Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

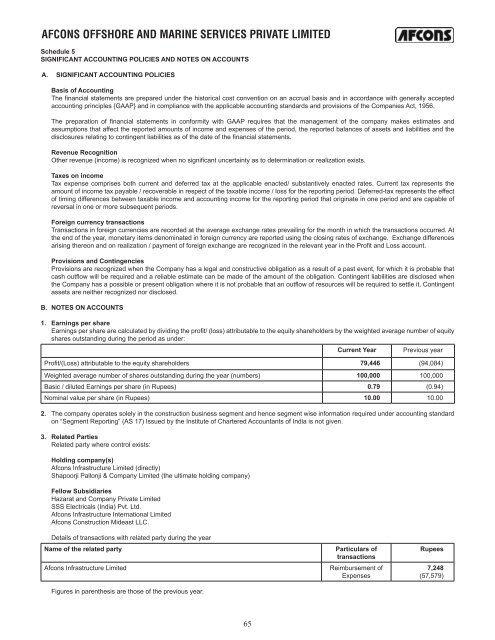

AFCONS OFFSHORE AND MARINE SERVICES PRIVATE LIMITEDSchedule 5SIGNIFICANT ACCOUNTING POLICIES AND NOTES ON ACCOUNTSA. SIGNIFICANT ACCOUNTING POLICIESBasis of AccountingThe financial statements are prepared under the historical cost convention on an accrual basis and in accordance with generally acceptedaccounting principles {GAAP} and in compliance with the applicable accounting standards and provisions of the Companies Act, 1956.The preparation of financial statements in conformity with GAAP requires that the management of the company makes estimates andassumptions that affect the reported amounts of income and expenses of the period, the reported balances of assets and liabilities and thedisclosures relating to contingent liabilities as of the date of the financial statements.Revenue RecognitionOther revenue (income) is recognized when no significant uncertainty as to determination or realization exists.Taxes on incomeTax expense comprises both current and deferred tax at the applicable enacted/ substantively enacted rates. Current tax represents theamount of income tax payable / recoverable in respect of the taxable income / loss for the reporting period. Deferred-tax represents the effectof timing differences between taxable income and accounting income for the reporting period that originate in one period and are capable ofreversal in one or more subsequent periods.Foreign currency transactionsTransactions in foreign currencies are recorded at the average exchange rates prevailing for the month in which the transactions occurred. Atthe end of the year, monetary items denominated in foreign currency are reported using the closing rates of exchange. Exchange differencesarising thereon and on realization / payment of foreign exchange are recognized in the relevant year in the Profit and Loss account.Provisions and ContingenciesProvisions are recognized when the Company has a legal and constructive obligation as a result of a past event, for which it is probable thatcash outflow will be required and a reliable estimate can be made of the amount of the obligation. Contingent liabilities are disclosed whenthe Company has a possible or present obligation where it is not probable that an outflow of resources will be required to settle it. Contingentassets are neither recognized nor disclosed.B. NOTES ON ACCOUNTS1. Earnings per shareEarnings per share are calculated by dividing the profit/ (loss) attributable to the equity shareholders by the weighted average number of equityshares outstanding during the period as under:Current Year Previous yearProfit/(Loss) attributable to the equity shareholders 79,446 (94,084)Weighted average number of shares outstanding during the year (numbers) 100,000 100,000Basic / diluted Earnings per share (in Rupees) 0.79 (0.94)Nominal value per share (in Rupees) 10.00 10.002. The company operates solely in the construction business segment and hence segment wise information required under accounting standardon “Segment Reporting” (AS 17) Issued by the Institute of Chartered Accountants of India is not given.3. Related PartiesRelated party where control exists:Holding company(s)<strong>Afcon</strong>s <strong>Infrastructure</strong> Limited (directly)Shapoorji Pallonji & Company Limited (the ultimate holding company)Fellow SubsidiariesHazarat and Company Private LimitedSSS Electricals (India) Pvt. <strong>Ltd</strong>.<strong>Afcon</strong>s <strong>Infrastructure</strong> International Limited<strong>Afcon</strong>s Construction Mideast LLC.Details of transactions with related party during the yearName of the related party<strong>Afcon</strong>s <strong>Infrastructure</strong> LimitedFigures in parenthesis are those of the previous year.Particulars oftransactionsReimbursement ofExpensesRupees7,248(57,579)65