Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

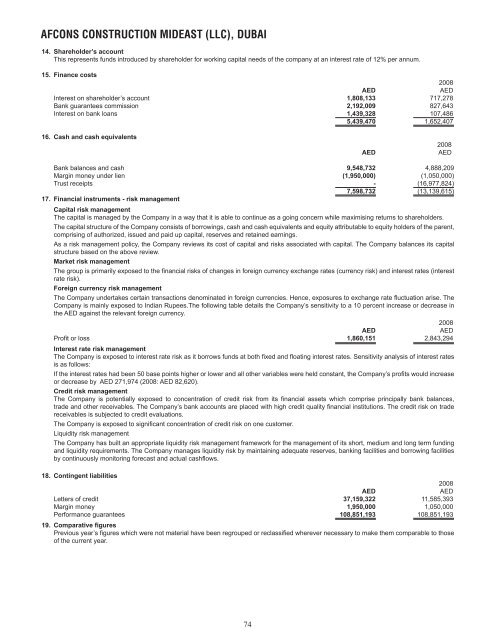

AFCONS CONSTRUCTION MIDEAST (LLC), DUBAI14. Shareholder’s accountThis represents funds introduced by shareholder for working capital needs of the company at an interest rate of 12% per annum.15. Finance costs2008AEDAEDInterest on shareholder’s account 1,808,133 717,278Bank guarantees commission 2,192,009 827,643Interest on bank loans 1,439,328 107,4865,439,470 1,652,40716. Cash and cash equivalentsAED2008AEDBank balances and cash 9,548,732 4,888,209Margin money under lien (1,950,000) (1,050,000)Trust receipts ‐ (16,977,824)7,598,732 (13,139,615)17. Financial instruments ‐ risk managementCapital risk managementThe capital is managed by the Company in a way that it is able to continue as a going concern while maximising returns to shareholders.The capital structure of the Company consists of borrowings, cash and cash equivalents and equity attributable to equity holders of the parent,comprising of authorized, issued and paid up capital, reserves and retained earnings.As a risk management policy, the Company reviews its cost of capital and risks associated with capital. The Company balances its capitalstructure based on the above review.Market risk managementThe group is primarily exposed to the financial risks of changes in foreign currency exchange rates (currency risk) and interest rates (interestrate risk).Foreign currency risk managementThe Company undertakes certain transactions denominated in foreign currencies. Hence, exposures to exchange rate fluctuation arise. TheCompany is mainly exposed to Indian Rupees.The following table details the Company’s sensitivity to a 10 percent increase or decrease inthe AED against the relevant foreign currency.2008AEDAEDProfit or loss 1,860,151 2,843,294Interest rate risk managementThe Company is exposed to interest rate risk as it borrows funds at both fixed and floating interest rates. Sensitivity analysis of interest ratesis as follows:If the interest rates had been 50 base points higher or lower and all other variables were held constant, the Company’s profits would increaseor decrease by AED 271,974 (2008: AED 82,620).Credit risk managementThe Company is potentially exposed to concentration of credit risk from its financial assets which comprise principally bank balances,trade and other receivables. The Company’s bank accounts are placed with high credit quality financial institutions. The credit risk on tradereceivables is subjected to credit evaluations.The Company is exposed to significant concentration of credit risk on one customer.Liquidity risk managementThe Company has built an appropriate liquidity risk management framework for the management of its short, medium and long term fundingand liquidity requirements. The Company manages liquidity risk by maintaining adequate reserves, banking facilities and borrowing facilitiesby continuously monitoring forecast and actual cashflows.18. Contingent liabilities2008AEDAEDLetters of credit 37,159,322 11,585,393Margin money 1,950,000 1,050,000Performance guarantees 108,851,193 108,851,19319. Comparative figuresPrevious year’s figures which were not material have been regrouped or reclassified wherever necessary to make them comparable to thoseof the current year.74