Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

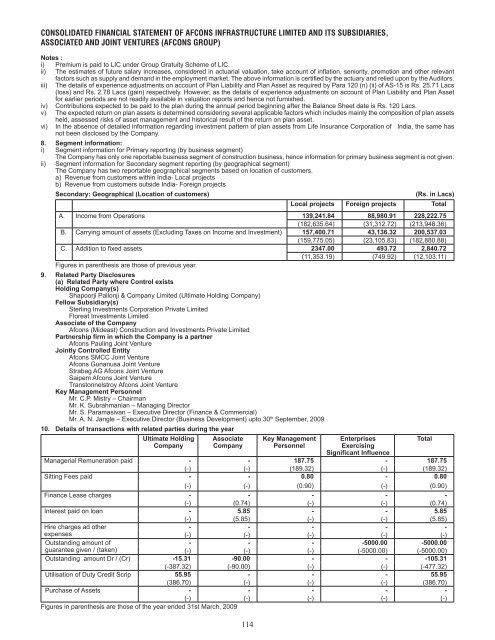

CONSOLIDATED FINANCIAL STATEMENT OF AFCONS INFRASTRUCTURE LIMITED AND ITS SUBSIDIARIES,ASSOCIATED AND JOINT VENTURES (AFCONS GROUP)Notes :i) Premium is paid to LIC under Group Gratuity Scheme of LIC.ii) The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority, promotion and other relevantfactors such as supply and demand in the employment market. The above information is certified by the actuary and relied upon by the Auditors.iii) The details of experience adjustments on account of Plan Liability and Plan Asset as required by Para 120 (n) (ii) of AS-15 is Rs. 25.71 Lacs(loss) and Rs. 2.78 Lacs (gain) respectively. However, as the details of experience adjustments on account of Plan Liability and Plan Assetfor earlier periods are not readily available in valuation reports and hence not furnished.iv) Contributions expected to be paid to the plan during the annual period beginning after the Balance Sheet date is Rs. 120 Lacs.v) The expected return on plan assets is determined considering several applicable factors which includes mainly the composition of plan assetsheld, assessed risks of asset management and historical result of the return on plan asset.vi) In the absence of detailed information regarding investment pattern of plan assets from Life Insurance Corporation of India, the same hasnot been disclosed by the Company.8. Segment information:i) Segment information for Primary reporting (by business segment)The Company has only one reportable business segment of construction business, hence information for primary business segment is not given.ii) Segment information for Secondary segment reporting (by geographical segment)The Company has two reportable geographical segments based on location of customers.a) Revenue from customers within India- Local projectsb) Revenue from customers outside India- Foreign projectsSecondary: Geographical (Location of customers)(Rs. in Lacs)Local projects Foreign projects TotalA. Income from Operations 139,241.84 88,980.91 228,222.75(182,635.64) (31,312.72) (213,948.36)B. Carrying amount of assets (Excluding Taxes on Income and Investment) 157,400.71 43,136.32 200,537.03(159,775.05) (23,105.83) (182,880.88)C. Addition to fixed assets 2347.00 493.72 2,840.72(11,353.19) (749.92) (12,103.11)Figures in parenthesis are those of previous year.9. Related Party Disclosures(a) Related Party where Control existsHolding Company(s)Shapoorji Pallonji & Company Limited (Ultimate Holding Company)Fellow Subsidiary(s)Sterling Investments Corporation Private LimitedFloreat Investments LimitedAssociate of the Company<strong>Afcon</strong>s (Mideast) Construction and Investments Private LimitedPartnership firm in which the Company is a partner<strong>Afcon</strong>s Pauling Joint VentureJointly Controlled Entity<strong>Afcon</strong>s SMCC Joint Venture<strong>Afcon</strong>s Gunanusa Joint VentureStrabag AG <strong>Afcon</strong>s Joint VentureSaipem <strong>Afcon</strong>s Joint VentureTranstonnelstroy <strong>Afcon</strong>s Joint VentureKey Management PersonnelMr. C.P. Mistry – ChairmanMr. K. Subrahmanian – Managing DirectorMr. S. Paramasivan – Executive Director (Finance & Commercial)Mr. A. N. Jangle – Executive Director (Business Development) upto 30 th September, 200910. Details of transactions with related parties during the yearUltimate HoldingCompanyAssociateCompany114Key ManagementPersonnelEnterprisesExercisingSignificant InfluenceManagerial Remuneration paid - - 187.75 - 187.75(-) (-) (189.32) (-) (189.32)Sitting Fees paid - - 0.80 - 0.80(-) (-) (0.90) (-) (0.90)Finance Lease charges - - - - -(-) (0.74) (-) (-) (0.74)Interest paid on loan - 5.85 - - 5.85(-) (5.85) (-) (-) (5.85)Hire charges ad other- - - - -expenses(-) (-) (-) (-) (-)Outstanding amount of- - - -5000.00 -5000.00guarantee given / (taken)(-) (-) (-) (-5000.00) (-5000.00)Outstanding amount Dr / (Cr) -15.31 -90.00 - - -105.31(-387.32) (-90.00) (-) (-) (-477.32)Utilisation of Duty Credit Scrip 55.95 - - - 55.95(386.70) (-) (-) (-) (386.70)Purchase of Assets - - - - -(-) (-) (-) (-) (-)Figures in parenthesis are those of the year ended 31st March, 2009Total