Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

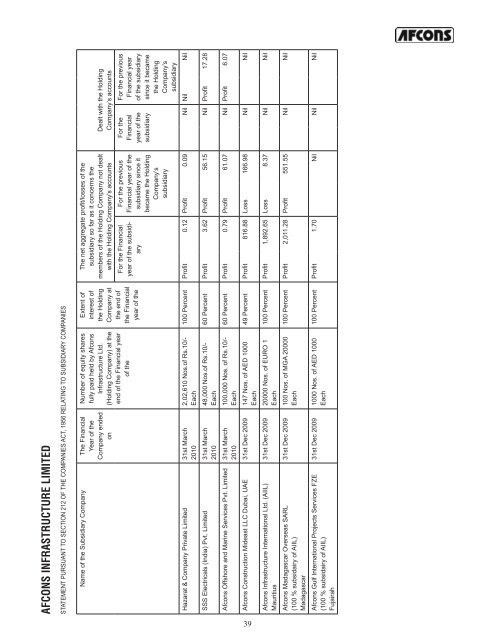

AFCONS INFRASTRUCTURE LIMITEDSTATEMENT PURSUANT TO SECTION 212 OF THE COMPANIES ACT, 1956 RELATING TO SUBSIDIARY COMPANIESName of the Subsidiary Company The FinancialYear of theCompany endedonHazarat & Company Private Limited 31st March2010SSS Electricals (India) Pvt. Limited 31st March2010<strong>Afcon</strong>s Offshore and Marine Services Pvt. Limited 31st March2010Number of equity sharesfully paid held by <strong>Afcon</strong>s<strong>Infrastructure</strong> <strong>Ltd</strong>.(Holding Company) at theend of the Financial yearof the2,02,610 Nos.of Rs.10/-Each48,000 Nos.of Rs.10/-Each100,000 Nos. of Rs.10/-Each<strong>Afcon</strong>s Construction Mideast LLC Dubai, UAE 31st Dec 2009 147 Nos. of AED 1000Each<strong>Afcon</strong>s <strong>Infrastructure</strong> International <strong>Ltd</strong>. (AIIL)Mauritius<strong>Afcon</strong>s Madagascar Overseas SARL(100 % subsidairy of AIIL)Madagascar<strong>Afcon</strong>s Gulf International Projects Services FZE(100 % subsidairy of AIIL)Fujairah31st Dec 2009 20000 Nos. of EURO 1Each31st Dec 2009 100 Nos. of MGA 20000Each31st Dec 2009 1000 Nos. of AED 1000EachExtent ofinterest ofthe HoldingCompany atthe end ofthe Financialyear of theThe net aggregate profit/losses of thesubsidiary so far as it concerns themembers of the Holding Company not dealtwith the Holding Company's accountsFor the Financialyear of the subsidiaryFor the previousFinancial year of thesubsidiary since itbecame the HoldingCompany’ssubsidiaryDealt with the HoldingCompany’s accountsFor theFinancialyear of thesubsidiaryFor the previousFinancial yearof the subsidiarysince it becamethe HoldingCompany’ssubsidiary100 Percent Profit 0.12 Profit 0.09 Nil Nil Nil60 Percent Profit 3.62 Profit 56.15 Nil Profit 17.2860 Percent Profit 0.79 Profit 61.07 Nil Profit 6.0749 Percent Profit 816.88 Loss 166.98 Nil Nil100 Percent Profit 1,892.65 Loss 8.37 Nil Nil100 Percent Profit 2,011.28 Profit 551.55 Nil Nil100 Percent Profit 1.70 Nil Nil Nil39