Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Afcon Book.indd - Afcons Infrastructure Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

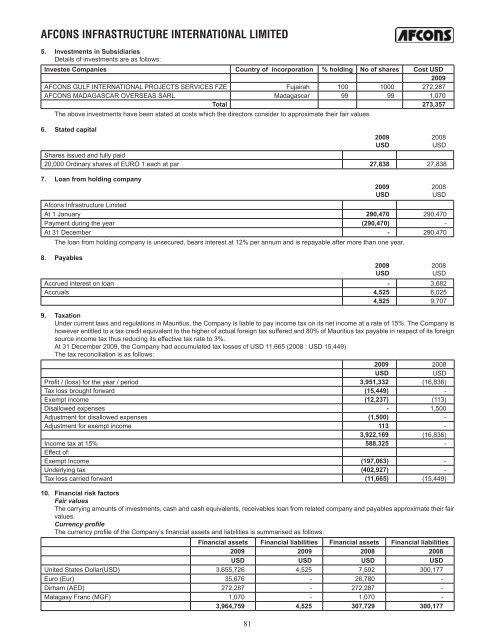

AFCONS INFRASTRUCTURE INTERNATIONAL LIMITED5. Investments in SubsidiariesDetails of investments are as follows:Investee Companies Country of incorporation % holding No of shares Cost USD2009AFCONS GULF INTERNATIONAL PROJECTS SERVICES FZE Fujairah 100 1000 272,287AFCONS MADAGASCAR OVERSEAS SARL Madagascar 99 99 1,070Total 273,357The above investments have been stated at costs which the directors consider to approximate their fair values.6. Stated capital812009 2008USDUSDShares issued and fully paid20,000 Ordinary shares of EURO 1 each at par 27,838 27,8387. Loan from holding company2009 2008USDUSD<strong>Afcon</strong>s <strong>Infrastructure</strong> LimitedAt 1 January 290,470 290,470Payment during the year (290,470) -At 31 December - 290,470The loan from holding company is unsecured, bears interest at 12% per annum and is repayable after more than one year.8. Payables2009 2008USDUSDAccrued interest on loan - 3,682Accruals 4,525 6,0254,525 9,7079. TaxationUnder current laws and regulations in Mauritius, the Company is liable to pay income tax on its net income at a rate of 15%. The Company ishowever entitled to a tax credit equivalent to the higher of actual foreign tax suffered and 80% of Mauritius tax payable in respect of its foreignsource income tax thus reducing its effective tax rate to 3%.At 31 December 2009, the Company had accumulated tax losses of USD 11,665 (2008 : USD 15,449)The tax reconciliation is as follows:2009 2008USDUSDProfit / (loss) for the year / period 3,951,332 (16,836)Tax loss brought forward (15,449) -Exempt income (12,237) (113)Disallowed expenses - 1,500Adjustment for disallowed expenses (1,500) -Adjustment for exempt income 113 -3,922,169 (16,836)Income tax at 15% 588,325 -Effect of:Exempt Income (197,063) -Underlying tax (402,927) -Tax loss carried forward (11,665) (15,449)10. Financial risk factorsFair valuesThe carrying amounts of investments, cash and cash equivalents, receivables loan from related company and payables approximate their fairvalues.Currency profileThe currency profile of the Company’s financial assets and liabilities is summarised as follows:Financial assets Financial liabilities Financial assets Financial liabilities2009 2009 2008 2008USD USD USD USDUnited States Dollar(USD) 3,655,726 4,525 7,592 300,177Euro (Eur) 35,676 - 26,780 -Dirham (AED) 272,287 - 272,287 -Malagasy Franc (MGF) 1,070 - 1,070 -3,964,759 4,525 307,729 300,177