Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

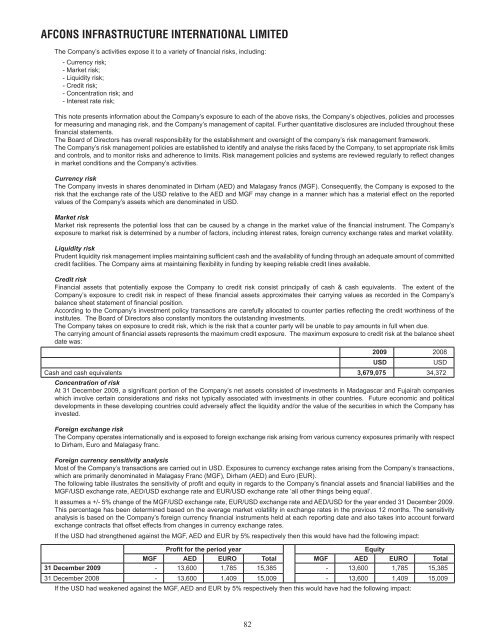

AFCONS INFRASTRUCTURE INTERNATIONAL LIMITEDThe Company’s activities expose it to a variety of financial risks, including:- Currency risk;- Market risk;- Liquidity risk;- Credit risk;- Concentration risk; and- Interest rate risk;This note presents information about the Company’s exposure to each of the above risks, the Company’s objectives, policies and processesfor measuring and managing risk, and the Company’s management of capital. Further quantitative disclosures are included throughout thesefinancial statements.The Board of Directors has overall responsibility for the establishment and oversight of the company’s risk management framework.The Company’s risk management policies are established to identify and analyse the risks faced by the Company, to set appropriate risk limitsand controls, and to monitor risks and adherence to limits. Risk management policies and systems are reviewed regularly to reflect changesin market conditions and the Company’s activities.Currency riskThe Company invests in shares denominated in Dirham (AED) and Malagasy francs (MGF). Consequently, the Company is exposed to therisk that the exchange rate of the USD relative to the AED and MGF may change in a manner which has a material effect on the reportedvalues of the Company’s assets which are denominated in USD.Market riskMarket risk represents the potential loss that can be caused by a change in the market value of the financial instrument. The Company’sexposure to market risk is determined by a number of factors, including interest rates, foreign currency exchange rates and market volatility.Liquidity riskPrudent liquidity risk management implies maintaining sufficient cash and the availability of funding through an adequate amount of committedcredit facilities. The Company aims at maintaining flexibility in funding by keeping reliable credit lines available.Credit riskFinancial assets that potentially expose the Company to credit risk consist principally of cash & cash equivalents. The extent of theCompany’s exposure to credit risk in respect of these financial assets approximates their carrying values as recorded in the Company’sbalance sheet statement of financial position.According to the Company’s investment policy transactions are carefully allocated to counter parties reflecting the credit worthiness of theinstitutes. The Board of Directors also constantly monitors the outstanding investments.The Company takes on exposure to credit risk, which is the risk that a counter party will be unable to pay amounts in full when due.The carrying amount of financial assets represents the maximum credit exposure. The maximum exposure to credit risk at the balance sheetdate was:2009 2008USDUSDCash and cash equivalents 3,679,075 34,372Concentration of riskAt 31 December 2009, a significant portion of the Company’s net assets consisted of investments in Madagascar and Fujairah companieswhich involve certain considerations and risks not typically associated with investments in other countries. Future economic and politicaldevelopments in these developing countries could adversely affect the liquidity and/or the value of the securities in which the Company hasinvested.Foreign exchange riskThe Company operates internationally and is exposed to foreign exchange risk arising from various currency exposures primarily with respectto Dirham, Euro and Malagasy franc.Foreign currency sensitivity analysisMost of the Company’s transactions are carried out in USD. Exposures to currency exchange rates arising from the Company’s transactions,which are primarily denominated in Malagasy Franc (MGF), Dirham (AED) and Euro (EUR).The following table illustrates the sensitivity of profit and equity in regards to the Company’s financial assets and financial liabilities and theMGF/USD exchange rate, AED/USD exchange rate and EUR/USD exchange rate ‘all other things being equal’.It assumes a +/- 5% change of the MGF/USD exchange rate, EUR/USD exchange rate and AED/USD for the year ended 31 December 2009.This percentage has been determined based on the average market volatility in exchange rates in the previous 12 months. The sensitivityanalysis is based on the Company’s foreign currency financial instruments held at each reporting date and also takes into account forwardexchange contracts that offset effects from changes in currency exchange rates.If the USD had strengthened against the MGF, AED and EUR by 5% respectively then this would have had the following impact:Profit for the period yearEquityMGF AED EURO Total MGF AED EURO Total31 December 2009 - 13,600 1,785 15,385 - 13,600 1,785 15,38531 December 2008 - 13,600 1,409 15,009 - 13,600 1,409 15,009If the USD had weakened against the MGF, AED and EUR by 5% respectively then this would have had the following impact:82