AFCONS CONSTRUCTION MIDEAST (LLC), DUBAIFinancial assetsAll financial assets are recognised and derecognised on trade date and are initially measured at fair value, plus transaction costs, except forthose financial assets classified as at fair value through profit or loss, which are initially measured at fair valueFinancial assets are classified into the following specified categories: Loans and receivables. The classification depends on the nature andpurpose of the financial assets and is determined at the time of initial recognition.Loans and receivables are non‐derivative financial assets with fixed or determinable payments that are not quoted in an active market.Loans and receivables comprise of trade and other receivables that have fixed or determinable payments and are not quoted in an active market.Loans and receivables are measured at amortised cost using the effective interest method, less any impairment. Interest income is recognisedby applying the effective interest rate.Employees’ end of service gratuitiesProvision is made for employees’ end of service gratuities on the basis prescribed in the UAE Labour Law, for the accumulated period of serviceat the date of statement of financial position.Financial liabilitiesFinancial liabilities are classified as either financial liabilities at fair value through profit or loss or other financial liabilities. The Company’sfinancial liabilities consist of trade and other payables, due to related parties, bank overdrafts and bank loan. The trade and other payables anddue to related parties are stated at cost and the bank loan and overdrafts are recorded at the proceeds received less repayments. All interest andborrowing costs incurred in connection with the above are expensed as incurred and reported as part of finance costs in the income statement.Other financial liabilities, including borrowings, are initially measured at fair value, net of transaction costs. The subsequent measurement is atamortised cost using the effective interest method, with interest expense recognised on an effective yield basis.ProvisionsProvisions are recognised in the balance sheet when the Company has a present obligation (legal or constructive) as a result of a past event,and it is probable that an outflow of economic benefits will be required to settle the obligation and a reliable estimate can be made of the amountof the obligation.Revenue recognitionRevenue from fixed price construction contracts is recognised on the percentage of completion method, measured by reference to thepercentage of costs incurred as on the date of statement of financial position to the estimated total costs for each contract.LeasingLeases in which a significant portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases.Payments made under operating leases (net of any incentives received from the lessor) are charged to the statement of comprehensive incomeon a straight‐line basis over the period of the lease.Foreign currenciesTransactions in foreign currencies during the year are converted into AED at rates of exchange ruling at the transaction dates. Monetaryassets and liabilities in foreign currencies are translated to AED at the rates of exchange ruling at the balance sheet date. All gains and losseson exchange are taken to the statement of comprehensive income.Cash and cash equivalentsFor the purpose of the statement of cash flows, cash and cash equivalents include cash, bank balances, bank overdrafts and fixed deposits freeof encumbrance with maturity period of three months or less from the date of deposit.4. Critical accounting judgements and key sources of estimation uncertaintyIn the application of the Establishment’s accounting policies, which are described in note 3, management is required to make judgments,estimates and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. The estimatesand associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differfrom these estimates.Key sources of estimation uncertaintyThe key assumptions concerning the future, and other key sources of estimation uncertainty at the date of statement of financial position,that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year, arediscussed below.Property, plant and equipmentProperty, plant and equipment is depreciated over its estimated useful life, which is based on estimates for expected usage of the asset andexpected physical wear and tear which are dependent on operational factors. Management has not considered any residual value as it is deemedimmaterial.Provisions for material and subcontractors costProvisions for material and subcontractors costs is determined using a combination of factors such as quantity survey, monitoring daily activityreports at the site and bills of quantities received by subcontractors to ensure that the all costs are accounted for and fairly stated as at the dateof statement of financial position.5. Property, plant and equipmentMovement in Property, plant and equipment are given below:PortaCabinsMachineryandequipmentAir conditionerandequipment72Computersand officeequipmentFurnitureandfituresMotorvehiclesCost AED AED AED AED AED AED AEDAt January 1, 2009 1,038,500 449,468 198,919 298,828 55,955 488,710 2,530,380Addition 131,850 1,532,419 136,643 289,629 101,061 163,000 2,354,602Disposals ‐ ‐ ‐ ‐ ‐ (62,500) (62,500)At December 31, 2009 1,170,350 1,981,887 335,562 588,457 157,016 589,210 4,822,482DepreciationAt January 1, 200941,366 11,555 4,525 8,982 1,258 37,985 105,671Charge for the year 372,049 379,798 57,419 125,031 28,495 114,504 1,077,296On disposals ‐ ‐ ‐ ‐ ‐ (15,714) (15,714)At December 31, 2009 413,415 391,353 61,944 134,013 29,753 136,775 1,167,253Net <strong>Book</strong> ValueAt December 31, 2009756,935 1,590,534 273,618 454,444 127,263 452,435 3,655,229At December 31, 2008 997,134 437,913 194,394 289,846 54,697 450,725 2,424,709Total

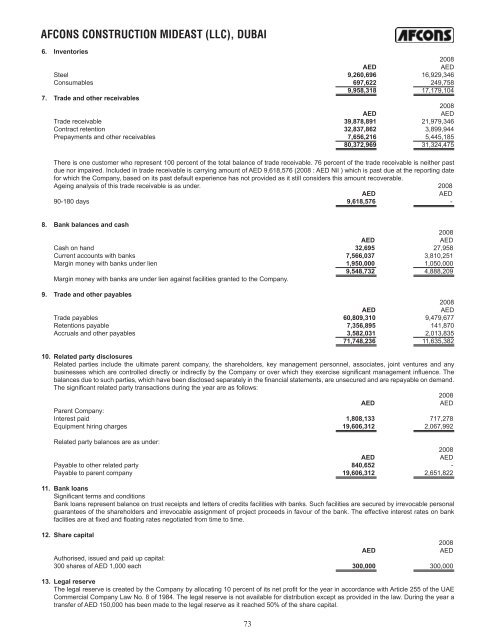

AFCONS CONSTRUCTION MIDEAST (LLC), DUBAI6. Inventories2008AEDAEDSteel 9,260,696 16,929,346Consumables 697,622 249,7589,958,318 17,179,1047. Trade and other receivables2008AEDAEDTrade receivable 39,878,891 21,979,346Contract retention 32,837,862 3,899,944Prepayments and other receivables 7,656,216 5,445,18580,372,969 31,324,475There is one customer who represent 100 percent of the total balance of trade receivable. 76 percent of the trade receivable is neither pastdue nor impaired. Included in trade receivable is carrying amount of AED 9,618,576 (2008 : AED Nil ) which is past due at the reporting datefor which the Company, based on its past default experience has not provided as it still considers this amount recoverable.Ageing analysis of this trade receivable is as under. 2008AEDAED90‐180 days 9,618,576 -8. Bank balances and cash2008AEDAEDCash on hand 32,695 27,958Current accounts with banks 7,566,037 3,810,251Margin money with banks under lien 1,950,000 1,050,0009,548,732 4,888,209Margin money with banks are under lien against facilities granted to the Company.9. Trade and other payables2008AEDAEDTrade payables 60,809,310 9,479,677Retentions payable 7,356,895 141,870Accruals and other payables 3,582,031 2,013,83571,748,236 11,635,38210. Related party disclosuresRelated parties include the ultimate parent company, the shareholders, key management personnel, associates, joint ventures and anybusinesses which are controlled directly or indirectly by the Company or over which they exercise significant management influence. Thebalances due to such parties, which have been disclosed separately in the financial statements, are unsecured and are repayable on demand.The significant related party transactions during the year are as follows:2008AEDAEDParent Company:Interest paid 1,808,133 717,278Equipment hiring charges 19,606,312 2,067,992Related party balances are as under:2008AEDAEDPayable to other related party 840,652 ‐ -Payable to parent company 19,606,312 2,651,82211. Bank loansSignificant terms and conditionsBank loans represent balance on trust receipts and letters of credits facilities with banks. Such facilities are secured by irrevocable personalguarantees of the shareholders and irrevocable assignment of project proceeds in favour of the bank. The effective interest rates on bankfaclities are at fixed and floating rates negotiated from time to time.12. Share capital2008AEDAEDAuthorised, issued and paid up capital:300 shares of AED 1,000 each 300,000 300,00013. Legal reserveThe legal reserve is created by the Company by allocating 10 percent of its net profit for the year in accordance with Article 255 of the UAECommercial Company Law No. 8 of 1984. The legal reserve is not available for distribution except as provided in the law. During the year atransfer of AED 150,000 has been made to the legal reserve as it reached 50% of the share capital.73