Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

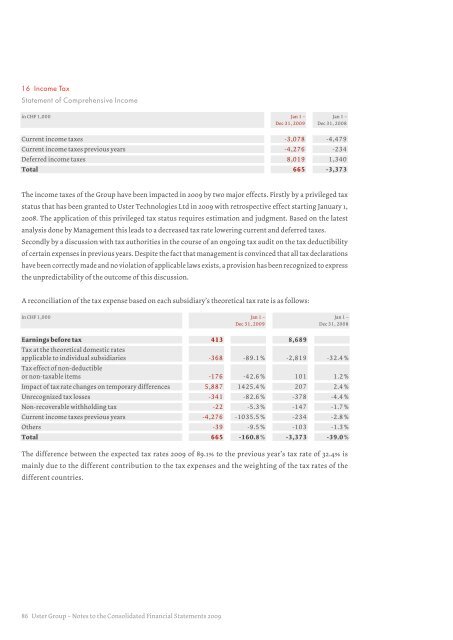

16 Income TaxStatement of Comprehensive Incomein CHF 1,000 Jan 1 –Dec 31, <strong>2009</strong>Jan 1 –Dec 31, 2008Current income taxes -3,078 -4,479Current income taxes previous years -4,276 -234Deferred income taxes 8,019 1,340Total 665 -3,373The income taxes of the Group have been impacted in <strong>2009</strong> by two major effects. Firstly by a privileged taxstatus that has been granted to <strong>Uster</strong> <strong>Technologies</strong> <strong>Ltd</strong> in <strong>2009</strong> with retrospective effect starting January 1,2008. The application of this privileged tax status requires estimation and judgment. Based on the latestanalysis done by Management this leads to a decreased tax rate lowering current and deferred taxes.Secondly by a discussion with tax authorities in the course of an ongoing tax audit on the tax deductibilityof certain expenses in previous years. Despite the fact that management is convinced that all tax declarationshave been correctly made and no violation of applicable laws exists, a provision has been recognized to expressthe unpredictability of the outcome of this discussion.A reconciliation of the tax expense based on each subsidiary’s theoretical tax rate is as follows:in CHF 1,000 Jan 1 –Dec 31, <strong>2009</strong>Jan 1 –Dec 31, 2008Earnings before tax 413 8,689Tax at the theoretical domestic ratesapplicable to individual subsidiaries -368 -89.1% -2,819 -32.4%Tax effect of non-deductibleor non-taxable items -176 -42.6% 101 1.2%Impact of tax rate changes on temporary differences 5,887 1425.4% 207 2.4%Unrecognized tax losses -341 -82.6% -378 -4.4%Non-recoverable withholding tax -22 -5.3% -147 -1.7%Current income taxes previous years -4,276 -1035.5% -234 -2.8%Others -39 -9.5% -103 -1.3%Total 665 -160.8% -3,373 -39.0%The difference between the expected tax rates <strong>2009</strong> of 89.1% to the previous year’s tax rate of 32.4% ismainly due to the different contribution to the tax expenses and the weighting of the tax rates of thedifferent countries.86 <strong>Uster</strong> Group – Notes to the Consolidated Financial Statements <strong>2009</strong>