Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

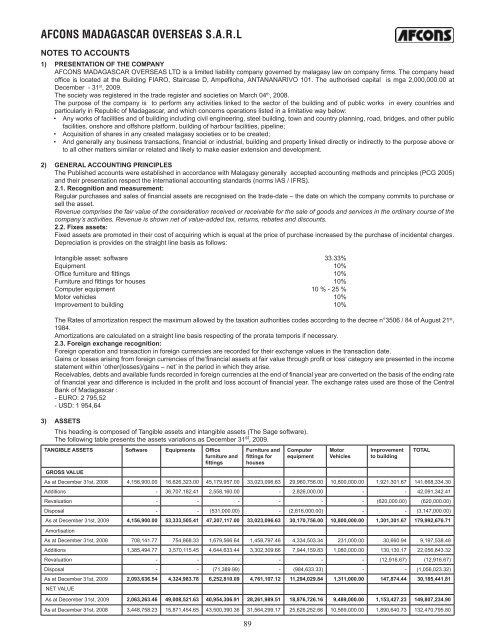

AFCONS MADAGASCAR OVERSEAS S.A.R.LNOTES TO ACCOUNTS1) PRESENTATION OF THE COMPANYAFCONS MADAGASCAR OVERSEAS LTD is a limited liability company governed by malagasy law on company firms. The company headoffice is located at the Building FIARO, Staircase D, Ampefiloha, ANTANANARIVO 101. The authorised capital is mga 2,000,000.00 atDecember - 31 st , 2009.The society was registered in the trade register and societies on March 04 th , 2008.The purpose of the company is to perform any activities linked to the sector of the building and of public works in every countries andparticularly in Republic of Madagascar, and which concerns operations listed in a limitative way below:• Any works of facilities and of building including civil engineering, steel building, town and country planning, road, bridges, and other publicfacilities, onshore and offshore platform, building of harbour facilities, pipeline;• Acquisition of shares in any created malagasy societies or to be created;• And generally any business transactions, financial or industrial, building and property linked directly or indirectly to the purpose above orto all other matters similar or related and likely to make easier extension and development.2) GENERAL ACCOUNTING PRINCIPLESThe Published accounts were established in accordance with Malagasy generally accepted accounting methods and principles (PCG 2005)and their presentation respect the international accounting standards (norms IAS / IFRS).2.1. Recognition and measurement:Regular purchases and sales of financial assets are recognised on the trade-date – the date on which the company commits to purchase orsell the asset.Revenue comprises the fair value of the consideration received or receivable for the sale of goods and services in the ordinary course of thecompany’s activities. Revenue is shown net of value-added tax, returns, rebates and discounts.2.2. Fixes assets:Fixed assets are promoted in their cost of acquiring which is equal at the price of purchase increased by the purchase of incidental charges.Depreciation is provides on the straight line basis as follows:Intangible asset: software 33.33%Equipment 10%Office furniture and fittings 10%Furniture and fittings for houses 10%Computer equipment 10 % - 25 %Motor vehicles 10%Improvement to building 10%The Rates of amortization respect the maximum allowed by the taxation authorities codes according to the decree n°3506 / 84 of August 21 st ,1984.Amortizations are calculated on a straight line basis respecting of the prorata temporis if necessary.2.3. Foreign exchange recognition:Foreign operation and transaction in foreign currencies are recorded for their exchange values in the transaction date.Gains or losses arising from foreign currencies of the‘financial assets at fair value through profit or loss’ category are presented in the incomestatement within ‘other(losses)/gains – net’ in the period in which they arise.Receivables, debts and available funds recorded in foreign currencies at the end of financial year are converted on the basis of the ending rateof financial year and difference is included in the profit and loss account of financial year. The exchange rates used are those of the CentralBank of Madagascar :- EURO: 2 795,52- USD: 1 954,643) ASSETSThis heading is composed of Tangible assets and intangible assets (The Sage software).The following table presents the assets variations as December 31 st , 2009.TANGIBLE ASSETS Software Equipments Officefurniture andfittingsGROSS VALUEFurniture andfittings forhouses89ComputerequipmentMotorVehiclesImprovementto buildingAs at December 31st, 2008 4,156,900.00 16,626,323.00 45,179,957.00 33,023,096.63 29,960,756.00 10,800,000.00 1,921,301.67 141,668,334.30Additions - 36,707,182.41 2,558,160.00 - 2,826,000.00 - - 42,091,342.41Revaluation - - - - - - (620,000.00) (620,000.00)Disposal - - (531,000.00) - (2,616,000.00) - - (3,147,000.00)As at December 31st, 2009 4,156,900.00 53,333,505.41 47,207,117.00 33,023,096.63 30,170,756.00 10,800,000.00 1,301,301.67 179,992,676.71AmortisationAs at December 31st, 2008 708,141.77 754,868.33 1,679,566.64 1,458,797.46 4,334,503.34 231,000.00 30,660.94 9,197,538.48Additions 1,385,494.77 3,570,115.45 4,644,633.44 3,302,309.66 7,944,159.83 1,080,000.00 130,130.17 22,056,843.32Revaluation - - - - - - (12,916.67) (12,916.67)Disposal - - (71,389.99) - (984,633.33) - - (1,056,023.32)As at December 31st, 2009 2,093,636.54 4,324,983.78 6,252,810.09 4,761,107.12 11,294,029.84 1,311,000.00 147,874.44 30,185,441.81NET VALUEAs at December 31st, 2009 2,063,263.46 49,008,521.63 40,954,306.91 28,261,989.51 18,876,726.16 9,489,000.00 1,153,427.23 149,807,234.90As at December 31st, 2008 3,448,758.23 15,871,454.65 43,500,390.36 31,564,299.17 25,626,252.66 10,569,000.00 1,890,640.73 132,470,795.80TOTAL