Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

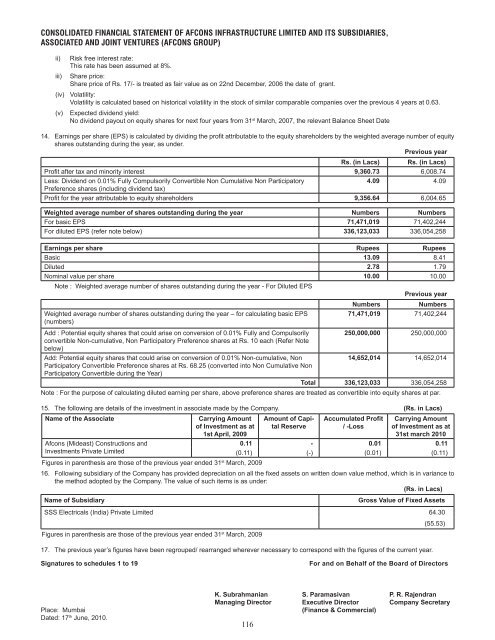

CONSOLIDATED FINANCIAL STATEMENT OF AFCONS INFRASTRUCTURE LIMITED AND ITS SUBSIDIARIES,ASSOCIATED AND JOINT VENTURES (AFCONS GROUP)ii) Risk free interest rate:This rate has been assumed at 8%.iii) Share price:Share price of Rs. 17/- is treated as fair value as on 22nd December, 2006 the date of grant.(iv) Volatility:Volatility is calculated based on historical volatility in the stock of similar comparable companies over the previous 4 years at 0.63.(v) Expected dividend yield:No dividend payout on equity shares for next four years from 31 st March, 2007, the relevant Balance Sheet Date14. Earnings per share (EPS) is calculated by dividing the profit attributable to the equity shareholders by the weighted average number of equityshares outstanding during the year, as under.Previous yearRs. (in Lacs) Rs. (in Lacs)Profit after tax and minority interest 9,360.73 6,008.74Less: Dividend on 0.01% Fully Compulsorily Convertible Non Cumulative Non Participatory4.09 4.09Preference shares (including dividend tax)Profit for the year attributable to equity shareholders 9,356.64 6,004.65Weighted average number of shares outstanding during the year Numbers NumbersFor basic EPS 71,471,019 71,402,244For diluted EPS (refer note below) 336,123,033 336,054,258Earnings per share Rupees RupeesBasic 13.09 8.41Diluted 2.78 1.79Nominal value per share 10.00 10.00Note : Weighted average number of shares outstanding during the year - For Diluted EPSPrevious yearWeighted average number of shares outstanding during the year – for calculating basic EPS(numbers)NumbersNumbers71,471,019 71,402,244Add : Potential equity shares that could arise on conversion of 0.01% Fully and Compulsorily250,000,000 250,000,000convertible Non-cumulative, Non Participatory Preference shares at Rs. 10 each (Refer Notebelow)Add: Potential equity shares that could arise on conversion of 0.01% Non-cumulative, Non14,652,014 14,652,014Participatory Convertible Preference shares at Rs. 68.25 (converted into Non Cumulative NonParticipatory Convertible during the Year)Total 336,123,033 336,054,258Note : For the purpose of calculating diluted earning per share, above preference shares are treated as convertible into equity shares at par.15. The following are details of the investment in associate made by the Company. ( Rs. in Lacs)Name of the AssociateCarrying Amountof Investment as at1st April, 2009Amount of CapitalReserveAccumulated Profit/ -LossCarrying Amountof Investment as at31st march 2010<strong>Afcon</strong>s (Mideast) Constructions andInvestments Private Limited0.11 - 0.01 0.11(0.11) (-) (0.01) (0.11)Figures in parenthesis are those of the previous year ended 31 st March, 200916. Following subsidiary of the Company has provided depreciation on all the fixed assets on written down value method, which is in variance tothe method adopted by the Company. The value of such items is as under:(Rs. in Lacs)Name of SubsidiaryGross Value of Fixed AssetsSSS Electricals (India) Private Limited 64.30(55.53)Figures in parenthesis are those of the previous year ended 31 st March, 200917. The previous year’s figures have been regrouped/ rearranged wherever necessary to correspond with the figures of the current year.Signatures to schedules 1 to 19For and on Behalf of the Board of DirectorsPlace: MumbaiDated: 17 th June, 2010.K. Subrahmanian S. Paramasivan P. R. RajendranManaging Director Executive Director Company Secretary(Finance & Commercial)116