Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

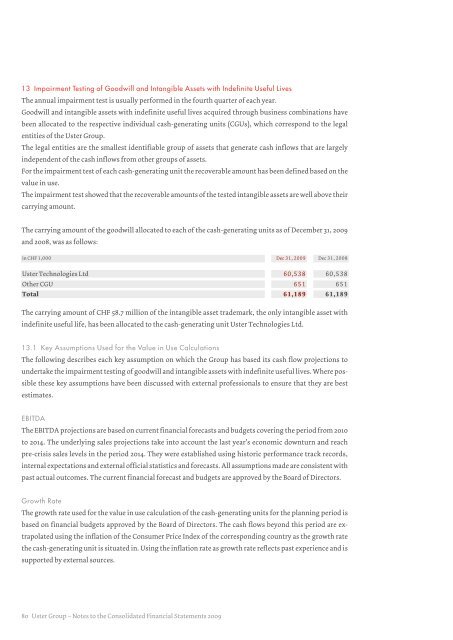

13 Impairment Testing of Goodwill and Intangible Assets with Indefinite Useful LivesThe annual impairment test is usually performed in the fourth quarter of each year.Goodwill and intangible assets with indefinite useful lives acquired through business combinations havebeen allocated to the respective individual cash-generating units (CGUs), which correspond to the legalentities of the <strong>Uster</strong> Group.The legal entities are the smallest identifiable group of assets that generate cash inflows that are largelyindependent of the cash inflows from other groups of assets.For the impairment test of each cash-generating unit the recoverable amount has been defined based on thevalue in use.The impairment test showed that the recoverable amounts of the tested intangible assets are well above theircarrying amount.The carrying amount of the goodwill allocated to each of the cash-generating units as of December 31, <strong>2009</strong>and 2008, was as follows:in CHF 1,000 Dec 31, <strong>2009</strong> Dec 31, 2008<strong>Uster</strong> <strong>Technologies</strong> <strong>Ltd</strong> 60,538 60,538Other CGU 651 651Total 61,189 61,189The carrying amount of CHF 58.7 million of the intangible asset trademark, the only intangible asset withindefinite useful life, has been allocated to the cash-generating unit <strong>Uster</strong> <strong>Technologies</strong> <strong>Ltd</strong>.13.1 Key Assumptions Used for the Value in Use CalculationsThe following describes each key assumption on which the Group has based its cash flow projections toundertake the impairment testing of goodwill and intangible assets with indefinite useful lives. Where possiblethese key assumptions have been discussed with external professionals to ensure that they are bestestimates.EBITDAThe EBITDA projections are based on current financial forecasts and budgets covering the period from 2010to 2014. The underlying sales projections take into account the last year’s economic downturn and reachpre-crisis sales levels in the period 2014. They were established using historic performance track records,internal expectations and external official statistics and forecasts. All assumptions made are consistent withpast actual outcomes. The current financial forecast and budgets are approved by the Board of Directors.Growth RateThe growth rate used for the value in use calculation of the cash-generating units for the planning period isbased on financial budgets approved by the Board of Directors. The cash flows beyond this period are extrapolatedusing the inflation of the Consumer Price Index of the corresponding country as the growth ratethe cash-generating unit is situated in. Using the inflation rate as growth rate reflects past experience and issupported by external sources.80 <strong>Uster</strong> Group – Notes to the Consolidated Financial Statements <strong>2009</strong>