Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

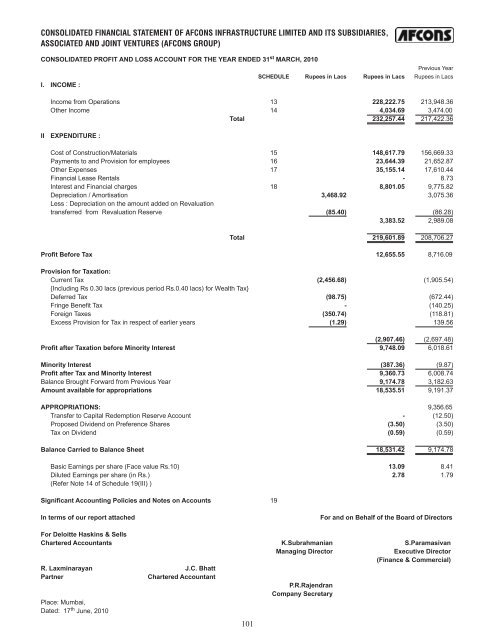

CONSOLIDATED FINANCIAL STATEMENT OF AFCONS INFRASTRUCTURE LIMITED AND ITS SUBSIDIARIES,ASSOCIATED AND JOINT VENTURES (AFCONS GROUP)CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 st MARCH, 2010Previous YearSCHEDULE Rupees in Lacs Rupees in Lacs Rupees in LacsI. INCOME :Income from Operations 13 228,222.75 213,948.36Other Income 14 4,034.69 3,474.00Total 232,257.44 217,422.36II EXPENDITURE :Cost of Construction/Materials 15 148,617.79 156,669.33Payments to and Provision for employees 16 23,644.39 21,652.87Other Expenses 17 35,155.14 17,610.44Financial Lease Rentals - 8.73Interest and Financial charges 18 8,801.05 9,775.82Depreciation / Amortisation 3,468.92 3,075.36Less : Depreciation on the amount added on Revaluationtransferred from Revaluation Reserve (85.40) (86.28)3,383.52 2,989.08Total 219,601.89 208,706.27Profit Before Tax 12,655.55 8,716.09Provision for Taxation:Current Tax (2,456.68) (1,905.54){Including Rs 0.30 lacs (previous period Rs.0.40 lacs) for Wealth Tax}Deferred Tax (98.75) (672.44)Fringe Benefit Tax - (140.25)Foreign Taxes (350.74) (118.81)Excess Provision for Tax in respect of earlier years (1.29) 139.56(2,907.46) (2,697.48)Profit after Taxation before Minority Interest 9,748.09 6,018.61Minority Interest (387.36) (9.87)Profit after Tax and Minority Interest 9,360.73 6,008.74Balance Brought Forward from Previous Year 9,174.78 3,182.63Amount available for appropriations 18,535.51 9,191.37APPROPRIATIONS: 9,356.65Transfer to Capital Redemption Reserve Account - (12.50)Proposed Dividend on Preference Shares (3.50) (3.50)Tax on Dividend (0.59) (0.59)Balance Carried to Balance Sheet 18,531.42 9,174.78Basic Earnings per share (Face value Rs.10) 13.09 8.41Diluted Earnings per share (in Rs.) 2.78 1.79(Refer Note 14 of Schedule 19(III) )Significant Accounting Policies and Notes on Accounts 19In terms of our report attachedFor and on Behalf of the Board of DirectorsFor Deloitte Haskins & SellsChartered Accountants K.Subrahmanian S.ParamasivanManaging DirectorExecutive Director(Finance & Commercial)R. Laxminarayan J.C. BhattPartnerChartered AccountantP.R.RajendranCompany SecretaryPlace: Mumbai,Dated: 17 th June, 2010101