Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

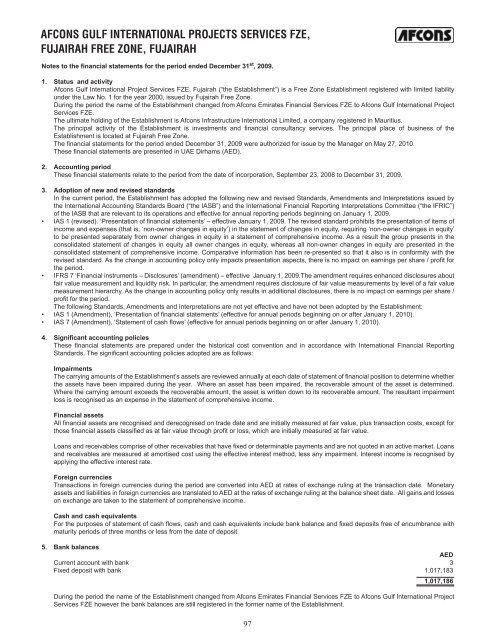

AFCONS GULF INTERNATIONAL PROJECTS SERVICES FZE,FUJAIRAH FREE ZONE, FUJAIRAHNotes to the financial statements for the period ended December 31 st , 2009.1. Status and activity<strong>Afcon</strong>s Gulf International Project Services FZE, Fujairah (“the Establishment”) is a Free Zone Establishment registered with limited liabilityunder the Law No. 1 for the year 2000, issued by Fujairah Free Zone.During the period the name of the Establishment changed from <strong>Afcon</strong>s Emirates Financial Services FZE to <strong>Afcon</strong>s Gulf International ProjectServices FZE.The ultimate holding of the Establishment is <strong>Afcon</strong>s <strong>Infrastructure</strong> International Limited, a company registered in Mauritius.The principal activity of the Establishment is investments and financial consultancy services. The principal place of business of theEstablishment is located at Fujairah Free Zone.The financial statements for the period ended December 31, 2009 were authorized for issue by the Manager on May 27, 2010.These financial statements are presented in UAE Dirhams (AED).2. Accounting periodThese financial statements relate to the period from the date of incorporation, September 23, 2008 to December 31, 2009.3. Adoption of new and revised standardsIn the current period, the Establishment has adopted the following new and revised Standards, Amendments and Interpretations issued bythe International Accounting Standards Board (“the IASB”) and the International Financial Reporting Interpretations Committee (“the IFRIC”)of the IASB that are relevant to its operations and effective for annual reporting periods beginning on January 1, 2009.• IAS 1 (revised). ‘Presentation of financial statements’ – effective January 1, 2009. The revised standard prohibits the presentation of items ofincome and expenses (that is, ‘non-owner changes in equity’) in the statement of changes in equity, requiring ‘non-owner changes in equity’to be presented separately from owner changes in equity in a statement of comprehensive income. As a result the group presents in theconsolidated statement of changes in equity all owner changes in equity, whereas all non-owner changes in equity are presented in theconsolidated statement of comprehensive income. Comparative information has been re-presented so that it also is in conformity with therevised standard. As the change in accounting policy only impacts presentation aspects, there is no impact on earnings per share / profit forthe period.• IFRS 7 ‘Financial instruments – Disclosures’ (amendment) – effective January 1, 2009.The amendment requires enhanced disclosures aboutfair value measurement and liquidity risk. In particular, the amendment requires disclosure of fair value measurements by level of a fair valuemeasurement hierarchy. As the change in accounting policy only results in additional disclosures, there is no impact on earnings per share /profit for the period.The following Standards, Amendments and Interpretations are not yet effective and have not been adopted by the Establishment:• IAS 1 (Amendment), ‘Presentation of financial statements’ (effective for annual periods beginning on or after January 1, 2010).• IAS 7 (Amendment), ‘Statement of cash flows’ (effective for annual periods beginning on or after January 1, 2010).4. Significant accounting policiesThese financial statements are prepared under the historical cost convention and in accordance with International Financial ReportingStandards. The significant accounting policies adopted are as follows:ImpairmentsThe carrying amounts of the Establishment’s assets are reviewed annually at each date of statement of financial position to determine whetherthe assets have been impaired during the year. Where an asset has been impaired, the recoverable amount of the asset is determined.Where the carrying amount exceeds the recoverable amount, the asset is written down to its recoverable amount. The resultant impairmentloss is recognised as an expense in the statement of comprehensive income.Financial assetsAll financial assets are recognised and derecognised on trade date and are initially measured at fair value, plus transaction costs, except forthose financial assets classified as at fair value through profit or loss, which are initially measured at fair value.Loans and receivables comprise of other receivables that have fixed or determinable payments and are not quoted in an active market. Loansand receivables are measured at amortised cost using the effective interest method, less any impairment. Interest income is recognised byapplying the effective interest rate.Foreign currenciesTransactions in foreign currencies during the period are converted into AED at rates of exchange ruling at the transaction date. Monetaryassets and liabilities in foreign currencies are translated to AED at the rates of exchange ruling at the balance sheet date. All gains and losseson exchange are taken to the statement of comprehensive income.Cash and cash equivalentsFor the purposes of statement of cash flows, cash and cash equivalents include bank balance and fixed deposits free of encumbrance withmaturity periods of three months or less from the date of deposit.5. Bank balancesAEDCurrent account with bank 3Fixed deposit with bank 1,017,1831,017,186During the period the name of the Establishment changed from <strong>Afcon</strong>s Emirates Financial Services FZE to <strong>Afcon</strong>s Gulf International ProjectServices FZE however the bank balances are still registered in the former name of the Establishment.97