Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

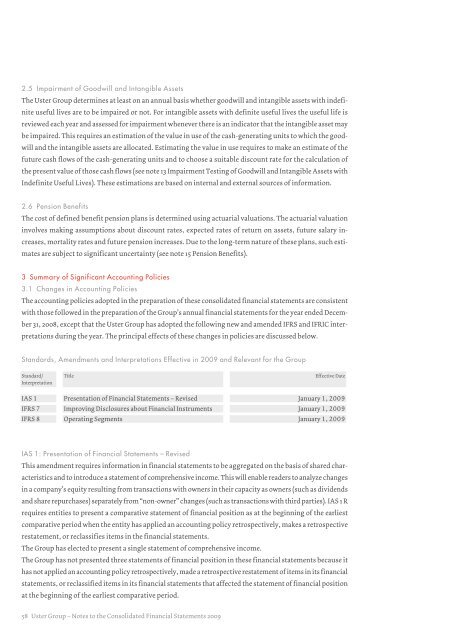

2.5 Impairment of Goodwill and Intangible AssetsThe <strong>Uster</strong> Group determines at least on an annual basis whether goodwill and intangible assets with indefiniteuseful lives are to be impaired or not. For intangible assets with definite useful lives the useful life isreviewed each year and assessed for impairment whenever there is an indicator that the intangible asset maybe impaired. This requires an estimation of the value in use of the cash-generating units to which the goodwilland the intangible assets are allocated. Estimating the value in use requires to make an estimate of thefuture cash flows of the cash-generating units and to choose a suitable discount rate for the calculation ofthe present value of those cash flows (see note 13 Impairment Testing of Goodwill and Intangible Assets withIndefinite Useful Lives). These estimations are based on internal and external sources of information.2.6 Pension BenefitsThe cost of defined benefit pension plans is determined using actuarial valuations. The actuarial valuationinvolves making assumptions about discount rates, expected rates of return on assets, future salary increases,mortality rates and future pension increases. Due to the long-term nature of these plans, such estimatesare subject to significant uncertainty (see note 15 Pension Benefits).3 Summary of Significant Accounting Policies3.1 Changes in Accounting PoliciesThe accounting policies adopted in the preparation of these consolidated financial statements are consistentwith those followed in the preparation of the Group’s annual financial statements for the year ended December31, 2008, except that the <strong>Uster</strong> Group has adopted the following new and amended IFRS and IFRIC interpretationsduring the year. The principal effects of these changes in policies are discussed below.Standards, Amendments and Interpretations Effective in <strong>2009</strong> and Relevant for the GroupStandard /InterpretationTitleEffective DateIAS 1 Presentation of Financial Statements – Revised January 1, <strong>2009</strong>IFRS 7 Improving Disclosures about Financial Instruments January 1, <strong>2009</strong>IFRS 8 Operating Segments January 1, <strong>2009</strong>IAS 1: Presentation of Financial Statements – RevisedThis amendment requires information in financial statements to be aggregated on the basis of shared characteristicsand to introduce a statement of comprehensive income. This will enable readers to analyze changesin a company’s equity resulting from transactions with owners in their capacity as owners (such as dividendsand share repurchases) separately from “non-owner” changes (such as transactions with third parties). IAS 1 Rrequires entities to present a comparative statement of financial position as at the beginning of the earliestcomparative period when the entity has applied an accounting policy retrospectively, makes a retrospectiverestatement, or reclassifies items in the financial statements.The Group has elected to present a single statement of comprehensive income.The Group has not presented three statements of financial position in these financial statements because ithas not applied an accounting policy retrospectively, made a retrospective restatement of items in its financialstatements, or reclassified items in its financial statements that affected the statement of financial positionat the beginning of the earliest comparative period.58 <strong>Uster</strong> Group – Notes to the Consolidated Financial Statements <strong>2009</strong>