Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

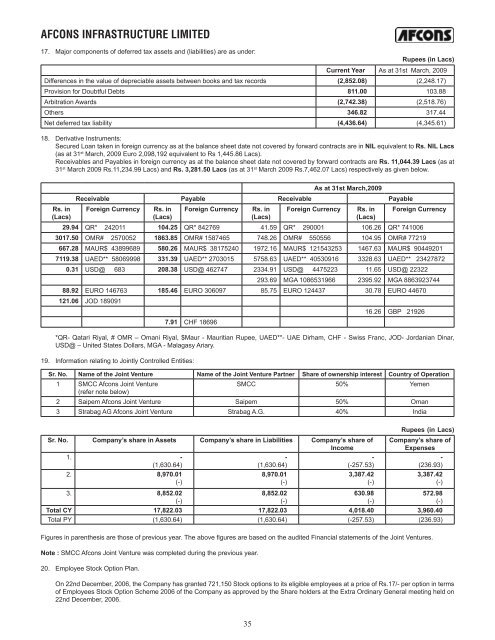

AFCONS INFRASTRUCTURE LIMITED17. Major components of deferred tax assets and (liabilities) are as under:Rupees (in Lacs)Current Year As at 31st March, 2009Differences in the value of depreciable assets between books and tax records (2,852.08) (2,248.17)Provision for Doubtful Debts 811.00 103.88Arbitration Awards (2,742.38) (2,518.76)Others 346.82 317.44Net deferred tax liability (4,436.64) (4,345.61)18. Derivative Instruments:Secured Loan taken in foreign currency as at the balance sheet date not covered by forward contracts are in NIL equivalent to Rs. NIL Lacs(as at 31 st March, 2009 Euro 2,098,192 equivalent to Rs 1,445.86 Lacs).Receivables and Payables in foreign currency as at the balance sheet date not covered by forward contracts are Rs. 11,044.39 Lacs (as at31 st March 2009 Rs.11,234.99 Lacs) and Rs. 3,281.50 Lacs (as at 31 st March 2009 Rs.7,462.07 Lacs) respectively as given below.Rs. in(Lacs)As at 31st March,2009Receivable Payable Receivable PayableForeign Currency Rs. in Foreign Currency Rs. in Foreign Currency Rs. in Foreign Currency(Lacs)(Lacs)(Lacs)29.94 QR* 242011 104.25 QR* 842769 41.59 QR* 290001 106.26 QR* 7410063017.50 OMR# 2570052 1863.85 OMR# 1587465 748.26 OMR# 550556 104.95 OMR# 77219667.28 MAUR$ 43899689 580.26 MAUR$ 38175240 1972.16 MAUR$ 121543253 1467.63 MAUR$ 904492017119.38 UAED** 58069998 331.39 UAED** 2703015 5758.63 UAED** 40530916 3328.63 UAED** 234278720.31 USD@ 683 208.38 USD@ 462747 2334.91 USD@ 4475223 11.65 USD@ 22322293.69 MGA 1086531966 2395.92 MGA 886392374488.92 EURO 146763 185.46 EURO 306097 85.75 EURO 124437 30.78 EURO 44670121.06 JOD 18909116.26 GBP 219267.91 CHF 18696*QR- Qatari Riyal, # OMR – Omani Riyal, $Maur - Mauritian Rupee, UAED**- UAE Dirham, CHF - Swiss Franc, JOD- Jordanian Dinar,USD@ – United States Dollars, MGA - Malagasy Ariary.19. Information relating to Jointly Controlled Entities:Sr. No. Name of the Joint Venture Name of the Joint Venture Partner Share of ownership interest Country of Operation1 SMCC <strong>Afcon</strong>s Joint VentureSMCC 50% Yemen(refer note below)2 Saipem <strong>Afcon</strong>s Joint Venture Saipem 50% Oman3 Strabag AG <strong>Afcon</strong>s Joint Venture Strabag A.G. 40% IndiaSr. No. Company’s share in Assets Company’s share in Liabilities Company’s share ofIncome1. -(1,630.64)2. 8,970.01(-)3. 8,852.02(-)-(1,630.64)8,970.01(-)8,852.02(-)-(-257.53)3,387.42(-)630.98(-)Rupees (in Lacs)Company’s share ofExpenses-(236.93)3,387.42(-)572.98(-)Total CY 17,822.03 17,822.03 4,018.40 3,960.40Total PY (1,630.64) (1,630.64) (-257.53) (236.93)Figures in parenthesis are those of previous year. The above figures are based on the audited Financial statements of the Joint Ventures.Note : SMCC <strong>Afcon</strong>s Joint Venture was completed during the previous year.20. Employee Stock Option Plan.On 22nd December, 2006, the Company has granted 721,150 Stock options to its eligible employees at a price of Rs.17/- per option in termsof Employees Stock Option Scheme 2006 of the Company as approved by the Share holders at the Extra Ordinary General meeting held on22nd December, 2006.35