Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

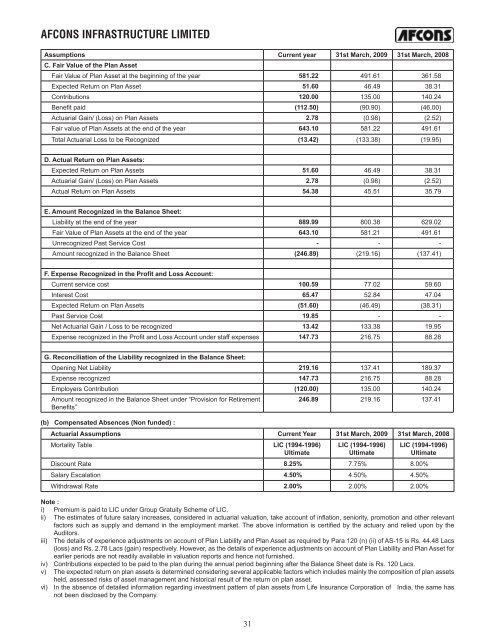

AFCONS INFRASTRUCTURE LIMITEDAssumptions Current year 31st March, 2009 31st March, 2008C. Fair Value of the Plan AssetFair Value of Plan Asset at the beginning of the year 581.22 491.61 361.58Expected Return on Plan Asset 51.60 46.49 38.31Contributions 120.00 135.00 140.24Benefit paid (112.50) (90.90) (46.00)Actuarial Gain/ (Loss) on Plan Assets 2.78 (0.98) (2.52)Fair value of Plan Assets at the end of the year 643.10 581.22 491.61Total Actuarial Loss to be Recognized (13.42) (133.38) (19.95)D. Actual Return on Plan Assets:Expected Return on Plan Assets 51.60 46.49 38.31Actuarial Gain/ (Loss) on Plan Assets 2.78 (0.98) (2.52)Actual Return on Plan Assets 54.38 45.51 35.79E. Amount Recognized in the Balance Sheet:Liability at the end of the year 889.99 800.38 629.02Fair Value of Plan Assets at the end of the year 643.10 581.21 491.61Unrecognized Past Service Cost - - -Amount recognized in the Balance Sheet (246.89) (219.16) (137.41)F. Expense Recognized in the Profit and Loss Account:Current service cost 100.59 77.02 59.60Interest Cost 65.47 52.84 47.04Expected Return on Plan Assets (51.60) (46.49) (38.31)Past Service Cost 19.85 - -Net Actuarial Gain / Loss to be recognized 13.42 133.38 19.95Expense recognized in the Profit and Loss Account under staff expenses 147.73 216.75 88.28G. Reconciliation of the Liability recognized in the Balance Sheet:Opening Net Liability 219.16 137.41 189.37Expense recognized 147.73 216.75 88.28Employers Contribution (120.00) 135.00 140.24Amount recognized in the Balance Sheet under “Provision for Retirement246.89 219.16 137.41Benefits”(b) Compensated Absences (Non funded) :Actuarial Assumptions Current Year 31st March, 2009 31st March, 2008Mortality Table LIC (1994-1996)UltimateLIC (1994-1996)UltimateLIC (1994-1996)UltimateDiscount Rate 8.25% 7.75% 8.00%Salary Escalation 4.50% 4.50% 4.50%Withdrawal Rate 2.00% 2.00% 2.00%Note :i) Premium is paid to LIC under Group Gratuity Scheme of LIC.ii) The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority, promotion and other relevantfactors such as supply and demand in the employment market. The above information is certified by the actuary and relied upon by theAuditors.iii) The details of experience adjustments on account of Plan Liability and Plan Asset as required by Para 120 (n) (ii) of AS-15 is Rs. 44.48 Lacs(loss) and Rs. 2.78 Lacs (gain) respectively. However, as the details of experience adjustments on account of Plan Liability and Plan Asset forearlier periods are not readily available in valuation reports and hence not furnished.iv) Contributions expected to be paid to the plan during the annual period beginning after the Balance Sheet date is Rs. 120 Lacs.v) The expected return on plan assets is determined considering several applicable factors which includes mainly the composition of plan assetsheld, assessed risks of asset management and historical result of the return on plan asset.vi) In the absence of detailed information regarding investment pattern of plan assets from Life Insurance Corporation of India, the same hasnot been disclosed by the Company.31