Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Review of 2012 â EUR - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

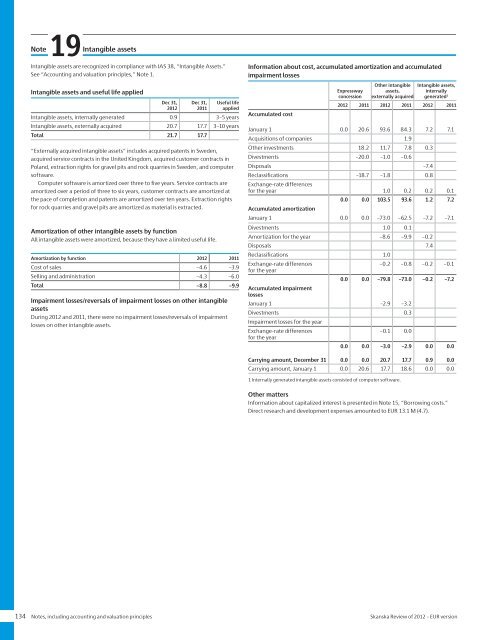

Note19Intangible assetsIntangible assets are recognized in compliance with IAS 38, “Intangible Assets.”See “Accounting and valuation principles,” Note 1.Intangible assets and useful life appliedDec 31,<strong>2012</strong>Dec 31,2011Useful lifeappliedIntangible assets, internally generated 0.9 3–5 yearsIntangible assets, externally acquired 20.7 17.7 3–10 yearsTotal 21.7 17.7“Externally acquired intangible assets” includes acquired patents in Sweden,acquired service contracts in the United Kingdom, acquired customer contracts inPoland, extraction rights for gravel pits and rock quarries in Sweden, and computers<strong>of</strong>tware.Computer s<strong>of</strong>tware is amortized over three to five years. Service contracts areamortized over a period <strong>of</strong> three to six years, customer contracts are amortized atthe pace <strong>of</strong> completion and patents are amortized over ten years. Extraction rightsfor rock quarries and gravel pits are amortized as material is extracted.Amortization <strong>of</strong> other intangible assets by functionAll intangible assets were amortized, because they have a limited useful life.Amortization by function <strong>2012</strong> 2011Cost <strong>of</strong> sales –4.6 –3.9Selling and administration –4.3 –6.0Total –8.8 –9.9Impairment losses/reversals <strong>of</strong> impairment losses on other intangibleassetsDuring <strong>2012</strong> and 2011, there were no impairment losses/reversals <strong>of</strong> impairmentlosses on other intangible assets.Information about cost, accumulated amortization and accumulatedimpairment lossesAccumulated costExpresswayconcessionOther intangibleassets,externally acquiredIntangible assets,internallygenerated 1<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011January 1 0.0 20.6 93.6 84.3 7.2 7.1Acquisitions <strong>of</strong> companies 1.9Other investments 18.2 11.7 7.8 0.3Divestments –20.0 –1.0 –0.6Disposals –7.4Reclassifications –18.7 –1.8 0.8Exchange-rate differencesfor the year 1.0 0.2 0.2 0.10.0 0.0 103.5 93.6 1.2 7.2Accumulated amortizationJanuary 1 0.0 0.0 –73.0 –62.5 –7.2 –7.1Divestments 1.0 0.1Amortization for the year –8.6 –9.9 –0.2Disposals 7.4Reclassifications 1.0Exchange-rate differences–0.2 –0.8 –0.2 –0.1for the year0.0 0.0 –79.8 –73.0 –0.2 –7.2Accumulated impairmentlossesJanuary 1 –2.9 –3.2Divestments 0.3Impairment losses for the yearExchange-rate differences–0.1 0.0for the year0.0 0.0 –3.0 –2.9 0.0 0.0Carrying amount, December 31 0.0 0.0 20.7 17.7 0.9 0.0Carrying amount, January 1 0.0 20.6 17.7 18.6 0.0 0.01 Internally generated intangible assets consisted <strong>of</strong> computer s<strong>of</strong>tware.Other mattersInformation about capitalized interest is presented in Note 15, “Borrowing costs.”Direct research and development expenses amounted to <strong>EUR</strong> 13.1 M (4.7).134 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2012</strong> – <strong>EUR</strong> version