Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

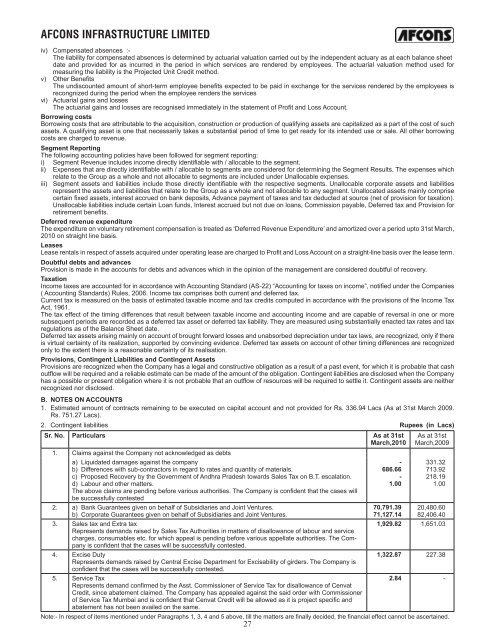

AFCONS INFRASTRUCTURE LIMITEDiv) Compensated absences :-The liability for compensated absences is determined by actuarial valuation carried out by the independent actuary as at each balance sheetdate and provided for as incurred in the period in which services are rendered by employees. The actuarial valuation method used formeasuring the liability is the Projected Unit Credit method.v) Other BenefitsThe undiscounted amount of short-term employee benefits expected to be paid in exchange for the services rendered by the employees isrecongnized during the period when the employee renders the servicesvi) Actuarial gains and lossesThe actuarial gains and losses are recognised immediately in the statement of Profit and Loss Account.Borrowing costsBorrowing costs that are attributable to the acquisition, construction or production of qualifying assets are capitalized as a part of the cost of suchassets. A qualifying asset is one that necessarily takes a substantial period of time to get ready for its intended use or sale. All other borrowingcosts are charged to revenue.Segment ReportingThe following accounting policies have been followed for segment reporting:i) Segment Revenue includes income directly identifiable with / allocable to the segment.ii) Expenses that are directly identifiable with / allocable to segments are considered for determining the Segment Results. The expenses whichrelate to the Group as a whole and not allocable to segments are included under Unallocable expenses.iii) Segment assets and liabilities include those directly identifiable with the respective segments. Unallocable corporate assets and liabilitiesrepresent the assets and liabilities that relate to the Group as a whole and not allocable to any segment. Unallocated assets mainly comprisecertain fixed assets, interest accrued on bank deposits, Advance payment of taxes and tax deducted at source (net of provision for taxation).Unallocable liabilities include certain Loan funds, Interest accrued but not due on loans, Commission payable, Deferred tax and Provision forretirement benefits.Deferred revenue expenditureThe expenditure on voluntary retirement compensation is treated as ‘Deferred Revenue Expenditure’ and amortized over a period upto 31st March,2010 on straight line basis.LeasesLease rentals in respect of assets acquired under operating lease are charged to Profit and Loss Account on a straight-line basis over the lease term.Doubtful debts and advancesProvision is made in the accounts for debts and advances which in the opinion of the management are considered doubtful of recovery.TaxationIncome taxes are accounted for in accordance with Accounting Standard (AS-22) “Accounting for taxes on income”, notified under the Companies( Accounting Standards) Rules, 2006. Income tax comprises both current and deferred tax.Current tax is measured on the basis of estimated taxable income and tax credits computed in accordance with the provisions of the Income TaxAct, 1961.The tax effect of the timing differences that result between taxable income and accounting income and are capable of reversal in one or moresubsequent periods are recorded as a deferred tax asset or deferred tax liability. They are measured using substantially enacted tax rates and taxregulations as of the Balance Sheet date.Deferred tax assets arising mainly on account of brought forward losses and unabsorbed depreciation under tax laws, are recognized, only if thereis virtual certainty of its realization, supported by convincing evidence. Deferred tax assets on account of other timing differences are recognizedonly to the extent there is a reasonable certainty of its realisation.Provisions, Contingent Liabilities and Contingent AssetsProvisions are recognized when the Company has a legal and constructive obligation as a result of a past event, for which it is probable that cashoutflow will be required and a reliable estimate can be made of the amount of the obligation. Contingent liabilities are disclosed when the Companyhas a possible or present obligation where it is not probable that an outflow of resources will be required to settle it. Contingent assets are neitherrecognized nor disclosed.B. NOTES ON ACCOUNTS1. Estimated amount of contracts remaining to be executed on capital account and not provided for Rs. 336.94 Lacs (As at 31st March 2009.Rs. 751.27 Lacs).2. Contingent liabilities Rupees (in Lacs)Sr. No. Particulars As at 31stMarch,20101. Claims against the Company not acknowledged as debtsa) Liquidated damages against the companyb) Differences with sub-contractors in regard to rates and quantity of materials.c) Proposed Recovery by the Government of Andhra Pradesh towards Sales Tax on B.T. escalation.d) Labour and other matters.The above claims are pending before various authorities. The Company is confident that the cases willbe successfully contested2. a) Bank Guarantees given on behalf of Subsidiaries and Joint Ventures.b) Corporate Guarantees given on behalf of Subsidiaries and Joint Ventures.3. Sales tax and Extra taxRepresents demands raised by Sales Tax Authorities in matters of disallowance of labour and servicecharges, consumables etc. for which appeal is pending before various appellate authorities. The Companyis confident that the cases will be successfully contested.4. Excise DutyRepresents demands raised by Central Excise Department for Excisability of girders. The Company isconfident that the cases will be successfully contested.5. Service TaxRepresents demand confirmed by the Asst. Commissioner of Service Tax for disallowance of CenvatCredit, since abatement claimed. The Company has appealed against the said order with Commissionerof Service Tax Mumbai and is confident that Cenvat Credit will be allowed as it is project specific andabatement has not been availed on the same.27-686.66-1.0070,791.3971,127.14As at 31stMarch,2009331.32713.92218.191.0020,480.6082,406.401,929.82 1,651.031,322.87 227.382.84 -Note:- In respect of items mentioned under Paragraphs 1, 3, 4 and 5 above, till the matters are finally decided, the financial effect cannot be ascertained.