Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

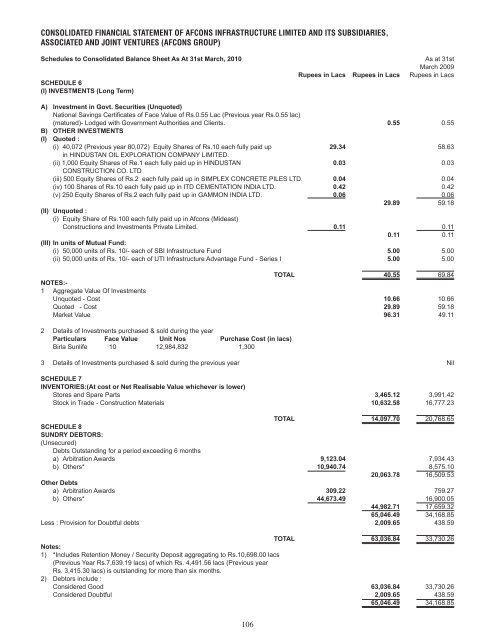

CONSOLIDATED FINANCIAL STATEMENT OF AFCONS INFRASTRUCTURE LIMITED AND ITS SUBSIDIARIES,ASSOCIATED AND JOINT VENTURES (AFCONS GROUP)Schedules to Consolidated Balance Sheet As At 31st March, 2010SCHEDULE 6(I) INVESTMENTS (Long Term)As at 31stMarch 2009Rupees in Lacs Rupees in Lacs Rupees in LacsA) Investment in Govt. Securities (Unquoted)National Savings Certificates of Face Value of Rs.0.55 Lac (Previous year Rs.0.55 lac)(matured)- Lodged with Government Authorities and Clients. 0.55 0.55B) OTHER INVESTMENTS(I) Quoted :(i) 40,072 (Previous year 80,072) Equity Shares of Rs.10 each fully paid up 29.34 58.63in HINDUSTAN OIL EXPLORATION COMPANY LIMITED.(ii) 1,000 Equity Shares of Re.1 each fully paid up in HINDUSTAN 0.03 0.03CONSTRUCTION CO. LTD(iii) 500 Equity Shares of Rs.2 each fully paid up in SIMPLEX CONCRETE PILES LTD. 0.04 0.04(iv) 100 Shares of Rs.10 each fully paid up in ITD CEMENTATION INDIA LTD. 0.42 0.42(v) 250 Equity Shares of Rs.2 each fully paid up in GAMMON INDIA LTD. 0.06 0.0629.89 59.18(II) Unquoted :(i) Equity Share of Rs.100 each fully paid up in <strong>Afcon</strong>s (Mideast)Constructions and Investments Private Limited. 0.11 0.110.11 0.11(III) In units of Mutual Fund:(i) 50,000 units of Rs. 10/- each of SBI <strong>Infrastructure</strong> Fund 5.00 5.00(ii) 50,000 units of Rs. 10/- each of UTI <strong>Infrastructure</strong> Advantage Fund - Series I 5.00 5.00TOTAL 40.55 69.84NOTES:-1 Aggregate Value Of InvestmentsUnquoted - Cost 10.66 10.66Quoted - Cost 29.89 59.18Market Value 96.31 49.112 Details of Investments purchased & sold during the yearParticulars Face Value Unit Nos Purchase Cost (in lacs)Birla Sunlife 10 12,984,832 1,3003 Details of Investments purchased & sold during the previous year NilSCHEDULE 7INVENTORIES:(At cost or Net Realisable Value whichever is lower)Stores and Spare Parts 3,465.12 3,991.42Stock in Trade - Construction Materials 10,632.58 16,777.23TOTAL 14,097.70 20,768.65SCHEDULE 8SUNDRY DEBTORS:(Unsecured)Debts Outstanding for a period exceeding 6 monthsa) Arbitration Awards 9,123.04 7,934.43b) Others* 10,940.74 8,575.1020,063.78 16,509.53Other Debtsa) Arbitration Awards 309.22 759.27b) Others* 44,673.49 16,900.0544,982.71 17,659.3265,046.49 34,168.85Less : Provision for Doubtful debts 2,009.65 438.59TOTAL 63,036.84 33,730.26Notes:1) *Includes Retention Money / Security Deposit aggregating to Rs.10,698.00 lacs(Previous Year Rs.7,639.19 lacs) of which Rs. 4,491.56 lacs (Previous yearRs. 3,415.30 lacs) is outstanding for more than six months.2) Debtors include :Considered Good 63,036.84 33,730.26Considered Doubtful 2,009.65 438.5965,046.49 34,168.85106