Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

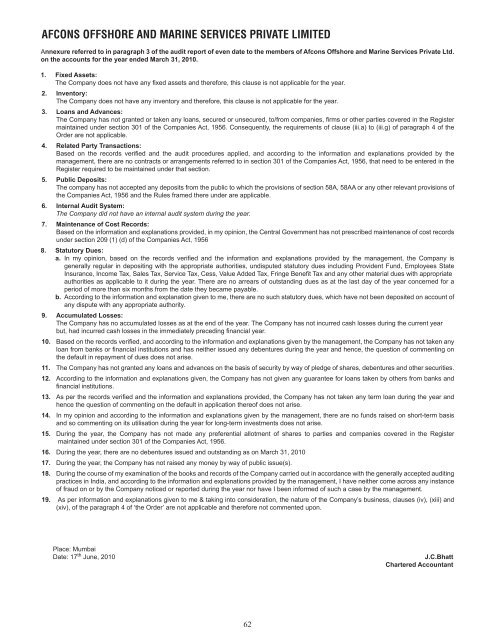

AFCONS OFFSHORE AND MARINE SERVICES PRIVATE LIMITEDAnnexure referred to in paragraph 3 of the audit report of even date to the members of <strong>Afcon</strong>s Offshore and Marine Services Private <strong>Ltd</strong>.on the accounts for the year ended March 31, 2010.1. Fixed Assets:The Company does not have any fixed assets and therefore, this clause is not applicable for the year.2. Inventory:The Company does not have any inventory and therefore, this clause is not applicable for the year.3. Loans and Advances:The Company has not granted or taken any loans, secured or unsecured, to/from companies, firms or other parties covered in the Registermaintained under section 301 of the Companies Act, 1956. Consequently, the requirements of clause (iii.a) to (iii.g) of paragraph 4 of theOrder are not applicable.4. Related Party Transactions:Based on the records verified and the audit procedures applied, and according to the information and explanations provided by themanagement, there are no contracts or arrangements referred to in section 301 of the Companies Act, 1956, that need to be entered in theRegister required to be maintained under that section.5. Public Deposits:The company has not accepted any deposits from the public to which the provisions of section 58A, 58AA or any other relevant provisions ofthe Companies Act, 1956 and the Rules framed there under are applicable.6. Internal Audit System:The Company did not have an internal audit system during the year.7. Maintenance of Cost Records:Based on the information and explanations provided, in my opinion, the Central Government has not prescribed maintenance of cost recordsunder section 209 (1) (d) of the Companies Act, 19568. Statutory Dues:a. In my opinion, based on the records verified and the information and explanations provided by the management, the Company isgenerally regular in depositing with the appropriate authorities, undisputed statutory dues including Provident Fund, Employees StateInsurance, Income Tax, Sales Tax, Service Tax, Cess, Value Added Tax, Fringe Benefit Tax and any other material dues with appropriateauthorities as applicable to it during the year. There are no arrears of outstanding dues as at the last day of the year concerned for aperiod of more than six months from the date they became payable.b. According to the information and explanation given to me, there are no such statutory dues, which have not been deposited on account ofany dispute with any appropriate authority.9. Accumulated Losses:The Company has no accumulated losses as at the end of the year. The Company has not incurred cash losses during the current yearbut, had incurred cash losses in the immediately preceding financial year.10. Based on the records verified, and according to the information and explanations given by the management, the Company has not taken anyloan from banks or financial institutions and has neither issued any debentures during the year and hence, the question of commenting onthe default in repayment of dues does not arise.11. The Company has not granted any loans and advances on the basis of security by way of pledge of shares, debentures and other securities.12. According to the information and explanations given, the Company has not given any guarantee for loans taken by others from banks andfinancial institutions.13. As per the records verified and the information and explanations provided, the Company has not taken any term loan during the year andhence the question of commenting on the default in application thereof does not arise.14. In my opinion and according to the information and explanations given by the management, there are no funds raised on short-term basisand so commenting on its utilisation during the year for long-term investments does not arise.15. During the year, the Company has not made any preferential allotment of shares to parties and companies covered in the Registermaintained under section 301 of the Companies Act, 1956.16. During the year, there are no debentures issued and outstanding as on March 31, 201017. During the year, the Company has not raised any money by way of public issue(s).18. During the course of my examination of the books and records of the Company carried out in accordance with the generally accepted auditingpractices in India, and according to the information and explanations provided by the management, I have neither come across any instanceof fraud on or by the Company noticed or reported during the year nor have I been informed of such a case by the management.19. As per information and explanations given to me & taking into consideration, the nature of the Company’s business, clauses (iv), (xiii) and(xiv), of the paragraph 4 of ‘the Order’ are not applicable and therefore not commented upon.Place: MumbaiDate: 17 th June, 2010J.C.BhattChartered Accountant62