Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

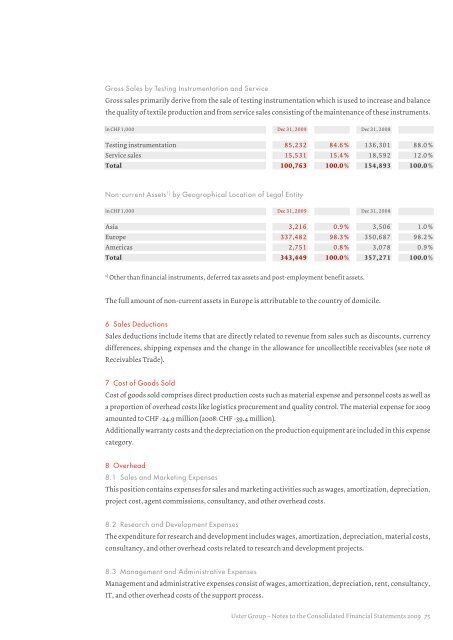

Gross Sales by Testing Instrumentation and ServiceGross sales primarily derive from the sale of testing instrumentation which is used to increase and balancethe quality of textile production and from service sales consisting of the maintenance of these instruments.in CHF 1,000 Dec 31, <strong>2009</strong> Dec 31, 2008Testing instrumentation 85,232 84.6% 136,301 88.0%Service sales 15,531 15.4% 18,592 12.0%Total 100,763 100.0% 154,893 100.0%Non-current Assets 1) by Geographical Location of Legal Entityin CHF 1,000 Dec 31, <strong>2009</strong> Dec 31, 2008Asia 3,216 0.9% 3,506 1.0%Europe 337,482 98.3% 350,687 98.2%Americas 2,751 0.8% 3,078 0.9%Total 343,449 100.0% 357,271 100.0%1)Other than financial instruments, deferred tax assets and post-employment benefit assets.The full amount of non-current assets in Europe is attributable to the country of domicile.6 Sales DeductionsSales deductions include items that are directly related to revenue from sales such as discounts, currencydifferences, shipping expenses and the change in the allowance for uncollectible receivables (see note 18Receivables Trade).7 Cost of Goods SoldCost of goods sold comprises direct production costs such as material expense and personnel costs as well asa proportion of overhead costs like logistics procurement and quality control. The material expense for <strong>2009</strong>amounted to CHF -24.9 million (2008: CHF -39.4 million).Additionally warranty costs and the depreciation on the production equipment are included in this expensecategory.8 Overhead8.1 Sales and Marketing ExpensesThis position contains expenses for sales and marketing activities such as wages, amortization, depreciation,project cost, agent commissions, consultancy, and other overhead costs.8.2 Research and Development ExpensesThe expenditure for research and development includes wages, amortization, depreciation, material costs,consultancy, and other overhead costs related to research and development projects.8.3 Management and Administrative ExpensesManagement and administrative expenses consist of wages, amortization, depreciation, rent, consultancy,IT, and other overhead costs of the support process.<strong>Uster</strong> Group – Notes to the Consolidated Financial Statements <strong>2009</strong> 75