Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

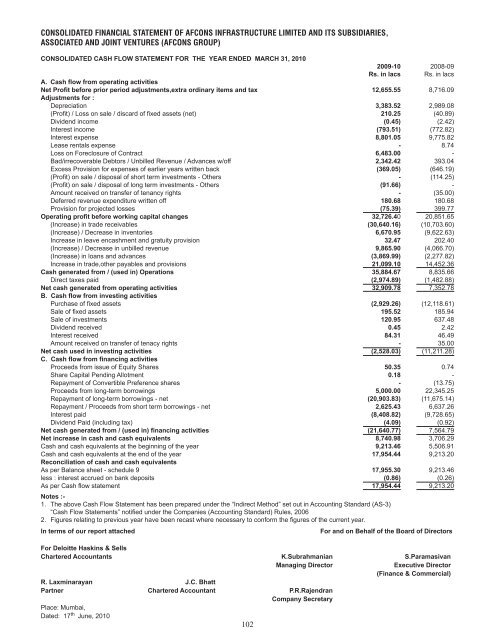

CONSOLIDATED FINANCIAL STATEMENT OF AFCONS INFRASTRUCTURE LIMITED AND ITS SUBSIDIARIES,ASSOCIATED AND JOINT VENTURES (AFCONS GROUP)CONSOLIDATED CASH FLOW STATEMENT FOR THE YEAR ENDED MARCH 31, 20102009-10 2008-09Rs. in lacs Rs. in lacsA. Cash flow from operating activitiesNet Profit before prior period adjustments,extra ordinary items and tax 12,655.55 8,716.09Adjustments for :Depreciation 3,383.52 2,989.08(Profit) / Loss on sale / discard of fixed assets (net) 210.25 (40.89)Dividend income (0.45) (2.42)Interest income (793.51) (772.82)Interest expense 8,801.05 9,775.82Lease rentals expense - 8.74Loss on Foreclosure of Contract 6,483.00 -Bad/irrecoverable Debtors / Unbilled Revenue / Advances w/off 2,342.42 393.04Excess Provision for expenses of earlier years written back (369.05) (646.19)(Profit) on sale / disposal of short term investments - Others - (114.25)(Profit) on sale / disposal of long term investments - Others (91.66) -Amount received on transfer of tenancy rights - (35.00)Deferred revenue expenditure written off 180.68 180.68Provision for projected losses (75.39) 399.77Operating profit before working capital changes 32,726.40 20,851.65(Increase) in trade receivables (30,640.16) (10,703.60)(Increase) / Decrease in inventories 6,670.95 (9,622.63)Increase in leave encashment and gratuity provision 32.47 202.40(Increase) / Decrease in unbilled revenue 9,865.90 (4,066.70)(Increase) in loans and advances (3,869.99) (2,277.82)Increase in trade,other payables and provisions 21,099.10 14,452.36Cash generated from / (used in) Operations 35,884.67 8,835.66Direct taxes paid (2,974.89) (1,482.88)Net cash generated from operating activities 32,909.78 7,352.78B. Cash flow from investing activitiesPurchase of fixed assets (2,929.26) (12,118.61)Sale of fixed assets 195.52 185.94Sale of investments 120.95 637.48Dividend received 0.45 2.42Interest received 84.31 46.49Amount received on transfer of tenacy rights - 35.00Net cash used in investing activities (2,528.03) (11,211.28)C. Cash flow from financing activitiesProceeds from issue of Equity Shares 50.35 0.74Share Capital Pending Allotment 0.18 -Repayment of Convertible Preference shares - (13.75)Proceeds from long-term borrowings 5,000.00 22,345.25Repayment of long-term borrowings - net (20,903.83) (11,675.14)Repayment / Proceeds from short term borrowings - net 2,625.43 6,637.26Interest paid (8,408.82) (9,728.65)Dividend Paid (including tax) (4.09) (0.92)Net cash generated from / (used in) financing activities (21,640.77) 7,564.79Net increase in cash and cash equivalents 8,740.98 3,706.29Cash and cash equivalents at the beginning of the year 9,213.46 5,506.91Cash and cash equivalents at the end of the year 17,954.44 9,213.20Reconciliation of cash and cash equivalentsAs per Balance sheet - schedule 9 17,955.30 9,213.46less : interest accrued on bank deposits (0.86) (0.26)As per Cash flow statement 17,954.44 9,213.20Notes :-1. The above Cash Flow Statement has been prepared under the “Indirect Method” set out in Accounting Standard (AS-3)“Cash Flow Statements” notified under the Companies (Accounting Standard) Rules, 20062. Figures relating to previous year have been recast where necessary to conform the figures of the current year.In terms of our report attachedFor and on Behalf of the Board of DirectorsFor Deloitte Haskins & SellsChartered Accountants K.Subrahmanian S.ParamasivanManaging DirectorExecutive Director(Finance & Commercial)R. Laxminarayan J.C. BhattPartner Chartered Accountant P.R.RajendranCompany SecretaryPlace: Mumbai,Dated: 17 th June, 2010102