts exceeding those <strong>of</strong> internal appraisals.Value creation in infrastructure developmentValueAward orFinancialCloseIdentifyingBid and negotiateQualifyingProject Development0−2 yearsConstructionAsset Management3−10 yearsRamp up<strong>of</strong> operationsTimeAchieving Financial Close is the firstand largest step in value creation.Value creation step by stepIn public-private partnership projects, <strong>Skanska</strong> is involved inthe entire development chain from design and financing toconstruction, operation and maintenance. By assuming thisoverall responsibility, <strong>Skanska</strong> optimizes both constructionand operating costs.The selection process is crucial to <strong>Skanska</strong>. Projects must bein product segments and markets where <strong>Skanska</strong> has pr<strong>of</strong>iciencyand experience. They must <strong>of</strong> course also meet the yieldrequirements that <strong>Skanska</strong> has established. <strong>Skanska</strong> performsa thorough examination <strong>of</strong> risks and opportunities, in closecollaboration with the Group’s construction units. As a result <strong>of</strong>this, <strong>Skanska</strong> focuses on a limited number <strong>of</strong> projects. <strong>Skanska</strong>usually forms a bidding consortium with one or more partners.Following the successful bid <strong>of</strong> the consortium, final negotiationswith the customer and potential financiers begin. When bindingcontracts have been signed, usually at Financial Close, the assignmentis included in the order bookings <strong>of</strong> the construction unit.CompetitorsBalfour BeattyACSVINCIMarketRevenueEarningsUnrealizeddevelopmentgainsOutlook2013– Bidding activitiy was high in <strong>2012</strong>, primarily in the U.S.– Lengthy processes make it difficult to assess when thebids will result in concrete projects.– There has been strong interest from investors in purchasingprojects in their operational phase with extended andstable cash flow.– Revenue in <strong>Skanska</strong> Infrastructure Development comesmainly from <strong>Skanska</strong>’s share <strong>of</strong> income in the companiesthat own assets in the project portfolio. When thesecompanies are divested, <strong>Skanska</strong> reports only the gainon the sale, or development gain, directly in operatingincome. Since <strong>Skanska</strong> owns minority holdings in thesecompanies, no revenue is recognized.– Operating income: <strong>EUR</strong> 68 M (523).– The divestment <strong>of</strong> four hospitals and one highway, inaddition to recovered tender costs, had a positive impacton earnings <strong>of</strong> <strong>EUR</strong> 57 M. Earnings for the comparativeperiod included the divestment <strong>of</strong> the Autopista Centralhighway for <strong>EUR</strong> 498 M.– <strong>EUR</strong> 202 M (134), an increase <strong>of</strong> <strong>EUR</strong> 68 M.– Conditions for PPP projects in the U.S. continue to improve.– The European market is more limited due to the Europeaneconomic and financial situation, even though there is astrong demand for infrastructure investments.Generating value<strong>Skanska</strong>’s Infrastructure Development operations focuson three segments; highways including bridges and tunnels,social infrastructure such as hospitals and schools,and utilities such as power generation stations. <strong>Skanska</strong>is involved in the entire value chain, from project designto operation and maintenance, which implies a gradualreduction in the risk level <strong>of</strong> projects. Its business model isbased on investing in long-term projects that increase invalue upon completion, thereby enabling <strong>Skanska</strong> to sellthem to investors that are interested in long-term, stablecash flows when the projects are in operation. <strong>Skanska</strong>’sambition is to expand its operations in the public-privatepartnership (PPP) sector.PPP allows private market players to provide facilitiesand buildings for the public sector. This implies a number<strong>of</strong> macroeconomic advantages for customers, taxpayers,users and construction companies. The model makesmore room for investments in public facilities by spreadingthe cost <strong>of</strong> large investments over longer periods.PPP projects create value for <strong>Skanska</strong> by generating largeconstruction assignments as well as potential capital gainsfrom divestment <strong>of</strong> completed projects, as shown in <strong>Skanska</strong>’sbusiness model on page 8. In addition to constructionassignments, in many cases <strong>Skanska</strong> is also responsible forlong-term service and maintenance assignments. <strong>Skanska</strong>Infrastructure Development creates assets characterizedby reliable cash flows lasting many years, once steady state(the operational phase) begins.66 Infrastructure Development Substantial growth Growth Stable Decline Significant decline<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version

Expansion <strong>of</strong> London’s M25 orbital roadThe widening <strong>of</strong> 62 kilometers <strong>of</strong> highway,equipping <strong>of</strong> tunnelPublic-private partnership for Highways AgencyContract period 2009–2039, expansioncompleted in <strong>2012</strong>Project company Connect Plus: <strong>Skanska</strong>Infrastructure Development: 40 percent;Balfour Beatty, Egis and Atkins<strong>Skanska</strong>’s investment: <strong>EUR</strong> 115 MConstruction contract: total <strong>of</strong> <strong>EUR</strong> 1.1 billion<strong>Skanska</strong> UK’s share <strong>of</strong> construction contract;50 percent, more than <strong>EUR</strong> 574 MQuicker, better, saferand cheaper.Quicker, better, safer and cheaper – these werethe aims <strong>of</strong> widening <strong>of</strong> London’s artery, the M25orbital road. This is also true <strong>of</strong> public private partnership(PPP) projects in which <strong>Skanska</strong> is investor,project developer and builder. PPP projects providea strong incentive for improvement. Throughinnovative designs and careful planning, theproject was completed ahead <strong>of</strong> schedule andunder budget.The M25 is the world’s most traffic-intensiveorbital road, and its widening contributed to thesuccess <strong>of</strong> the London <strong>2012</strong> Olympic Games. Thedreaded traffic congestion could be avoided on the62-kilometer-long stretch <strong>of</strong> the northern section<strong>of</strong> the road.The construction project was completed in May<strong>2012</strong>, two months ahead <strong>of</strong> schedule, despite two<strong>of</strong> the three winters <strong>of</strong> the construction periodbeing unusually severe. At most, 2,500 employeeswere engaged in the project.The project was divided into three sections withseparate project teams. To increase safety, all workwas performed within the short work zones thatwere screened <strong>of</strong>f using massive concrete barriers.“Our focus was always on improving planning anddesign. We repeatedly reviewed every detail,” saysProject Manager David Blackburn.For example, the cost <strong>of</strong> a flyover was reducedby <strong>EUR</strong> 2 M. A newly patented method for pile drivingreduced the amount <strong>of</strong> steel used and thus, theamount <strong>of</strong> carbon emissions.The project utilized very little new land butwhen this occurred, birds, reptiles, toads andbadgers were moved to new safe locations. Thewider M25 was opened in May <strong>2012</strong> but <strong>Skanska</strong>’sresponsibility continues, since the company isresponsible for operation and maintenanceuntil 2039.“The M25 project shows what is achievablethrough PPP. In our role as owner, developerand builder, we have the opportunity to createcomprehensive solutions. PPP provides us withstrong incentives to improve each phase, fromfinancing, to design, construction and operation,”says Nick Doherty, Vice President,<strong>Skanska</strong> Infrastructure Development.

- Page 1:

Review of 2012EUR version

- Page 4 and 5:

Skanska’s strengthsPositions Empl

- Page 6 and 7:

2012 in briefFirst quarterSecond qu

- Page 8 and 9:

Comments by the President and CEOTh

- Page 10 and 11:

MissionSkanska’s mission isto dev

- Page 12 and 13:

◀◀◀◀◀Business modelProjec

- Page 14 and 15:

Financial targetsSkanska’s busine

- Page 16 and 17:

Risk managementThe continuous stren

- Page 18 and 19:

30,000potential projects analyzed e

- Page 20 and 21: Skanska’s role in the communitySk

- Page 22 and 23: -100of thousands of people get invo

- Page 24 and 25: Earnings are generated by peopleCom

- Page 26 and 27: 22,000employees are developed each

- Page 28 and 29: Share dataFor more than ten years,

- Page 30 and 31: Growth in equityDividends re-invest

- Page 32 and 33: ConstructionThe Värtan Interchange

- Page 34 and 35: Increased revenues and strong order

- Page 36 and 37: Nordic countriesSwedenNorwayFinland

- Page 38 and 39: StatoilBuilt by: Skanska NorwayCust

- Page 40 and 41: Other European countriesPolandCzech

- Page 42 and 43: Cross London Rail Links - Cross Rai

- Page 44 and 45: The AmericasUSA BuildingUSA CivilLa

- Page 46 and 47: High pace forhigher education

- Page 48 and 49: Residential DevelopmentContinued gr

- Page 50 and 51: Enhancing efficiency in the Nordic

- Page 52 and 53: Nordic countriesSwedenNorwayFinland

- Page 54 and 55: Other European countriesPolandCzech

- Page 56 and 57: Commercial Property DevelopmentFull

- Page 58 and 59: Profitable property divestments yea

- Page 60 and 61: Nordic countriesSwedenNorwayFinland

- Page 62 and 63: Other European countriesPolandCzech

- Page 64 and 65: Strong expansionin PolandPoznańWar

- Page 66 and 67: United StatesIn the U.S., Skanska i

- Page 68 and 69: Infrastructure DevelopmentOne of Lo

- Page 72 and 73: Project portfolioSkanska’s Infras

- Page 74 and 75: Elizabeth River Tunnels(Downtown Tu

- Page 76 and 77: Sustainable developmentSustainable

- Page 78 and 79: We play fairSkanska Czech Republic

- Page 80 and 81: Väla Gård, Helsingborg, SwedenVä

- Page 82 and 83: WasteSkanska’s targets for waste

- Page 84 and 85: Global leadershipRecognitionSkanska

- Page 86 and 87: Financial review 2012Revenue showed

- Page 88 and 89: Operating incomeEUR M 2012 2011Oper

- Page 90 and 91: Investments/DivestmentsEUR M 2012 2

- Page 92 and 93: Greater standardization, with short

- Page 94 and 95: NominationCommitteeCompensationComm

- Page 96 and 97: The President and CEO and the eight

- Page 98 and 99: term balance between financial resu

- Page 100 and 101: The allotment of shares earned by t

- Page 102 and 103: Consolidated statement of comprehen

- Page 104 and 105: Consolidated statement of financial

- Page 106 and 107: Consolidated cash flow statementCha

- Page 108 and 109: Notes including accounting and valu

- Page 110 and 111: Note01ContinuedEquityThe Group’s

- Page 112 and 113: 01NoteContinuedhanded over to the c

- Page 114 and 115: 01NoteContinuedwhich means that a p

- Page 116 and 117: Note01Continuedwere an independent

- Page 118 and 119: 02NoteKey estimates and judgmentsKe

- Page 120 and 121:

Note04Continued2011 ConstructionRes

- Page 122 and 123:

06NoteFinancial instruments and fin

- Page 124 and 125:

06NoteContinuedContracted net flows

- Page 126 and 127:

06NoteContinuedReconciliation with

- Page 128 and 129:

06NoteContinuedImpact of financial

- Page 130 and 131:

07NoteContinuedPurchase price alloc

- Page 132 and 133:

08NoteContinuedRevenue by category2

- Page 134 and 135:

Note14Net financial items2012 2011F

- Page 136 and 137:

Note17Property, plant and equipment

- Page 138 and 139:

Note19Intangible assetsIntangible a

- Page 140 and 141:

20NoteContinuedInfrastructure Devel

- Page 142 and 143:

Note21FinancialassetsFinancial inve

- Page 144 and 145:

22NoteContinuedNoteDifference betwe

- Page 146 and 147:

26NoteContinuedActuarial gains and

- Page 148 and 149:

28NoteContinuedPlan assetsSweden No

- Page 150 and 151:

Note29ProvisionsProvisions are repo

- Page 152 and 153:

Note32Expected recovery periods of

- Page 154 and 155:

34NoteForeign-exchange rates and ef

- Page 156 and 157:

Note35Cash-flow statementAside from

- Page 158 and 159:

Note36PersonnelWages, salaries, oth

- Page 160 and 161:

Note37ContinuedIn addition to the a

- Page 162 and 163:

Note37ContinuedFinancial targets fo

- Page 164 and 165:

Note42Consolidatedquarterly results

- Page 166 and 167:

43NoteFive-year Group financial sum

- Page 168 and 169:

Note43ContinuedFinancial ratios etc

- Page 170 and 171:

Note45Supplementary information, Pa

- Page 172 and 173:

Independent Auditors’ ReportTo th

- Page 174 and 175:

Senior Executive TeamPositionJohan

- Page 176 and 177:

Board of directorsStuart E. Graham

- Page 178 and 179:

Major events during 2012This page s

- Page 180 and 181:

Below are the investments and dives

- Page 182 and 183:

Definitions and explanationsAverage

- Page 184 and 185:

Annual Shareholders’ MeetingInves